“U.S. corporate debt has climbed to roughly 46% of gross domestic product, the highest on record” – Rachel Louise Ensign, Wall Street Journal

We wrote about elevated levels of corporate debt in our post “Turning Safe Into Risky” last May. Most people probably didn’t care because the U.S. equity market was off to a strong start. Looking back in the rearview mirror, Q4 2018 provided an inexpensive lesson for fixed income investors…

Were you paying attention?

Most of the pain for unsuspecting fixed income investors comes from reaching for yield. In other words, getting enamored by the investment income of a particular class of bonds. Think high yield (junk) bonds, leveraged loans, floating rate notes, and other exotic debt instruments. Getting entrapped by juicy yields has been a common occurrence in the era of low interest rates. Nonetheless, we assume most investors dabbling in this space have a basic understanding of what could go wrong, although we have seen investors dismiss or ignore potential risks.

Even more dangerous, what if you presumed a basket of bonds was safe, but it was actually a ticking time bomb? In our opinion, there is a BBB boogeyman laying in the weeds and he makes up a big chunk of widely owned investment grade bond indices.

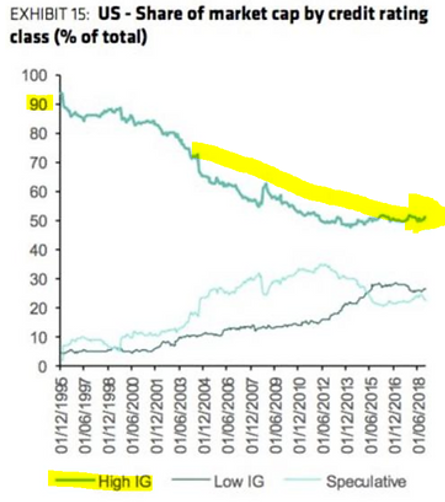

Source: Bernstein

The above graph shows low investment grade and speculative issues (trending up lines) becoming a larger percentage of corporate debt. Conversely, high quality debt (downtrending w/yellow highlights) has been declining steadily for the past 20+ years.

BBB rated corporate debt sits a notch above junk status. It’s technically classified as “investment grade”, but just barely. Historically, it has been safe to associate “investment grade” with safety & soundness, but this no longer the case. U.S. corporate debt levels are the highest in history and BBB issues are making up a larger percentage of bond indices.

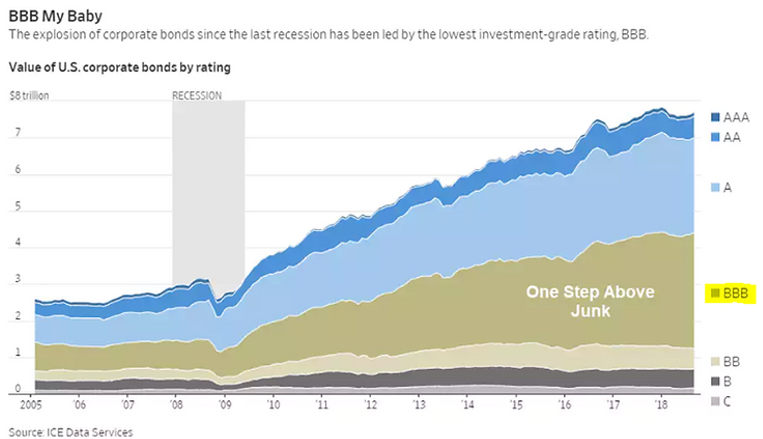

Source: ICE Data Services

Source: ICE Data Services

The above graph shows the explosion of corporate debt fueled by record low interest rates. Notice the huge increase in debt issued by marginal companies, A (light blue) & BBB (light brown) rated issues.

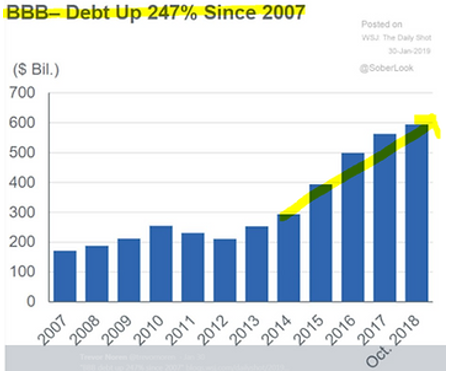

Source: Wall Street Journal

Source: Wall Street Journal

The above graph takes a closer look at the bulging BBB debt class. In 2007, BBB rated debt outstanding was ~$160 billion. In Q4 2018, BBB rated debt outstanding was approaching ~$600 billion dollars!

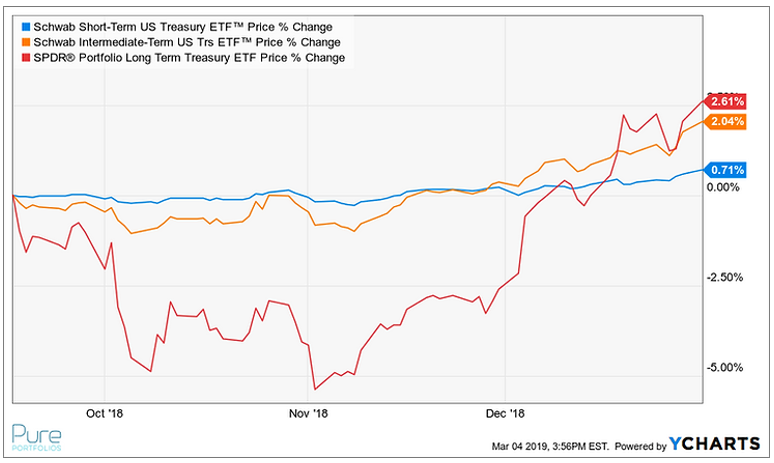

Back to the inexpensive lesson we referenced at the open. During the drama filled of Q4 2018, real investment-grade bonds provided a safe-haven from the carnage:

The above graph shows the performance of U.S. Treasury ETFs at various maturities in the 4th quarter of 2018 (blue/short, orange/intermediate, and red/long). We can debate the fiscal health of our great nation, but when things go sideways, U.S. bonds have historically been a good place to be.

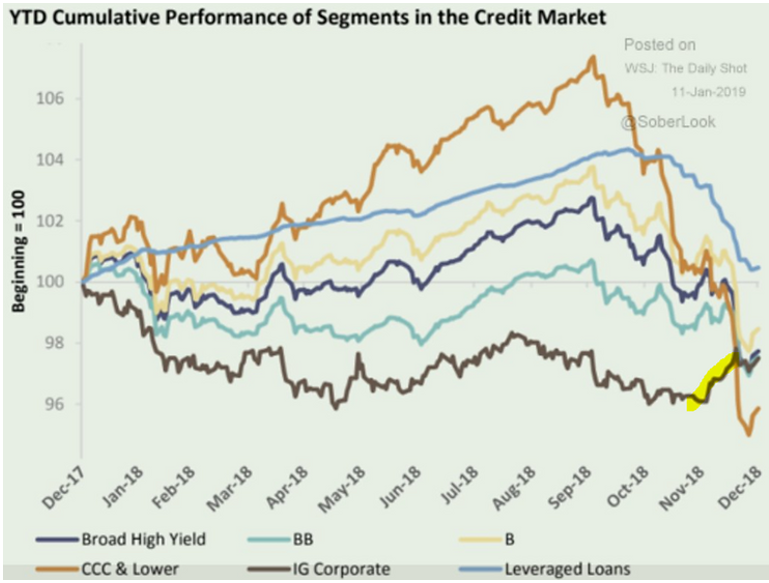

The opposite was true of lower quality investment grade and junk rated debt:

Source: Wall Street Journal

Source: Wall Street Journal

The above graph shows the huge move downward in lower quality bonds during Q4 2018. This is a nightmare scenario for a portfolio, as bonds behave like equities, and everything moves down together.

Here’s how you can avoid a fixed income blow-up:

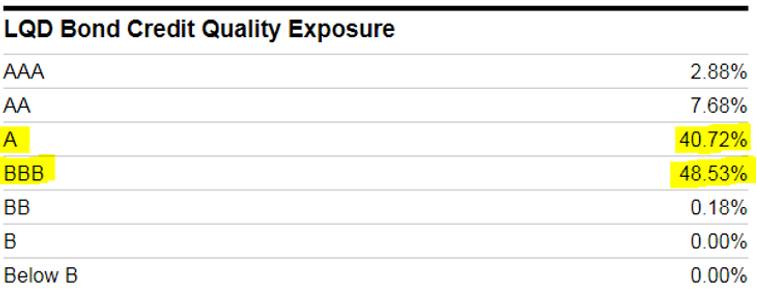

Know What You Own

We were shocked when examining the credit quality of the largest investment grade bond ETF (ticker LQD). The below graphic shows ~90% of LQD’s bond holdings are marginal companies! FYI, most fund companies will publish the credit breakdown of their holdings on their website.

Source: YCharts

Source: YCharts

Don’t Reach for Yield

It’s easy to fall in love with outsized investment income. Make sure you understand how your speculative holdings held up during recent periods of market stress.

Don’t Turn Safe into Risky

Reread our previous post “Turning Safe Into Risky.” Remember, bonds are supposed to provide shelter during a equity market storm, not take it on the chin.

The BBB creep into investment grade indices is huge reason why we prefer owning individual bonds when possible. We can target our preferred maturity, duration (interest rate risk), and credit quality. More importantly, we know exactly what we own.

Investing in bond index funds and ETFs is fine too. Just make sure you know what’s under the hood. Not all indexes are created equally. You could be sitting on a ticking time bomb that goes off when you need stability.