“Most investors tend to project near-term trends – both favorable and adverse indefinitely into the future.” – Seth Klarman, famous investor

Let’s go back to 2021.

The below NFT (non-fungible token) or digital art sold for $11.8 million dollars. $11.8 million dollars!

Source: Twitter, Reuters

The above graphic is literally a JPEG picture file that someone paid eight figures for. Perhaps nothing captures the reckless exuberance of the market top better than NFT trading.

Special Purpose Acquisition Companies (SPACs) raised $172.2 billion dollars. These blank check companies collect money from investors with the promise of buying other companies in the open market.

SPACs typically have no formal action plan to present investors. It was basically “trust me, I’m going to make us all rich.”

Novice traders were using gamified trading apps to gamble on options, meme stocks, crypto, etc. on leverage. Companies that were technically insolvent skyrocketed to nosebleed valuations for no logical reason. Crypto projects that were called a joke by their own creator minted new millionaires.

Interest rates were at 0%. Speculation was rampant. Investors were throwing money around without consideration of risk management.

In hindsight, it was pure madness. In the moment, it felt comfortably unsustainable.

Fast forward to 2022…

NFT sales volume and prices have fallen off a cliff.

SPAC issuance has ground to a halt. Most existing SPACs are down at least 50% (some have lost nearly all of their value, see the “SPAC King Goes Silent with His Empire Shriveling“).

The meme stock craze seems to have come and gone, with many investors losing everything.

The crypto market has cratered.

Investors are shunning risk, clamoring for “boring” I-Savings bonds and short-term U.S. Treasuries.

Call it the year of the 180.

Most everything we’ve known to be true during the previous cycle has changed.

- Low inflation gave way to higher inflation.

- Low rates turned into higher rates.

- Risk management replaced irrational speculation.

- Borrowing has become less attractive. Saving has become more attractive.

- Technology stocks have been crushed. Old economy, value stocks are in favor.

- Fixed income finally has income.

- Non-existent volatility preceded outsized volatility.

Unfortunately, the calm and prosperity of the previous cycle became the “new normal” for investors. Many were misallocated, over-exposed, and had zero concept of risk.

Who can blame them? We were coming off the most serene decade of the last 100 years.

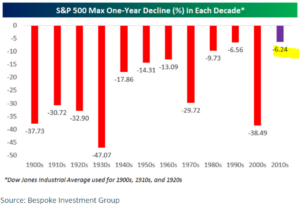

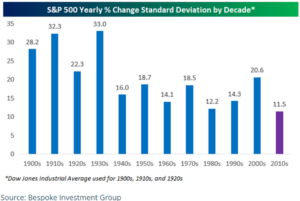

We pulled the following graphs from our December 2019 post, “Did Investors Experience a Golden Decade?”

Stunningly, the max one-year decline during the entire 2010s decade was 6.24%!!

The above graph shows the S&P’s max one-year decline per decade. Think about it, the max one-year decline for the 2010s was only 6.24%. Over the last hundred years, only the 1990s come close.

The S&P 500 posted the lowest standard deviation (measure of risk) of any decade in the 1900s.

The above graph shows yearly S&P 500 standard deviation per decade. The lower the number, the less violently stocks moved. The 2010s saw outsized gains with little worry about the downside.

From the same 2019 post, we warned…

“We don’t know what 2020 or beyond will bring for U.S. investors, but if historical relationships hold, the next decade could be characterized by lower returns, elevated volatility, and an overdue recessionary period.”

This isn’t meant to be an “I told you so.” There are plenty of things we got wrong.

2020 Bear Market Assessment: What We Got Right & Wrong

2022 Bear Market Assessment: What We Got Right & Wrong

The takeaway is that markets have a way of humbling even the best investors.

Markets move in cycles.

Good times precede difficult times. Difficult times precede good times.

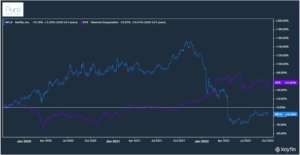

What’s in favor becomes out of favor. Perhaps nothing captures this phenomenon better than Technology and Energy…

Source: Koyfin, Pure Portfolios

The above graph shows the three-year price performance of Netflix (blue) and Chevron (purple). Energy stocks had massively underperformed for over a decade while Tech could do no wrong. That’s completely shifted in 2022.

The year of the 180 has challenged the playbook from the last golden decade. In our opinion, it would be reckless to assume what worked yesterday i.e., growth, big Tech, ignoring valuation, endless private equity money searching for the next start-up unicorn, etc. is going to win tomorrow.

Famous hedge fund manager Stanley Drukenmiller sums it up nicely…

“The world changes. You’re only going to pick up change if you’re opening your mind up to how things could be different, whether it’s better or worse.“