“The stock market is a battlefield. Always remember to survive in the game first. Only those that survive the battle can enjoy the spoils of war.”- Unknown Investor

Last week we discussed proactive steps investors can take to optimize their portfolios ahead of the next market pullback (read here). This week we highlight what we believe to be the best asset classes to reduce total portfolio risk. We also look at several asset classes that you might think reduce risk, but provide very little portfolio diversification and can actually increase risk, especially during times of market stress.

At this point in the cycle, we are not interested in reaching for return or income. We are interested in asset classes that behave differently than equities. Our research* is focused on how asset class relationships evolve over time (for example, how the relationship between U.S. Large Cap equities and long-term Treasuries changes through market cycles). We have stated that it doesn’t do any good to own multiple asset classes if they behave the same way.

Correlation: Statistic that measures the degree to which two securities move in relation to each other. A perfect positive correlation means that the correlation coefficient is exactly 1. This implies that as one security moves, either up or down, the other security moves in lockstep, in the same direction. A perfect negative correlation means that two assets move in opposite directions, while a zero correlation implies no relationship at all. Source: Investopedia

*We examine how the S&P 500 correlates against various asset classes from 10/1/2007 – 10/1/2009.

What to Own When Times Are Bad

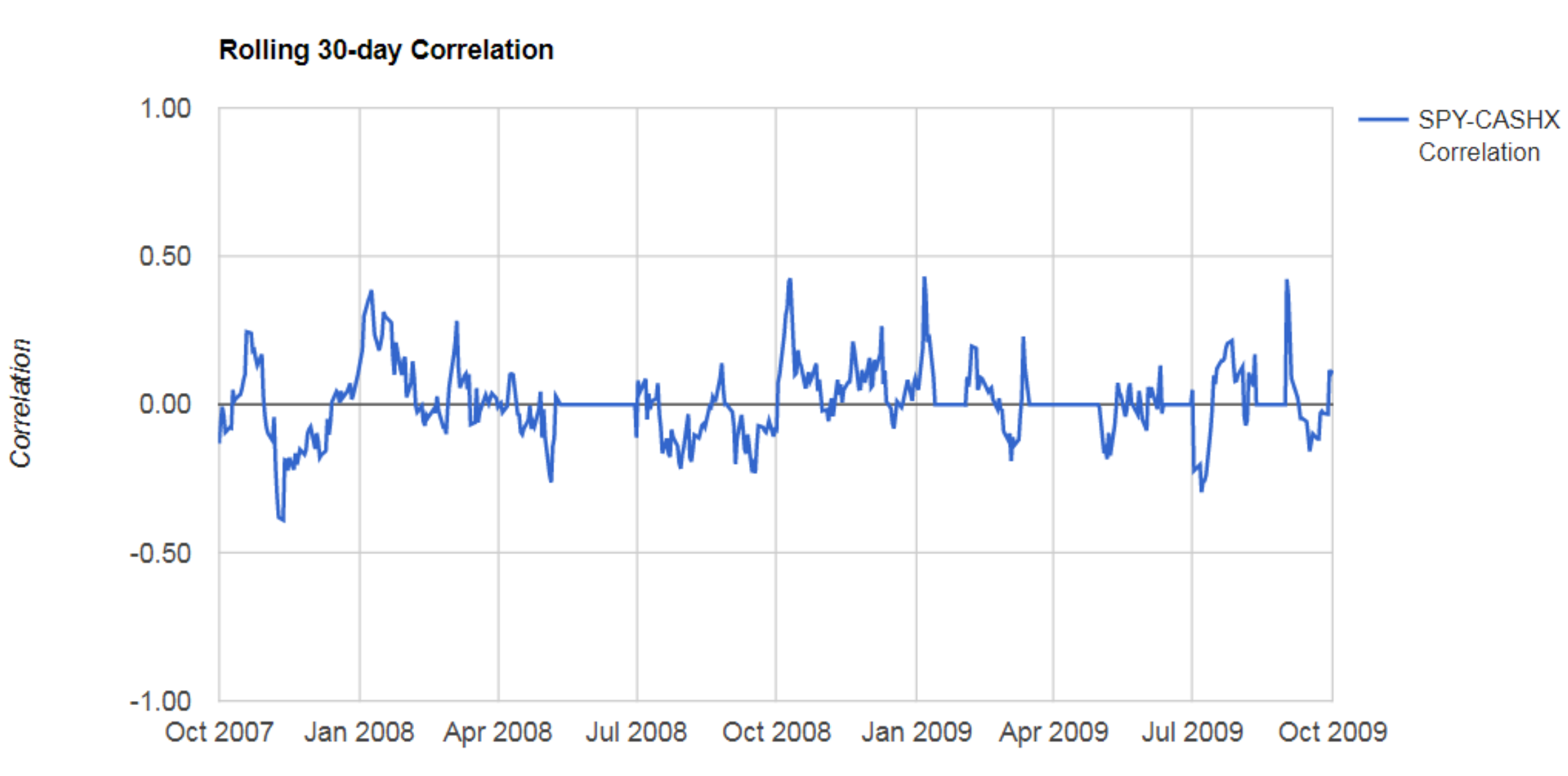

Cash

You can see cash hovers around the zero bound which means it doesn’t really correlate to the broader equity market (conceptually this makes sense… the cash in your checking account doesn’t care what the stock market is doing).

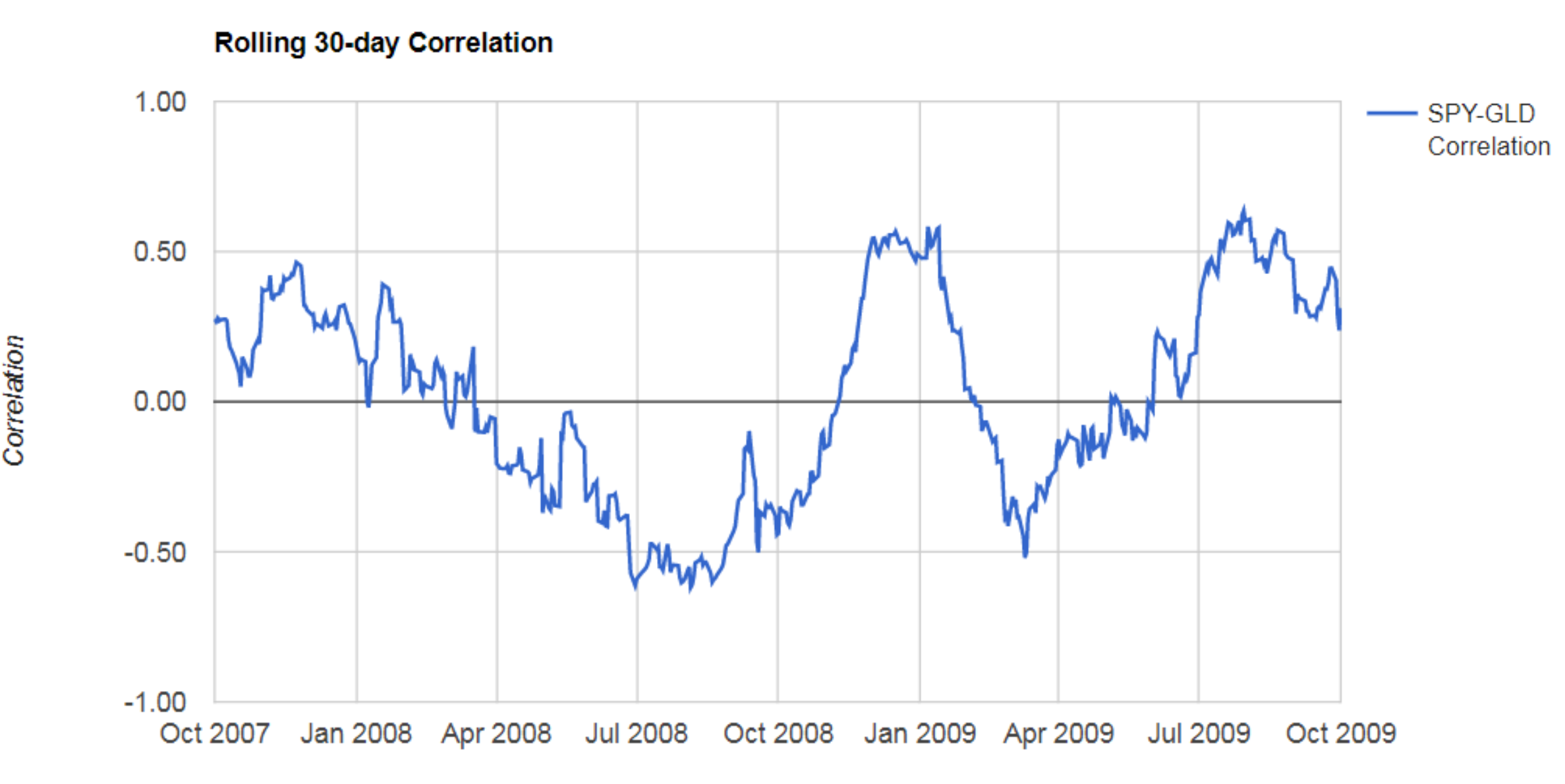

Gold

The relationship between Gold and the S&P 500 fluctuated wildly in 2008. This speaks to the importance of understanding how your assets move in relation to one another. You could be taking more risk than you set out to.

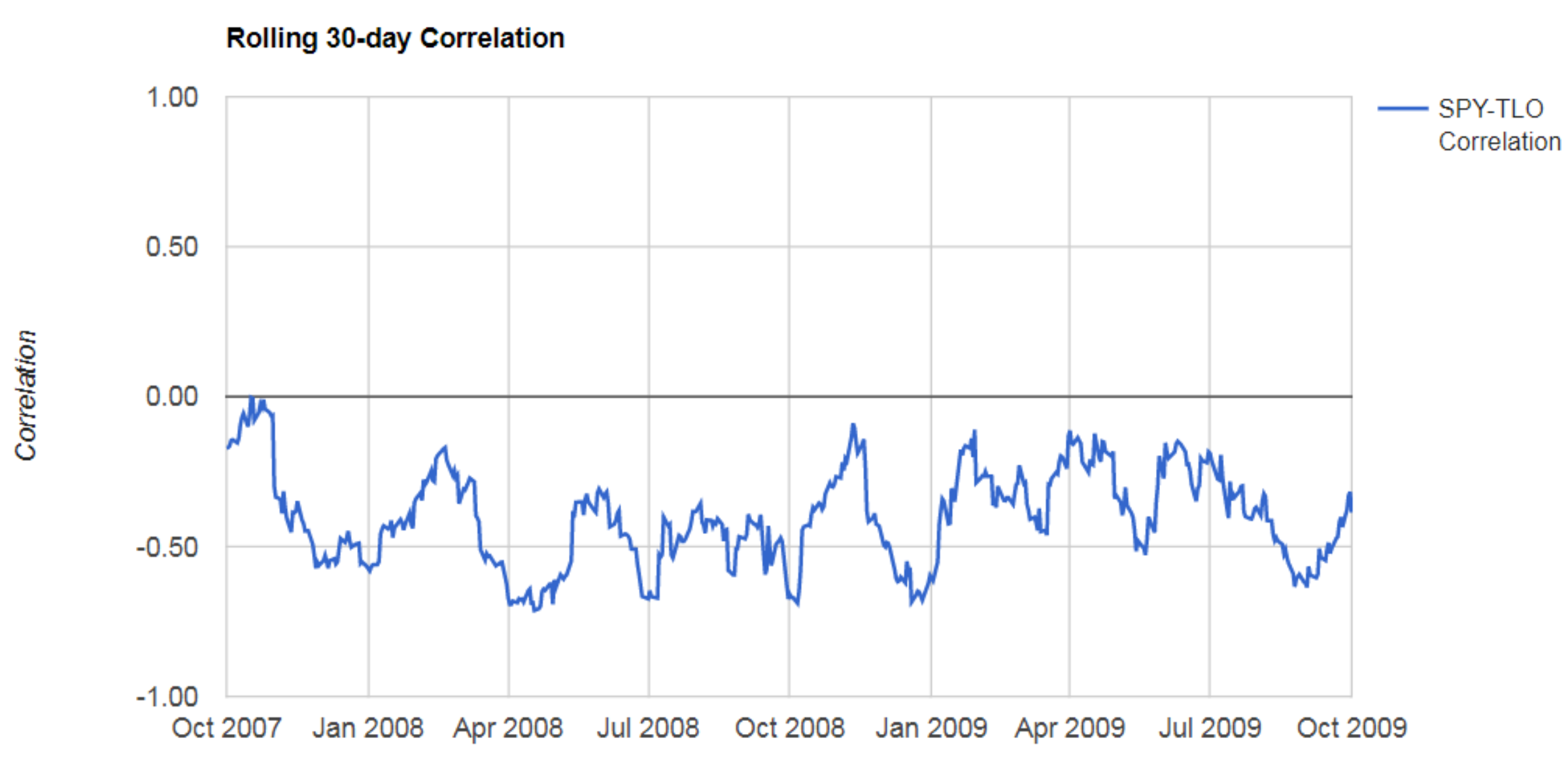

Long-Term Treasuries

Over the past 20 years, Long-Term U.S. Treasuries have been a good diversification tool to mitigate equity risk.

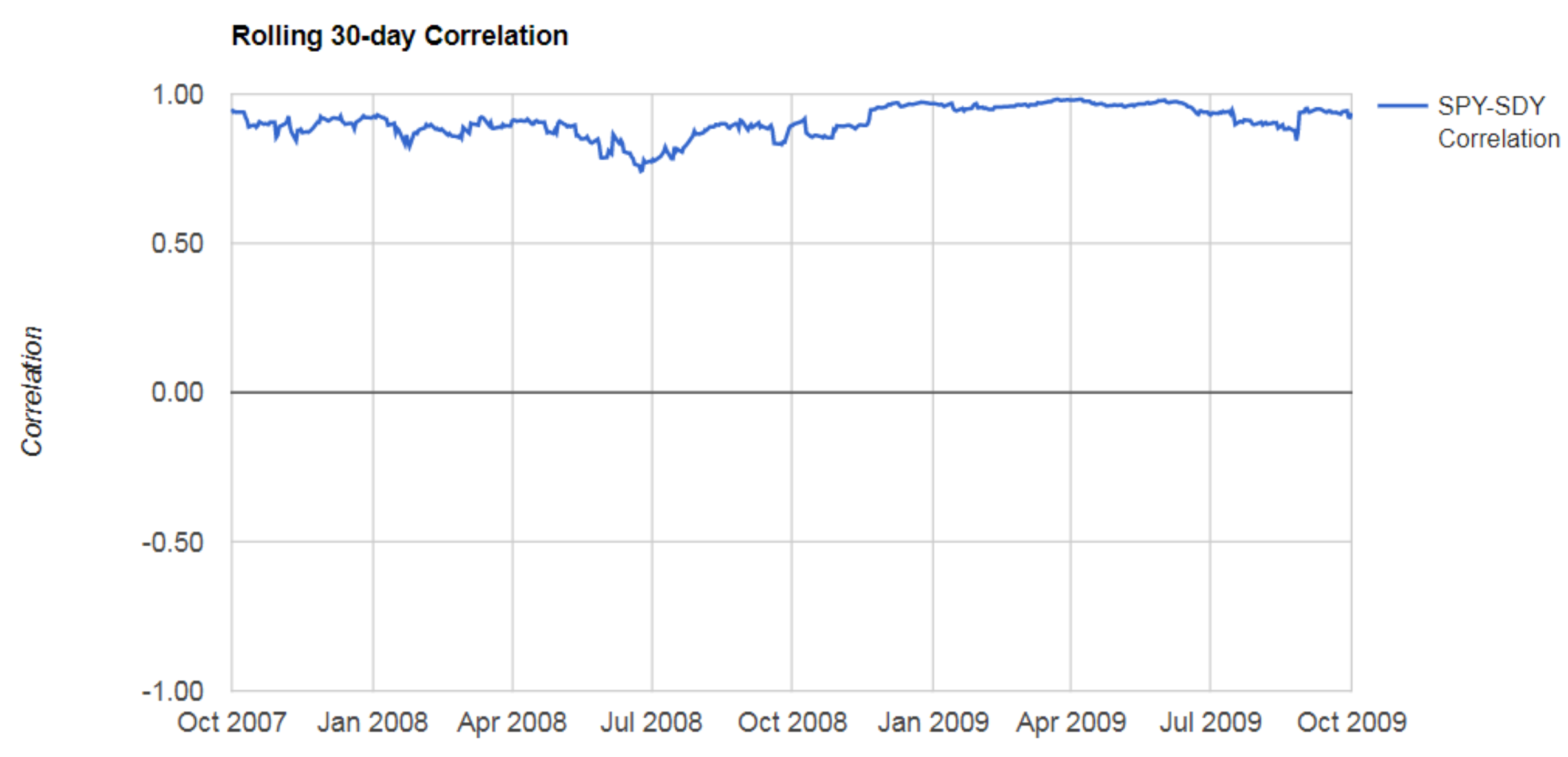

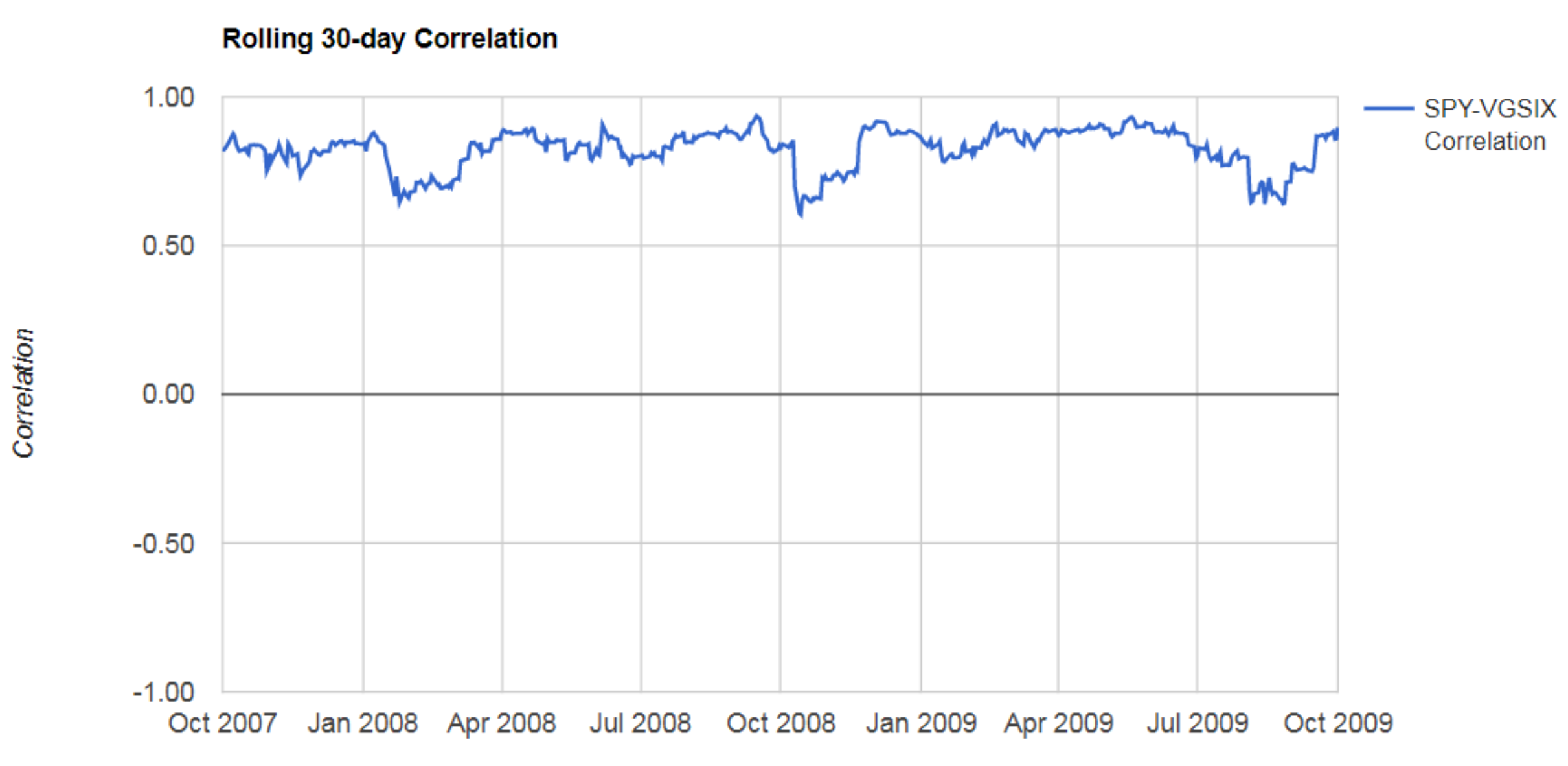

Dividend Paying Stocks

Dividend paying stocks should not be used as a replacement for bonds to generate income. The above dividend paying ETF (SDY) fully participated in the broader market drawdown of 2008-2009.

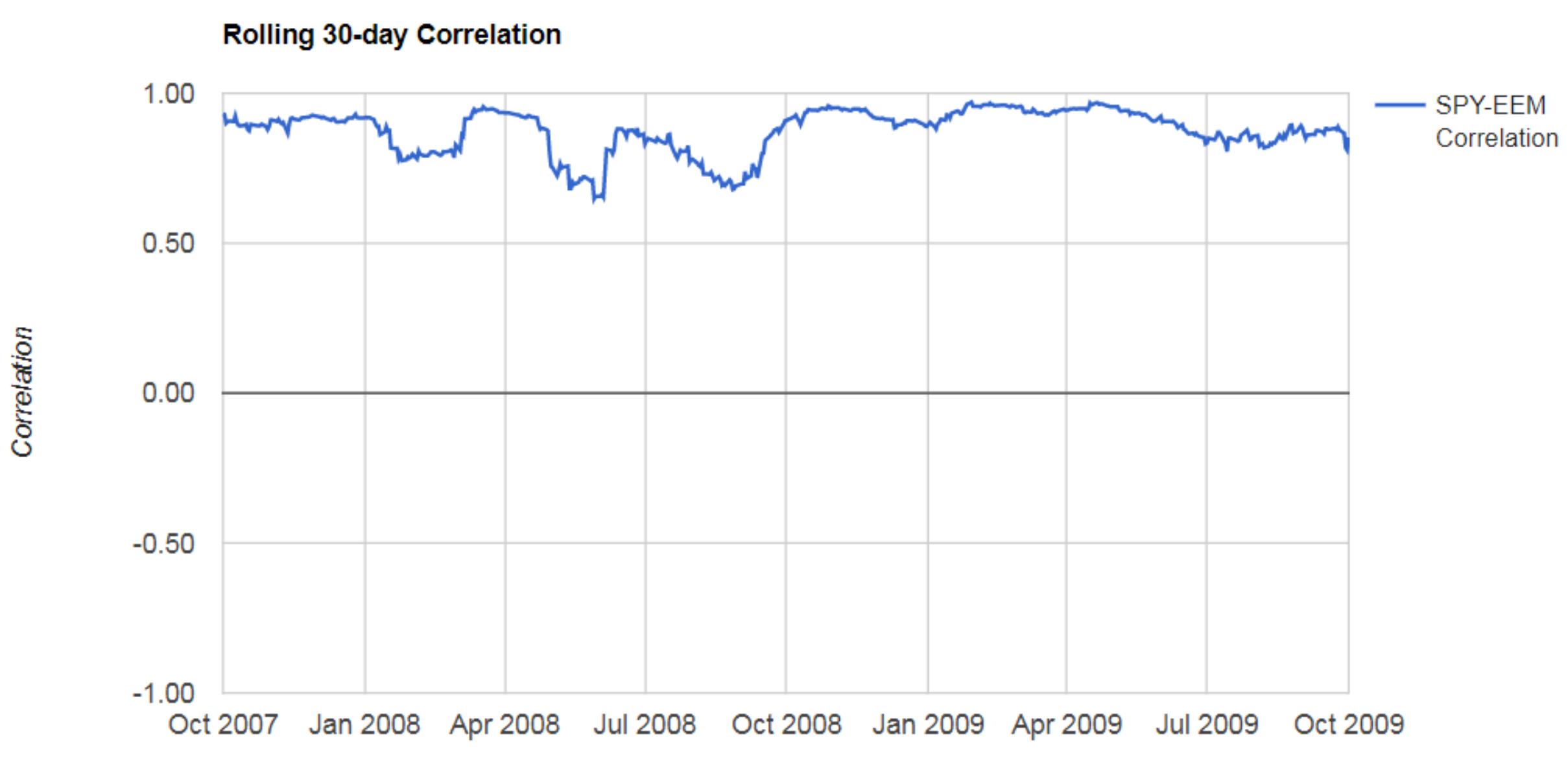

Emerging Market Stocks

Global diversification has its benefits, but equity correlations tend to increase during market stress.

Real Estate

US real estate was at the epicenter of the crisis and provided little downside protection.

Investors can mitigate downside risk without making emotional decisions that derail a sound long-term plan. Understand your range of portfolio outcomes and whether it aligns with your risk profile. Own assets that behave differently during times of market stress. We can’t control financial market movements, but we can adopt sound portfolio management principles that give us the best opportunity for success.