“Those of you who make investments outside of any retirement accounts are absolutely crazy if you are using actively managed funds rather than ETFs.” Suze Orman on the tax-efficiency of ETFs.

Investors understand when you buy an asset at $100, hold it for a year, sell at $150, you would have a long-term capital gain of $50.

In short, if you sell a financial security at a gain, you would owe taxes in some capacity.

This is intuitive and fair, and would be true if the underlying position was an individual stock, mutual fund, or exchange traded fund (ETF).

But what about getting hit with a random tax bill for doing nothing? That doesn’t seem fair, but it happens to unsuspecting mutual fund investors every year.

Enter the ETF.

Exchange traded funds have many benefits, low cost, real-time settlement, free to trade, transparency, access to almost every asset class, and tax-efficiency.

What makes the ETF tax-efficient?

The most obvious reason is that ETFs are mirroring an asset class, sector, industry, or style. There is very little turnover (trading).

A mutual fund has a team of managers, analysts, researchers that are actively trading trying to beat their respective benchmark. The activity leads to buying and selling, which often saddles the mutual fund owner with capital gains.

Furthermore, when an investor redeems shares in a mutual fund, the fund manager has to sell underlying securities at the fund level. Throughout the year, between tactical trading, rebalancing, and shareholder redemptions, mutual funds often have accrued capital gains which they must distribute at the end of the calendar year.

When an individual investor goes to sell an ETF, it gets sold to another investor. There’s no liquidating of the underlying securities or distribution. The fund is simply exchanged with another market participant much like an individual stock. The other ETF owners do not get hit with a taxable event because you decided to sell.

The real magic happens when new ETF shares are created and redeemed.

There are two main players for this function…

The authorized participant (AP) are liquidity providers for an ETF fund. The APs are authorized to change the supply of ETF shares in the market. They are often market makers and financial institutions.

The ETF fund i.e. Blackrock (iShares), Vanguard, Schwab, etc.

The AP and the ETF fund interact to create new ETF shares or redeem shares. This is called the creation and redemption mechanism. It’s a major reason why ETFs are tax-efficient…

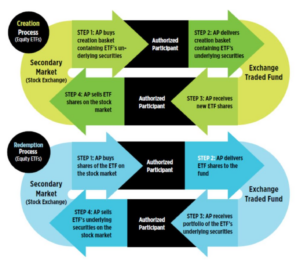

Source: ETF.com

The above graphic shows the creation and redemption function between the AP and ETF. The creation (first graphic) allows the AP to create new ETF shares by swapping the underlying securities. The redemption (second graphic) works in the opposite way, the AP delivers ETF shares by swapping underlying securities with the fund company. The ongoing creation and redemption function allows the ETF price to mirror the value of the underlying securities.

The creation and redemption function allows the fund to create and redeem shares in the ETF without triggering a capital gain at the fund level. This equates to minimal tax drag for the ETF shareholder.

The big mutual fund companies are starting to see the writing on the wall.

J.P. Morgan Converting Four Mutual Funds to ETFs

Mutual Fund Giant American Funds Launches ETF Products

DFA Lists Four New ETFs Following Industry’s Largest Mutual Fund to ETF Conversion

Furthermore, big custodians are making mutual funds more expensive & annoying to trade. I entered a sell order for a new client’s mutual fund and couldn’t believe my eyes at the $45 commission Schwab charged.

Why would anyone pay $45 per trade when you can buy/sell an ETF for virtually free?

But Nik, everyone knows ETFs are superior to mutual funds. You aren’t telling me anything I don’t know!

While the gap is closing, ETFs have a long way to go to unseat the mutual fund complex.

According to Statista, mutual funds registered in the United States managed ~$24 trillion in assets.

The total ETF industry is ~$7.7 trillion (per Statisa).

In our opinion, ETFs will make the mutual fund obsolete within the next 5-10 years. You’re starting to see the winds shift with large mutual fund shops converting strategies to ETFs or launching their own ETF product lines.

Take a look at your taxable accounts. If you own mutual funds, you or your advisor may be committing an egregious offense, unless you like writing unnecessary checks to Uncle Sam.