“Volatility in the up direction is not a problem, it’s only downward volatility that offers discourse.” – Coreen T. Sol, Financial Author.

Buy and hold investing has plenty of merits. It takes emotion out of the equation. It’s usually tax efficient. It takes less effort than a more active strategy.

All else being equal, buy and hold investing is easy to understand, monitor, and implement. Buy & hold is a heck of a lot easier when the market is going up.

The below comments are from a friend regarding his investment portfolio:

“All the emails my financial advisor sends me always say – stay the course. If I stay the course I am sure I would make money in the long run…..but what about a looming recession that may be on the horizon? Is the smart money going into less risky investments and waiting it out and then will jump back in on the downturn. I’d rather keep my money than ride the wave down.”

There is much to unpack in the above paragraph. We kept coming back to the universally offered advice most financial advisors lean on, “stay the course.”

This got us thinking, stay the course is generally fine advice for some people, but whom is it not good for?

Let’s look at situations where a stay the course approach is appropriate:

Young Investors – For those with future earnings power and time on their side, staying the course is a sound strategy. As our Twitter friend Josh Brown likes to say, every millennial should be rooting for the market to tank.

Ample Resources – We have known many investors with sufficient assets to meet current obligations. Therefore, the bulk of their investable assets will be passed on to heirs or charity. If you aren’t dependent on financial markets to meet current or future obligations, staying the course is fine.

Embracing Risk – The risk seeker that doesn’t care about daily market swings. They might have the bulk of their wealth tied up in their business, real estate, or another asset. If your investable assets make up a sliver of your balance sheet, stay the course.

For whom does stay the course become poor or even lazy advice?

Pre-Retirees & Retirees – For those living off of a fixed income or those depending on market returns to achieve their goals, a huge drawdown could be disastrous. Look no further than 2008-2010, many pre-retirees/retirees had to keep working and/or go back to work.

The part of stay the course (buy and hold) that is often understated, assumes the current portfolio is optimally allocated.

Is stay the course good advice if the investor is paying too much in fees?

What if the portfolio is tax-inefficient or doesn’t mirror how the investor feels about risk?

Quite often, the stay the course program is the path of least resistance for the advisor providing the guidance. The advisor keeps you as a client and doesn’t have to act. Making portfolio allocation changes requires work. Crafting a risk management strategy takes discipline and a deep understanding of portfolio management.

To be clear, we are not advocating pre-retirees/retirees start jumping in and out of stocks. Rather, there are some practical risk management strategies that could help preserve wealth during the next market disruption.

The following nuggets could help you better manage risk during the next market event:

Don’t Be Caught Off-Guard – Understand how your portfolio performed during the last down market. You should run stress tests to see how your portfolio held up during the Great Financial Crisis. If you’re uncomfortable by the results, you’re invested incorrectly.

Run your financial plan to show lower future returns. You don’t want to rely on unrealistic return assumptions to meet your retirement goals.

Reduce Distributions – If you’re comfortable with your asset allocation and wish to stay the course, reducing your portfolio distributions, especially during down markets, can help soften the double whammy of a market drawdown and portfolio distributions.

Counter-Cyclical Investing – We covered this is detail in “Beware of the Lazy 60/40.” The gist of the post was that risk characteristics change over a market cycle. In our opinion, owning 60% equities in 2010 (at the beginning of the economic/market cycle) was much less risky than owning 60% equities today (near the end of the economic/market cycle). In practice, this means shading your asset allocation a bit more defensively. We would rather not reach for returns in the late innings of the business cycle.

Adopt “Risk-off” Rules – Price, trend, and momentum can be powerful forces in financial markets. Empirical evidence has shown a rules-based risk management plan can reduce portfolio drawdowns.

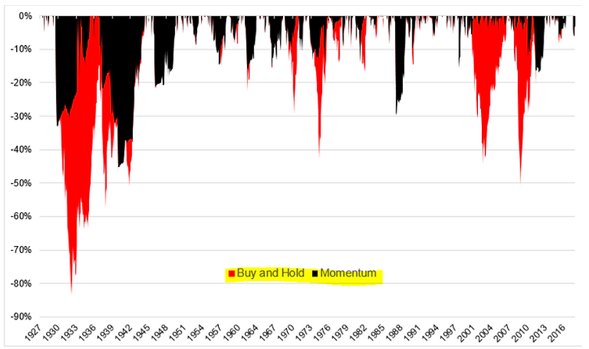

Here’s an example using a simple momentum strategy:

Source: The Irrelevant Investor Blog*

The above graph shows S&P 500 drawdowns for buy and hold (red) vs. a simple momentum strategy (black). The simple momentum strategy rules are as follows: If the S&P 500 outperformed 5-year U.S. treasury notes over the previous twelve months, invest 100% of this portfolio in the S&P 500 in the following month. If the 5-year U.S. treasury notes outperformed the S&P 500 over the previous twelve months, invest 100% of this portfolio in bonds the following month.

If you have an asset allocation that mirrors your risk profile, pay low fees, and have a tax-efficient portfolio, staying the course would be a sound approach.

For those that don’t want to ride their portfolio to the bottom or are sick of being told to stay the course, there are alternative strategies to manage risk and reduce portfolio drawdowns.

*This example was used in The Irrelevant Investor Blog and is for illustrative purposes only. Please reach out to learn more about our rules-based risk management approach.