“There’s clearly an indication that a systematic government-led approach using all tactics and all elements available seems to be able to turn this disease around.” – Mike Ryan, the World Health Organization’s Head of Emergencies

Many investors are asking a variation of the same question; where is the market bottom? Combing through previous pandemics and looking at countries that have curtailed their COVID-19 infection rate, here’s what we found.

First off, this isn’t your typical financial crisis. This is a health crisis. The economic impact and lasting effects are immeasurable. The VIX, which measures the market’s expectation for future volatility, is projecting that the range of short-term outcomes for the S&P 500 is extremely wide. The violent downward move in financial markets, especially in the US, is a loud wake up call to every level of government that the response has been inadequate. It seems our political leaders are finally getting the message.

While we are swimming in uncharted waters, we aren’t completely in the dark. We can take lessons from previous pandemics and examine countries that have had success containing the COVID-19. It seems the U.S. is trending on a dangerous path. Therefore, things are likely to get worse before they get better.

In our opinion, three things need to happen for the market to turn. Monetary policy response, fiscal stimulus, and global infections need to peak (we contain the virus by taking more aggressive steps to stop the spread). In isolation, each of the below solutions might be ineffective. Taken together, the result could be major progress towards the path to normalcy.

Monetary Policy

The Fed was the most aggressive government entity throwing the kitchen sink to provide liquidity to financial markets and cut interest rates. The response was lukewarm…

“The first rule of crisis management is don’t fire all your ammunition when it is not going to hit the target,” – Allianz’s CIO Mohamed A. El-Erian

We give the Fed credit for being the first mover, but again, this is a health crisis. Reducing borrowing costs isn’t going to contain the virus or help those with a loss of income.

Fiscal Stimulus

As of this writing (3/18), nothing has been officially announced, but we would expect some sort of stimulus package from the federal government. The package would likely include small business support, tax cuts/credits, corporate bailouts, sending money to Americans… it’s all on the table. Italy, France, China, Hong Kong, et al have announced similar packages to soften the economic blow of COVID-19.

Peak Infections/Containment

This is where the U.S. is far behind, trending closer to Italy & Iran which have seen cases explode. If there’s a silver lining to the steep drop in global financial markets, it’s the major wakeup call for countries that didn’t take the virus seriously.

“Our response is much, much worse than almost any other country that’s been affected.” – Ashish Jha, Harvard Global Health Institute on the United States response to COVID-19

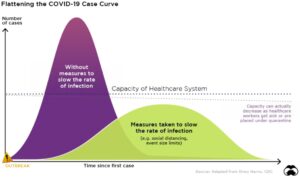

Source: Drew Harris, CDC

The above graph shows the potential path for COVID-19 cases. The goal is to flatten the case curve before the capacity of the healthcare system gets overwhelmed.

So how can the U.S. turn the tide? South Korea might be the example to follow. According to Kim Woo-Joo, an infectious disease specialist at Korea University, South Korea has the most expansive and well-organized testing program in the world, combined with extensive efforts to isolate infected people and trace and quarantine their contacts. South Korea has tested more than 270,000 people, which amounts to more than 5,200 tests per million inhabitants. The United States has so far carried out 74 tests per 1 million inhabitants, according to data from the U.S. Centers for Disease Control and Prevention.

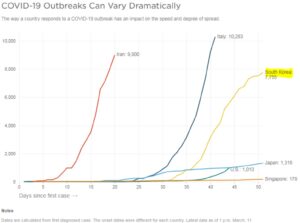

Source: Humanistic GIS Lab at the University of Washington

The above chart shows South Korea cases flatlining due to aggressive testing, isolating infected people, and quarantining their contacts. This is the playbook Europe and the United States would be wise to follow.

Why are peak cases important? Because it shows the spread of the virus is contained. Containment has often been a catalyst for global markets to rebound…

Source: Charles Schwab, Factset. Data as of 1/21/2020

The above graph shows various global epidemics and MSCI World Market Index returns over the next one, three, and six month periods. This isn’t an apples to apples comparison as COVID-19 is much more widespread and has yet to be contained.

In the depths of hell, it seems like this will never end. Morgan Housel said it best, “Every bear market in hindsight was the opportunity of a lifetime. In real-time, every future event is fraught with risk.”

We sent this chart out to clients earlier in the week. The further we fall today, has historically led to better future returns tomorrow.

Source: Ycharts, S&P 500 returns since 1950

The above graph shows future market returns after falling from market highs (left column). The further we fall today, the better future market returns. We can make changes around the margin to manage risk, but evidence doesn’t support making huge allocation shifts (for example, going from 100% stocks to cash), especially during times of market panic.

On a personal note, I’m focused on doing my part to keep my family and others safe. Overreacting is okay. In my opinion, being casual about the whole thing is a poor trade. If you’re right and the COVID-19 panic is overblown, you don’t get a huge payoff. If you’re wrong, the result could be fatal for you or someone else.

Stay safe and healthy!