“Inflation sparks heated debates because everyone spends their money differently so there’s no single inflation rate — your inflation may be very different than someone else’s, then people get angry that others don’t see what they see.” – Morgan Housel, Collaborative Fund.

There’s little doubt inflation is here. There is a debate of how sustainable inflation will be.

Is it a long-term or transitory problem due to the pandemic?

A few inflation tidbits…

- Inflation is difficult to forecast.

- The way the government calculates inflation is antiquated and broken (that’s a separate topic).

- Inflation is not a centralized phenomenon. What’s true in Washougal, WA might not be true in La Jolla, CA. Furthermore, the inflation rate for a 22 year old college student is different than that of a 70 year old retiree.

- Inflation data is mucked up due to the pandemic.

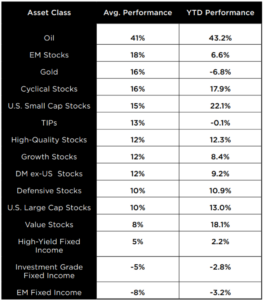

Let’s assume inflation is here to stay. We examine several asset classes and how they’ve performed in recent (post 2000) inflationary environments…

Source: Wells Fargo

The above chart shows various asset classes and how they’ve historically performed during inflationary periods and YTD (year-to-date). Most of the asset classes expected to perform well during the current inflationary environment have held up well, except for Gold & Treasury Inflation Protected Securities (TIPS). The above data is from inflationary periods since 2000.

The “since 2000” caveat in the above paragraph is important, as U.S. inflation has been relatively benign for the past twenty years…

Source: Koyfin

The above graph shows the U.S. Consumer Price Index (CPI) over the past twenty years. Other than a few instances, CPI has bounced between a fairly tight range.

While recent history provides some context how certain assets perform during inflationary periods, let’s look at a period where prices for goods and services were fluctuating wildly…

Source: Koyfin

The above graph shows CPI from 1942-1951. The mid-40’s were riddled with periods of huge upticks in inflation. The early 50’s saw another run-up, although it was not as pronounced.

Which assets performed the best during the roaring inflationary period between 1942-1951?

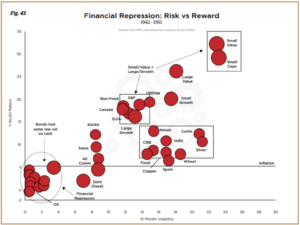

Source: Grant Williams, The Winds of Change

The above graph shows how various asset classes (red dots) held up during a period of high inflation. The bottom axis (x) shows volatility. The vertical axis (y) shows return. Assets in the southwest corner performed poorly. Assets in the north/northeast corner performed well.

Here is a summary of assets that held up well (and not so well)…

Performed Well in Inflationary Environment

Small Cap Value Stocks

Small Cap Stocks

Large Cap Value Stocks

Small Cap Growth Stocks

Large Cap Stocks, including Utilities

Large Cap Growth Stocks

Mixed Bag

Commodities

Precious Metals, including Gold and Silver

60/40 Portfolio

Performed Poorly in Inflationary Environment

Cash and cash equivalents

Oil

Bonds

*We should note that the losers had low volatility, but with negative real (after inflation) returns.

You can make a strong case for real estate as an inflation hedge. Also, many progressive investors are touting digital assets i.e. Bitcoin, Ethereum, etc. as a modern inflation hedge (and a bet against manipulated fiat or paper currencies).

Here’s a look at how real estate and Bitcoin have held up over the past 12 months…

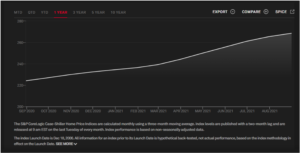

Source: S&P Global Indices

The above graph is the S&P CoreLogic Case-Shiller Home Price Index. The Case-Shiller is a proxy for national home prices and is released every month. Over the past year, U.S. home prices have appreciated by ~20%.

Source: Coindesk, Highcharts.com

The above graph shows the price of Bitcoin (BTC) over the past 12 months. The polarizing digital asset is up ~330% (3x) over the last year.

Each inflationary environment has its own cause and effect. The winners and losers might be different this time around. However, we can use previous inflation cycles to help make allocation decisions. If you believe inflation is a long-term problem, you would do well to express those viewpoints in your portfolio.

I can’t tell you how many times someone is convinced, worried, or hell-bent on something happening, only to express the opposite view in their portfolio. Whatever your story, make sure it’s consistent with your actions.

If you want to learn more about Pure Portfolios allocation process, click here.