“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”– Peter Lynch

A correction must be coming, right? Investors are nervous. Financial media is perplexed. Perma-bears are shouting for a market pullback. The current business cycle has defied historical relationships due to unprecedented central bank intervention. Often we feel compelled to do something after the stuff hits the fan which leads to emotional, destructive decisions. What can we do now to ensure our investment portfolio is built to withstand a market downturn? More importantly, do we understand the range of possible outcomes based on how we are currently invested?

The Age-Based Portfolio Construction Epidemic

Humans love mental shortcuts to help operate more efficiently (the popularity of life hacks is proof). The antiquated age-based method of building an investors risk profile is the ultimate financial advisory life hack. The age-based method basically states, if you’re a young investor you should be aggressive and if you’re an older investor you should be conservative. Advisors subscribe to the age-based portfolio construction process because it’s easy to explain and widely accepted. It passes the smell test, but it’s sub-optimal. For example, millennials still scarred from the financial crisis might lean toward a conservative investment allocation. While baby boomers who enjoyed relative prosperity during the bulk of their careers (1980s & 1990s) might feel comfortable with a more aggressive allocation. This is simplistic, but it highlights the importance of aligning investor portfolios with life experience and perspective on risk.

Riskalyze is a leading financial technology company that seeks to align investment portfolios with how people feel about risk. The process starts by answering a few questions based upon hypothetical return outcomes (negative and positive). At the end of the exercise the investor is assigned a risk score between 0 & 100. The higher the risk score, the more aggressive the investment portfolio (risk score of zero would be 100% cash).

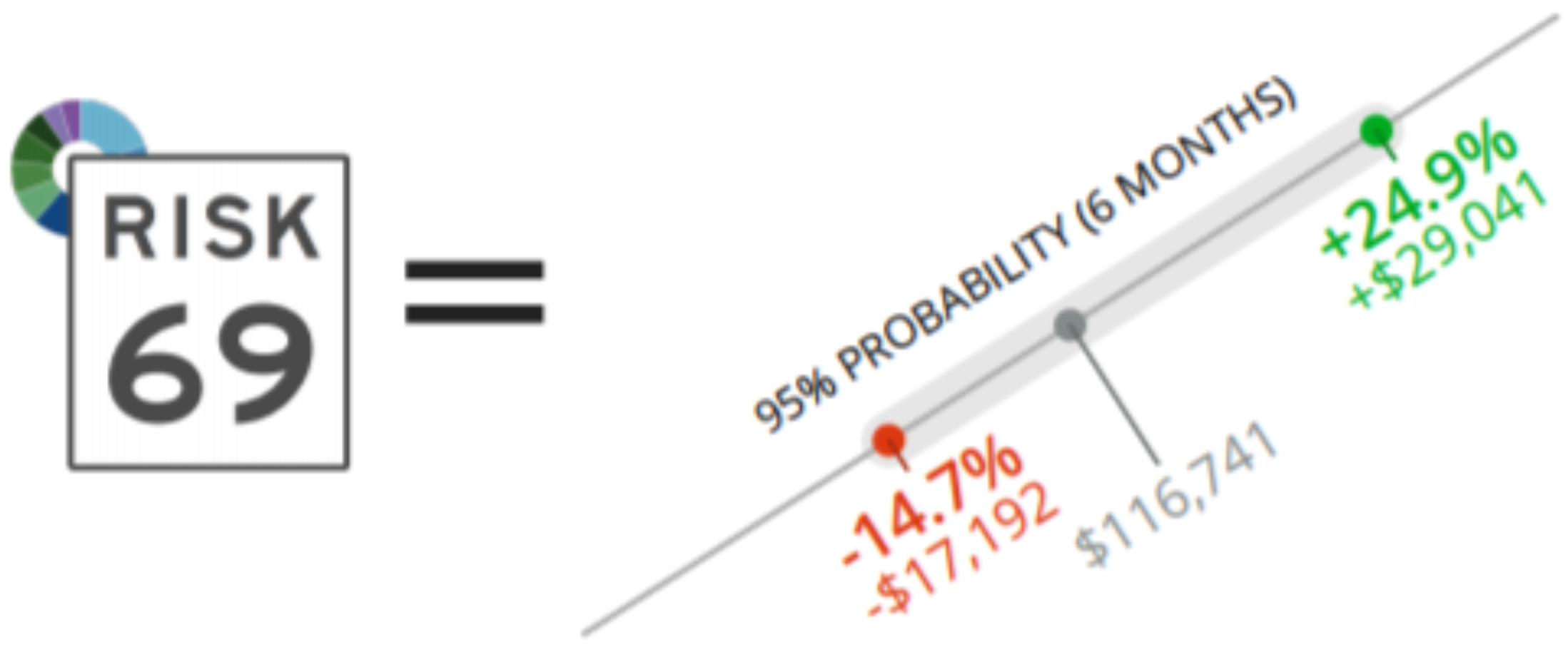

The magic of Riskalyze lies in the basic way risk is presented. The software displays a range of outcomes in dollars ($) and percentage (%) looking ahead 6 months (see below).

In practice, we are interested in how investors react to the red number (negative outcome). Does the depth of loss make them uncomfortable? Does the severity of the loss surprise them? Would they accept that result in 6 months without making emotional decisions? We want to build portfolios that allow people to behave correctly in the long-term by understanding their potential outcomes in the short-term. Investors can’t embrace risk during good times and shun it during bad times.

Other cool features that drive our pursuit of optimal portfolio construction:

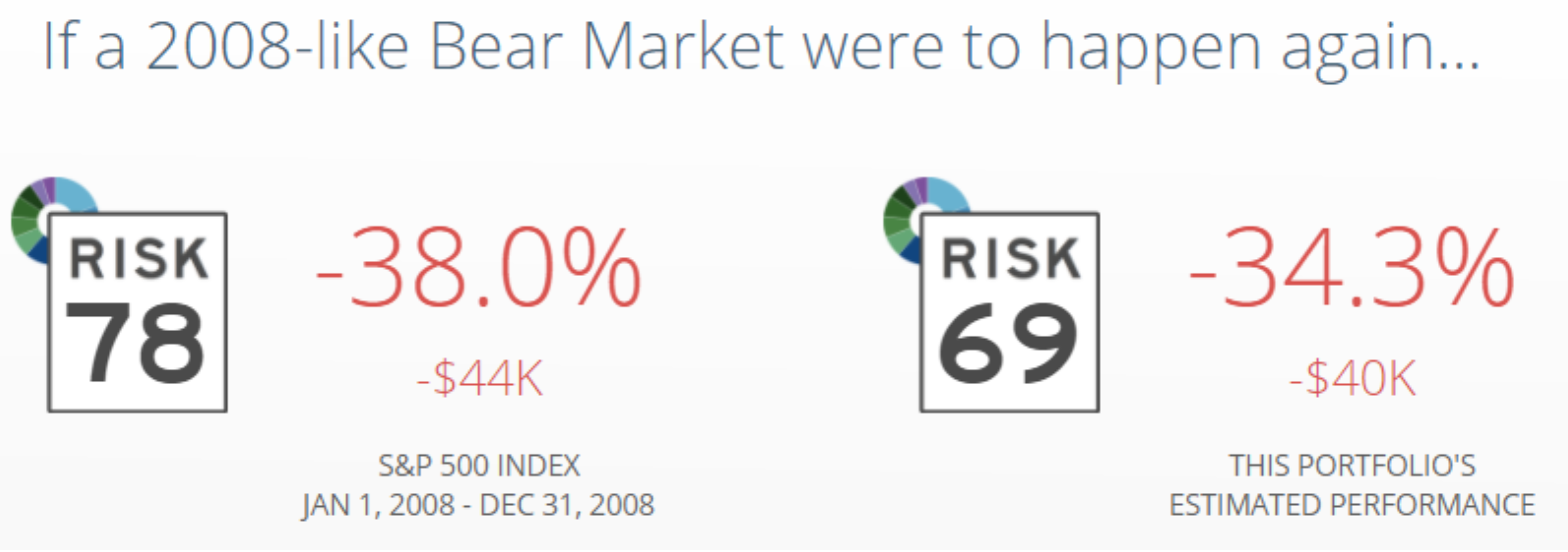

Stress test the portfolio – we can stress actual market events or run hypothetical market drawdowns. For example, how would my portfolio fare if the S&P 500 declined by 10%?

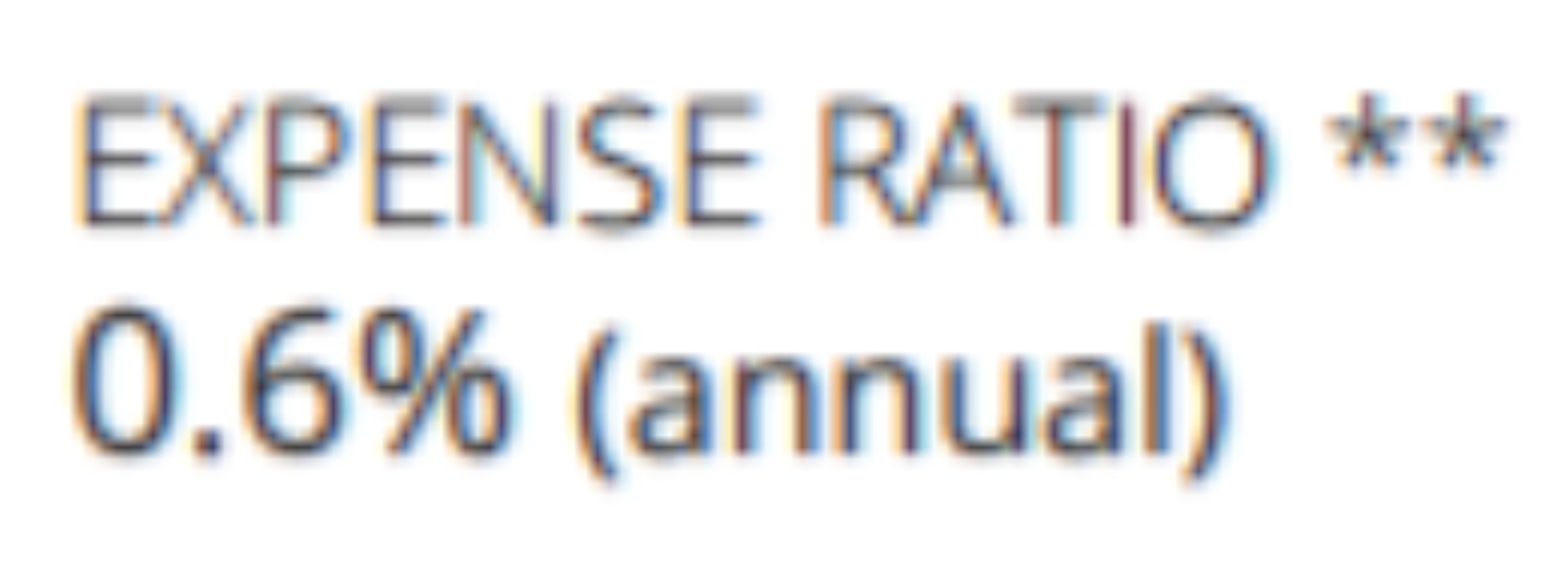

Show internal cost of funds – visibility around the total cost of investing is imperative. You could be paying much more than you thought.

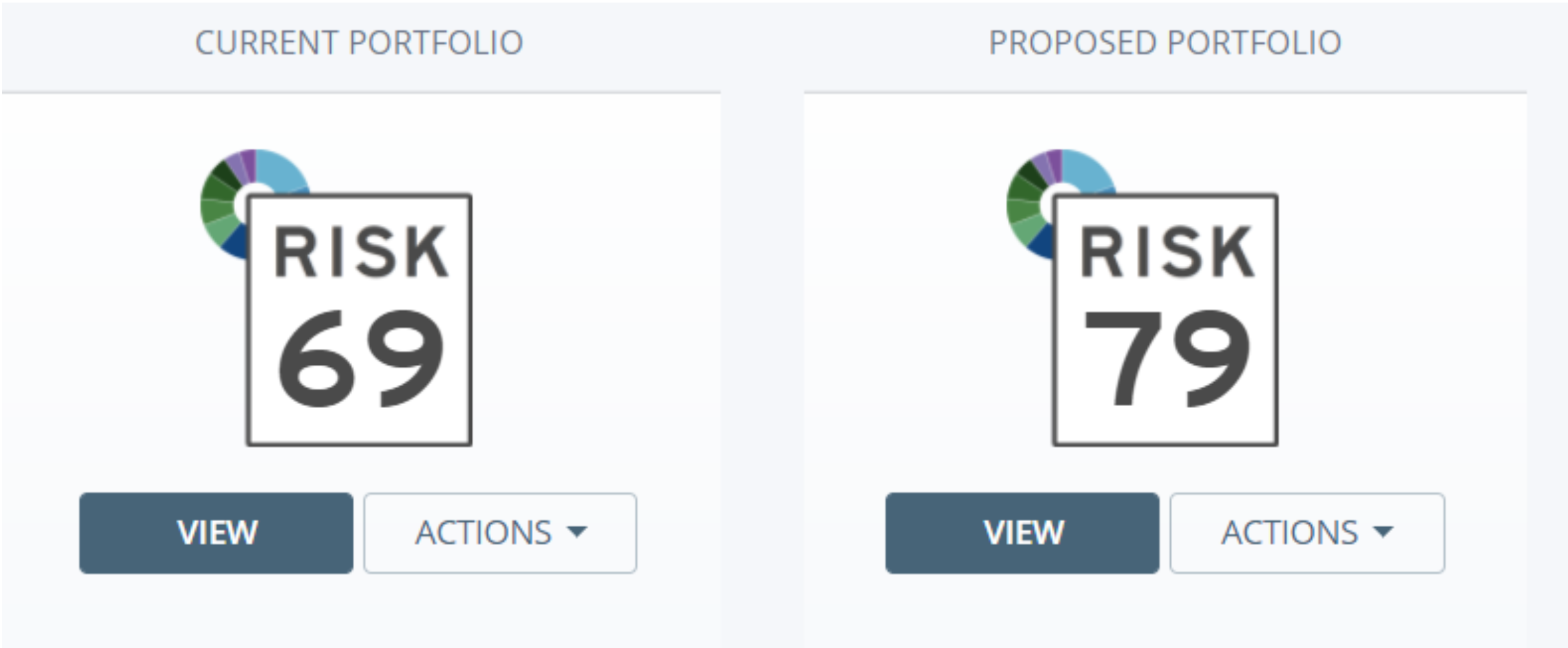

Compare current vs. risk appropriate portfolio – does your personal risk score align with your current investment portfolio?

The aged-based portfolio construction method is outdated and stale. The time to dial in your investment portfolio using the latest in financial technology is now, not after a market event happens.

How does your risk score align with how you’re currently invested?

In part II, we will look at which asset classes to own when the business cycle turns downward.