“Consider two degenerate gamblers flipping a quarter for $100 per flip. One of the gamblers has heads and the other has tails for the duration of the game. If it lands on tails 10x in a row, the unlucky gambler with heads might be bust before the math evens out. This is sequence risk in action.” – Pure Blog on Monte Carlo Analysis, January 28th, 2021

You’ve saved your entire life. It’s time to downshift and enjoy the fruits of your hard work. It’s finally time to retire.

You’ve been meticulous in your planning. Medicare, check. Social Security, check. Creating a retirement budget (including plenty of travel), check. Mapping out distributions from your investment accounts, check.

What’s potentially the biggest risk to your retirement plan?

It’s not-so-obvious and you might not have even heard of it. It’s known as sequence of return risk.

Sequence of return risk is experiencing a period of negative returns early in retirement. That’s when you have the most capital invested, and it has to last the longest amount of time. For example, a newly retired 60-year old, with a life expectancy of 94, has to live off of their investable assets for 34 years!

Furthermore, early retirees often draw the highest distributions out of their retirement plans, as they adapt to an active new lifestyle. The double-edged sword of market declines and outsized distributions can significantly impair the amount of projected retirement capital.

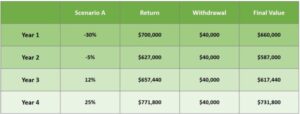

Let’s assume a new retiree has $1,000,000 to invest and takes out $40,000 (4% rule, which is obsolete in our opinion) per year.

In year one of retirement, our new retiree gets a rude awakening…

Source: The Seven Group

The above graph shows back-to-back negative return years for our unlucky retiree. The investment losses coupled with the annual distributions severely impair the capital base of the portfolio by 34% after the first year of retirement. *We are assuming our retiree doesn’t freak out and abandon their long-term investment plan in subsequent years. Easier said than done.*

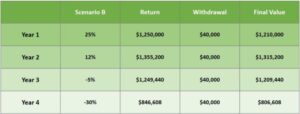

Using the same $1,000,000 portfolio and $40,000 annual withdrawal, let’s flip the sequence returns from scenario A.

Source: The Seven Group

The above graphic shows the same set of returns, but in opposite order. Our retiree is feeling much more confident with his long term plan. Even with the negative returns later on, the retiree is working off a heathier capital base and has ~$75,000 more. The only difference in the two examples is the sequence of returns.

Here’s how a new retiree can mitigate sequence of return risk, without having an opinion on what financial markets do next…

Model Negative Market Returns the First Year of Retirement

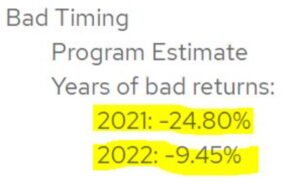

We think it is important that financial plans we run at Pure Portfolios hammers the new retiree with steep negative returns at retirement.

It looks something like this…

Source: MoneyGuide Pro

Our financial planning software randomly generates back-to-back negative return years on the client’s retirement date.

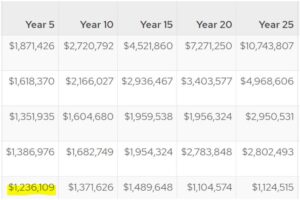

Source: MoneyGuide Pro

We are able to sort sequence of returns by quartile. The top rows are a sequence of strong returns. The bottom row is a sequence of poor returns. If the plan is still favorable with poor returns, the retiree is in a powerful position to enjoy a successful retirement.

We can average the above sequence of return outcomes with an end of plan range of investable assets…

Source: MoneyGuide Pro

The above graphic is the value of the investable assets at the end of the plan. The higher number on the left is the retiree realizing the average return (in this case, we modeled ~5% per year). The lower figure on the right shows poor timing with several negative return years at retirement. The large gap is sequence of return risk in practice.

We are trying to bulletproof our clients’ retirement plans. The randomness of 2020 is a good reminder your plan probably won’t go according to plan.

Dial Back Expenses or Reduce Distributions

Reduce distributions and/or cut expenses during difficult market environments. This could help preserve your capital base. Another option would be keeping ~one year of expenses in cash to avoid selling financial assets.

Be Honest About Risk Capacity

For most investors, chasing outsized returns in retirement is a recipe for disaster. Build a portfolio that reflects your risk profile. Run a financial plan assuming a modest and realistic rate of return. Boring investing in retirement is a good thing, if you want excitement find another hobby.

For piece of mind and to understand your portfolio’s range of outcomes, run a scenario analysis during an ugly time period…

Source: Riskalyze

The above is a scenario analysis for Random Dude during the spring of 2020. If Random Dude doesn’t like the -23% return in three months, it might be back to the drawing board to tighten up the range of potential outcomes.

We obviously cannot control financial market returns, but we can help optimize what we can control. You can work mitigate sequence of return risk without playing the market oracle.

Want to learn more? Get started building your own customized retirement plan by clicking here.