“The debt is not going to be balanced. The annual deficit seems to be getting worse and worse. And if the dollar is going to be debased, then bitcoin is going to keep going up.” – Anthony Pompliano, The Pomp Letter

Gold and Bitcoin are more similar than you think.

One is widely accepted. The other is the annoying party guest that won’t leave.

Both should have a seat at the dinner table.

We examine the simple case for Gold & Bitcoin (BTC) for the modern investor.

I’ve heard people worry about fiscal recklessness of government, inflation, debasement of the U.S. dollar, and incompetent politicians. In the next breath, they dismiss the merits of Gold or BTC.

They are making the case for owning both without knowing it.

The Case for Gold

- Functions as a safe-haven asset during turbulent times

- Provides protection during economic and geopolitical uncertainty

- Acts as an effective hedge against inflation and currency devaluation

- Historically rallies when confidence in fiat (paper) currencies deteriorates

- Serves as an effective hedge for portfolios weighed toward equities and bonds

- Limited (inelastic) supply helps protect it from monetary policy shenanigans

The Case for Bitcoin (BTC)

- Limited supply of 21 million coins creates structural pressure for price appreciation

- Fixed supply helps protect it from monetary policy shenanigans

- Historically rallies when confidence in fiat (paper) currencies deteriorates

- Massive institutional and retail investor adoption. The Bitcoin ETF approval by the SEC in 2024 was a game changer.

- Developing regulatory framework has legitimized the digital asset

- Enables large cross-border payments

- Provides diversification from traditional stocks & bonds

- Central banks and corporations are buying BTC as a store of value

While most wouldn’t associate gold with BTC, I see many similarities in their respective investment thesis’. I believe the primary reason for owning Gold and BTC is very simple…

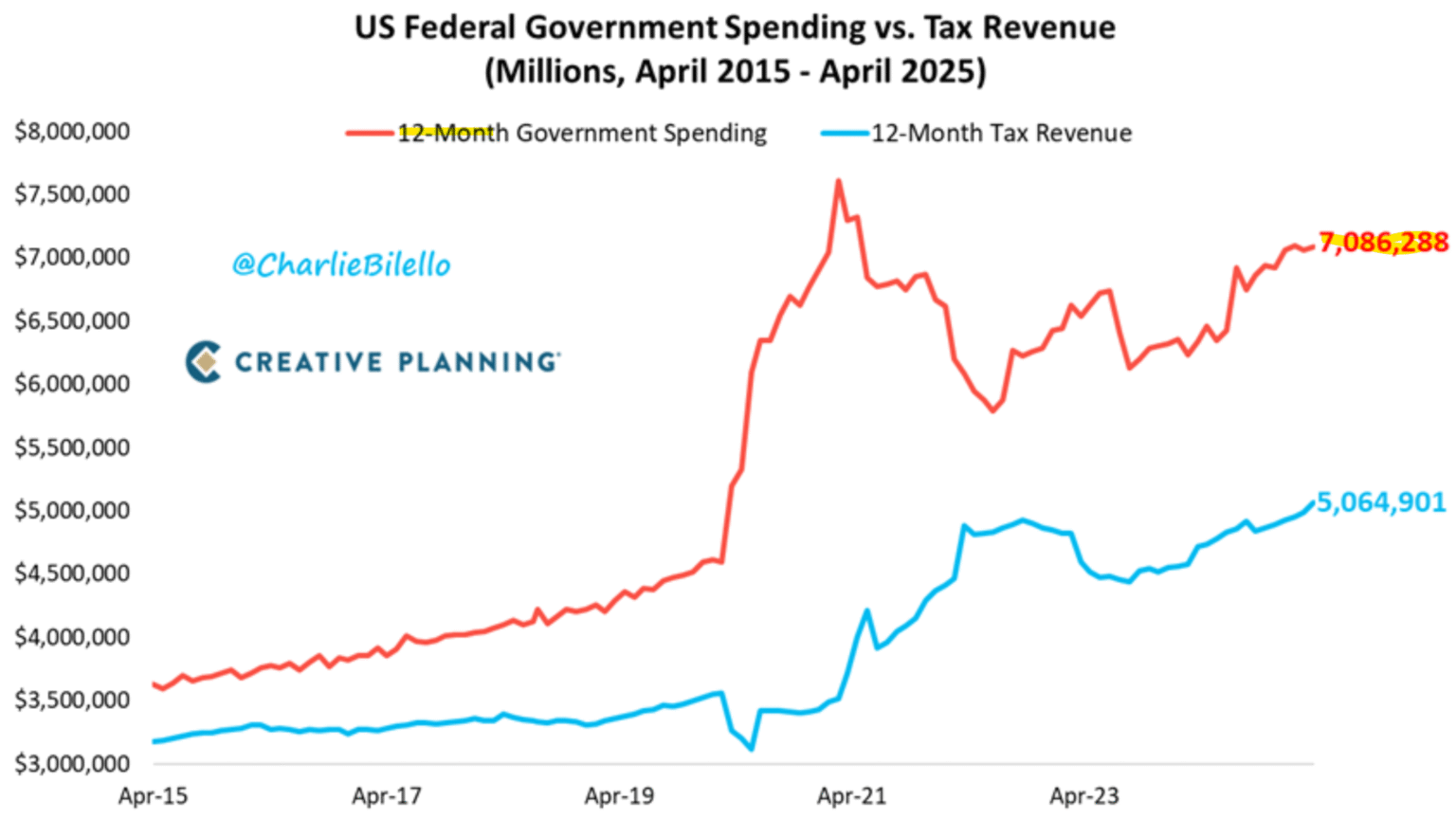

Source: Creative Planning, Charlie Bilello

The above chart shows U.S. federal spending (red) vs. tax revenue (blue) going back to April 2015.

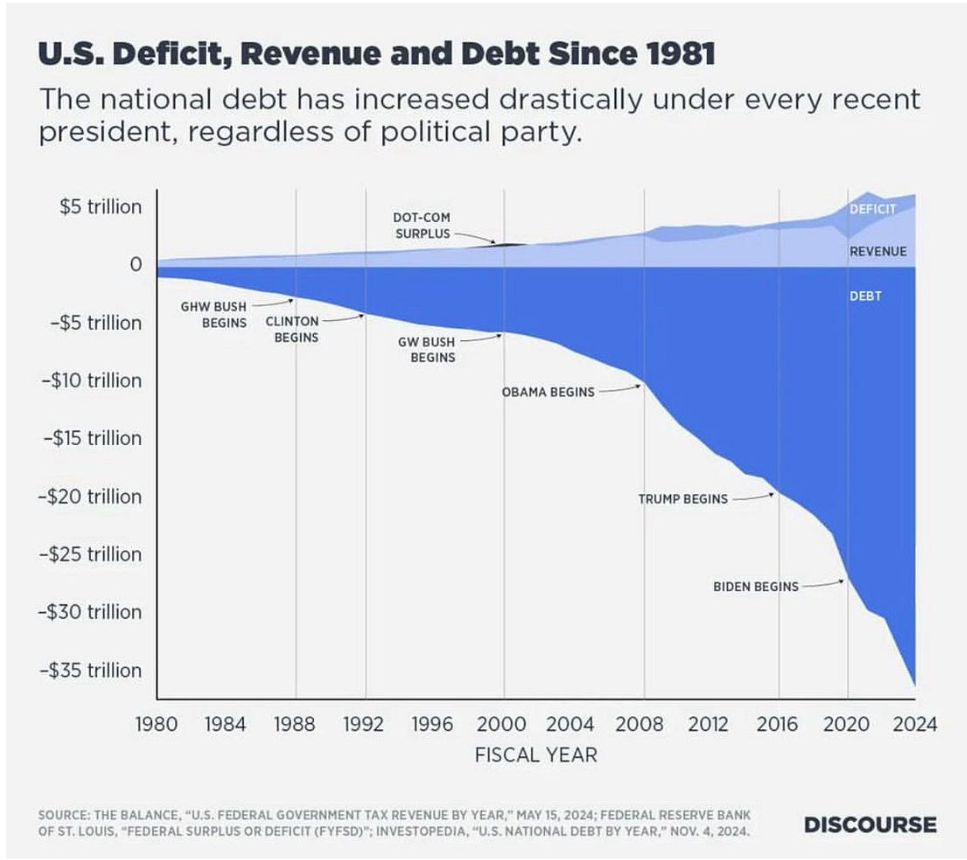

Source: Discourse

The above chart shows accumulated national debt, revenue, and deficit spending. The out-of-control spending is very much a two-party problem with no end in sight.

In my opinion, fiscal recklessness, massive debt burdens, and the debasement of the U.S. dollar have been the biggest tailwinds to the price of Gold and BTC.

Source: Visual Capitalist

The above graph shows the positive correlation between Gold’s price and U.S. government debt.

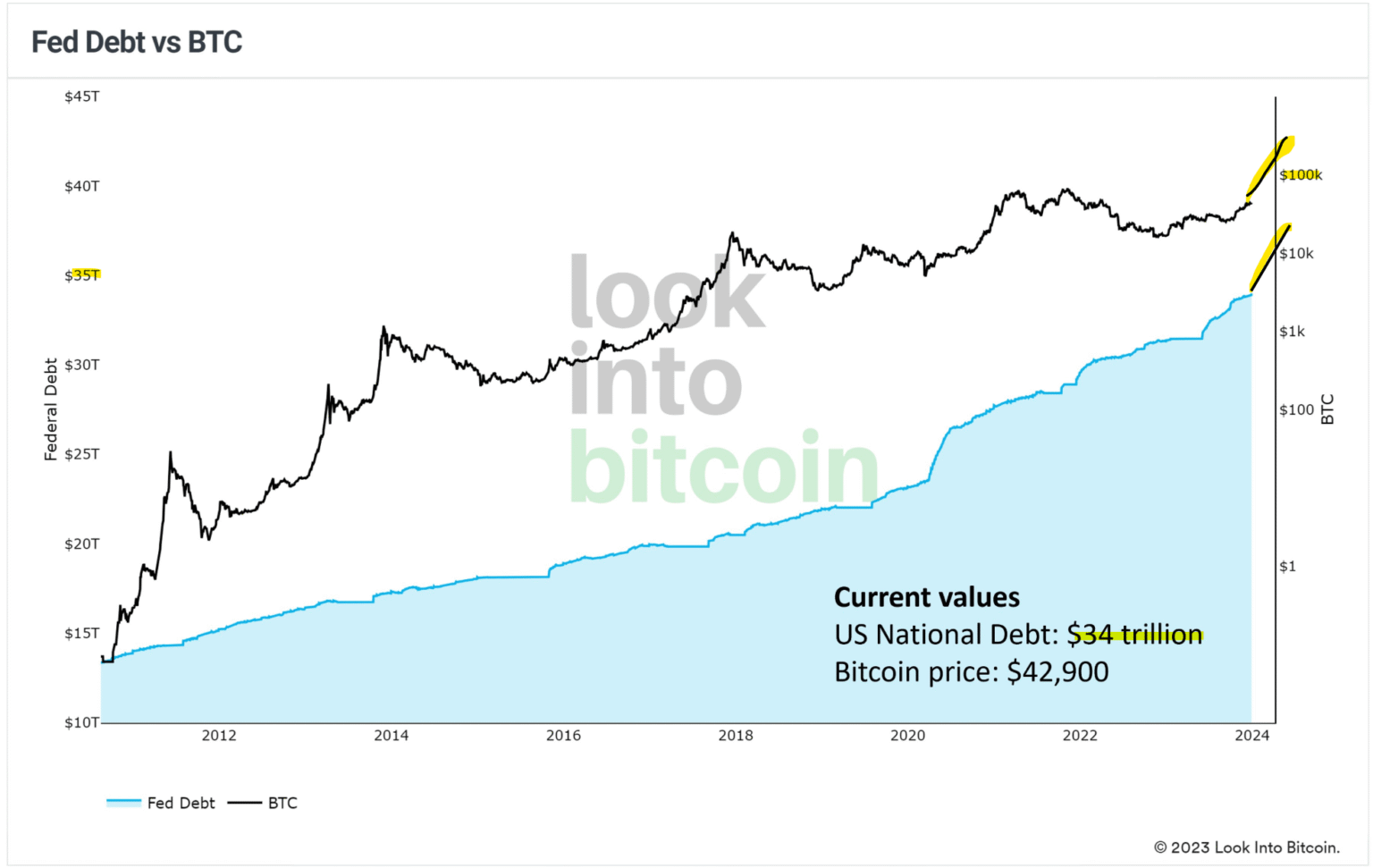

Source: Look Into Bitcoin

The above chart shows the price of BTC (black) vs. accumulated U.S. national debt (blue). The graphic is a bit dated, but you can clearly see the positive relationship between BTC’s price and U.S. federal debt.

Why is Gold and BTC’s price correlated to U.S. debt levels?

If the U.S. dollar keeps getting weaker and BTC/Gold are priced in dollars, it becomes a simple math equation; it’s going to require more dollars to buy one BTC or ounce of Gold.

Gold and BTC’s price will continue to rise along with debt levels as the U.S. dollar doesn’t exhibit sound money principles.

According to Forbes, sound money refers to a currency that maintains stable value over time and provides a reliable foundation for economic transactions (fail).

Requires governments to align spending with reserves (fail)

Limit excess debt accumulation and restrain government’s ability to print money freely (fail).

The U.S. is not alone. It would seem most every G7 country is violating sound money principles.

Critics might say BTC isn’t money. It’s fake internet money, a Ponzi scheme, and no one uses it to pay for anything.

Others will have similar complaints about Gold (but to a lesser extent) i.e. it’s not liquid, it’s expensive to store and move, no one uses Gold to pay for stuff.

I would counter with a dollar is only a dollar because you and I agree it’s worth a dollar. If enough people agree & accept Gold, BTC, or toilet paper as a medium of exchange, two willing parties can conduct commerce.

The sheer size of Gold & BTC indicates the world is catching on…

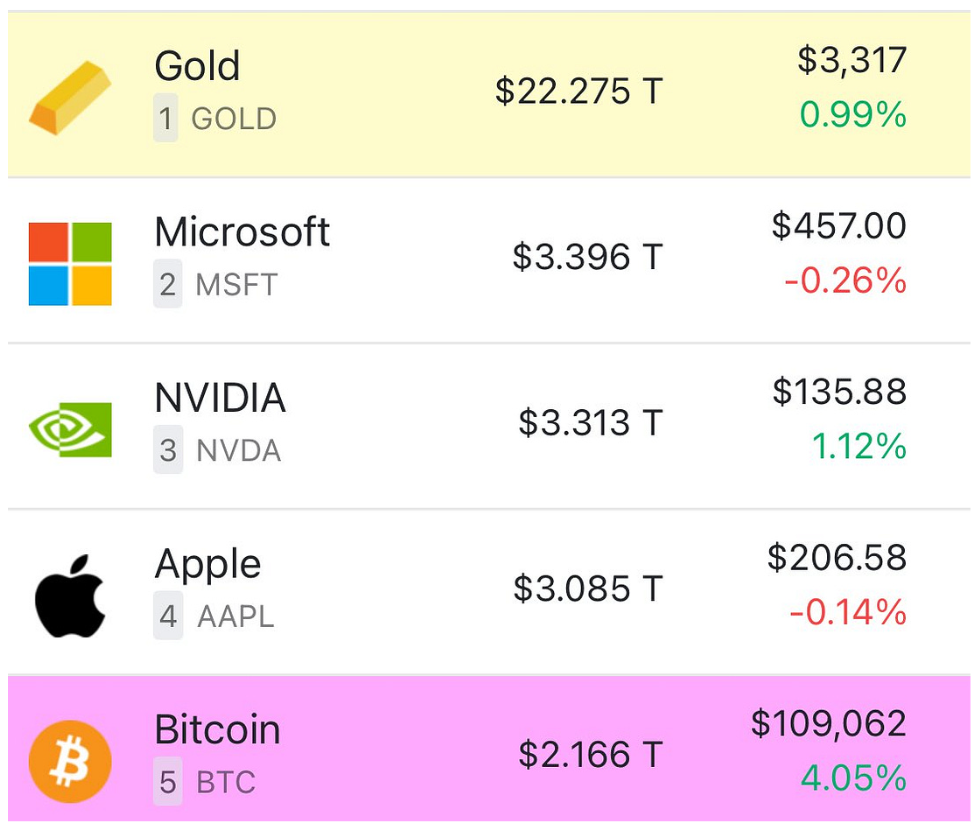

Source: The Pomp Letter 5/22/25

The above chart shows Gold & Bitcoin’s market cap (measure of size, in trillions) vs. several technology companies. Gold & BTC are quietly amassing size and adoption.

I’m not writing this post to convince someone to go out and blindly buy Gold and BTC. Gold and BTC can be volatile assets with price movements that often have zero rhyme or reason.

You might not agree with owning Gold or BTC. That’s fine.

However, in a world where there’s constant change, uncertainty, and randomness, it’s important to identify structural, long-term trends that aren’t going to change.

From our 9/12/2024 post, “What’s NOT Going to Change in 10 Years?” …

Amazon founder Jeff Bezos was often asked what’s going to change in the future. Bezos cringed at the question. How the heck can anyone know what the future would look like?

“I almost never get asked, what’s NOT going to change in the next 10 years? This question is actually the more important of the two because you can build a business strategy around things that are stable in time.”

Most can agree it’s highly unlikely budgets will be balanced, the debt paid down, and paper currencies maintain their purchasing power. Therefore, I feel strongly Gold and BTC could benefit from structural issues that aren’t likely to change.

For additional content on Gold & Bitcoin, see “Reckless Government Spending: How it Could Impact Your Investments.”