“It might make sense to hedge some of your equity risk.” – Toby Weber, Pure Portfolios

“I’m 72 years old. Why would I spend my remaining years on Earth rooting for the market to go down? I have more than enough.” – Pure client.

Ahh, touché. It turns out, there’s sage wisdom packed in the above client statement.

Which begs the question…

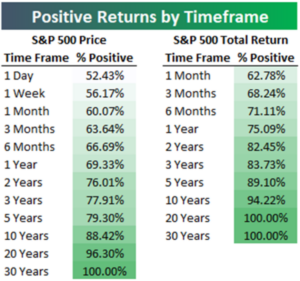

Over various time periods, from a few months to a few decades, what is the likelihood of positive returns for the S&P 500?

Most investors know that time is their friend. Even we were surprised at some of the short-term numbers. For example, the S&P’s total return has been positive 75% of the time over a one-year period!

Source: Bespoke Investment Group

The above graph shows S&P 500 positive returns by timeframe. The left column is price return (excluding dividends). The right column is total return (including dividends). The S&P’s likelihood of a positive outcomes is virtually a coinflip over 1-day. However, as time passes, the odds drastically shift in favor of the patient investor. Going out 30 years, the S&P 500 has posted positive returns 100% of the time! However, past performance does not guarantee future returns.

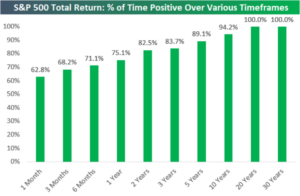

The below is a graphical representation of the S&P’s “% of time positive over various timeframes” (the first graph is price return, the second graph is total return).

Source: Bespoke Investment Group

The above graph shows price return of the S&P 500 (excluding dividends).

Source: Bespoke Investment Group

The above graph shows total return of the S&P 500 (including dividends).

A few things jump out…

- Market pessimists are fighting a strong current of positive market outcomes.

- Young people with decades to invest shouldn’t fret about noise, i.e. entry points for investing new cash, daily financial news, market timing, etc. Let time and the magic of compounding do its thing.

- ~100 years of market returns would suggest patience and optimism are the two most powerful weapons for the individual investor.

- Executing on the above is easier said than done. Per our previous post, “Intoxicated with Pessimism,” most people aren’t interested in what could go right. We are infatuated with tales of market carnage and train wrecks.

It should be noted that a retiree might not have the liberty to shovel his nest egg into 100% equities. It takes years, sometimes decades to smooth out negative investment returns (see “The Biggest Risk to New Retirees“).

Nor are we advocating you shovel 100% of your portfolio into equities. Build a portfolio that reflects the way you view the world. Stick to it.

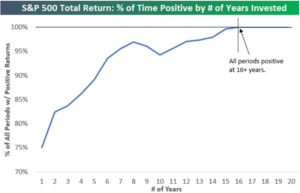

Source: Bespoke Investment Group

The above graph show the odds of a positive investment outcome (y-axis) and number of years invested (x-axis). Over a two-year period, the odds of a positive return are over 80%! That’s a pretty good case for plugging cash into equities rather than agonizing over market entry points. Keep in mind that past performance does not guarantee future returns.

If you’re young and have decades to invest, focus on your savings rate. Don’t agonize over your entry point.

If you’re a perpetual pessimist, you’re fighting 93 years of empirical evidence. Be honest with yourself about your disposition and biases. There is a very real cost to doom and gloom (see “Unspoken Cost of a Doomsdayer“).

Perhaps Warren Buffett said it best…

“Who has benefited during the past 238 years by betting against America?”