“Only government can take perfectly good paper, cover it with perfectly good ink, and make the combination worthless.” – Milton Friedman on money printing and inflationary monetary policy

Every month investors, speculators, market participants eagerly await inflation data.

Trillions of dollars of capital shift on whim to capitalize on the latest trends. The hope is to gain an advantage (make more money) than the next person.

The financial media speculates on what’s driving inflation trends, the source of unexpected inflation, and what happens next.

Every new report seems like the biggest market moving event in history. Every past report is old news and quickly forgotten.

Shortly after inflation is reported, we enter new conversations about what the Fed does next.

- Does the Fed cut interest rates?

- Is inflation running too hot?

- Is inflation sticky or temporary?

- Are wages keeping up with inflation?

The cycle repeats every 30 days.

Here’s an open secret; where inflation comes from is not a mystery.

For the past 100 years, the source of inflation is highly correlated to government spending.

It’s not tariffs. It’s not evil grocery stores. It’s not greedy businesses.

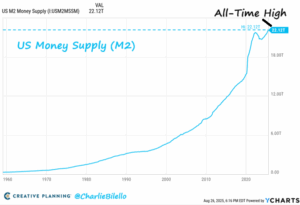

Source: Charlie Bilello, Creative Planning

The above chart shows the M2 Money Supply. It represents a broad measure of money in circulation which includes cash, checking deposits, savings deposits, small time deposits (CDs), and retail money market funds. M2 captures both spendable cash and near-cash assets, it’s often used as a proxy for the overall liquidity available in the economy.

How does an increase in M2 money supply equal more inflation?

If the government prints more money, then there would be an increase in cash circulating through the economy. Households would have more money and so their demand for goods and services would rise. With more cash, we wish to buy more goods.

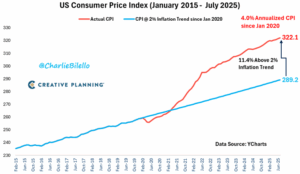

Source: Charlie Bilello, Creative Planning

The above chart shows the U.S. Consumer Price Index (CPI) from 2015 to 2025. The blue line represents CPI’s path at the Fed’s 2% inflation target. The red line shows actual CPI over the past five years. Historically, large expansions in M2 (1970s, post-COVID) are associated with sustained inflation. In simple terms, too much money chasing a fixed supply of goods & services equals higher inflation.

As goods and services become more expensive, the purchasing power of the consumer dollar erodes…

Source: Koyfin

The above chart shows the purchasing power of the consumer dollar in U.S. cities. Since October 2020, the U.S. consumer dollar buys 20% less than it did 5 years ago. Yikes!

How can a long-term investor protect against higher inflation and a loss of purchasing power?

In our opinion, these four asset classes could be a solid inflation hedge going forward…

Stocks

Most people don’t think of stocks as a hedge against inflation.

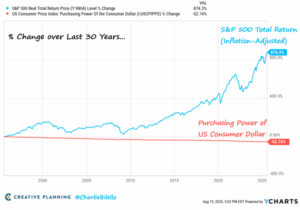

Source: Charlie Bilello, Creative Planning

The above graph makes a darn good case for U.S. stocks (measured by the S&P 500, blue) as a hedge against inflation and maintaining purchasing power (red, purchasing power of the U.S. dollar). While stocks can be risky in the short-term, over long periods, one could argue that holding cash is riskier.

Real Estate

There are many different types of real estate, from residential to real estate investment trust investments (REITS). In either case, real estate offers a tangible asset we can touch, investment income, and a history of maintaining and/or increasing value over time.

Source: www.inflationdata.com

The above chart shows the inflation adjusted home price index from 1902 to 2024 (orange line).

Gold

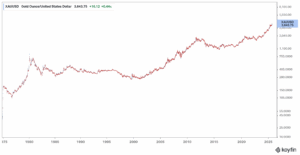

My former boss used to say, “an ounce of gold bought a new suit in the 70’s, 80’s, and 90’s. An ounce of gold can buy a new suit today.”

Source: Koyfin

The above chart shows an ounce of gold priced in U.S. dollars from 1975 to September 2025.

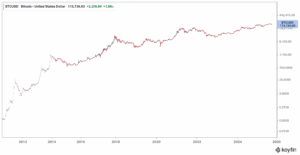

Bitcoin (BTC)

Love it or loathe it, Bitcoin has been a runaway freight train. The “internet money” has been a strong hedge against U.S. dollar debasement since 2011.

Source: Koyfin

The above chart shows Bitcoin priced in U.S. dollars. Bitcoin is a polarizing asset class, but it’s clear those championing the long-term thesis of BTC have been correct.

Many investors are focused on the next month’s inflation report, media is focused on what’s driving inflation as if it’s a mystery. In our opinion, unless you’re a short-term trader or speculator, this is wasted energy.

An astute long-term investor knows inflation is positively correlated to government spending. We can acknowledge that deficits and currency debasement aren’t likely to go away. We can own assets that could benefit from what’s NOT going to change over the coming years, i.e. perpetual deficits, fiscal recklessness, and currency debasement.