I used to have a healthy disdain for financial planning. I viewed it as data entry; type numbers into a software program and generate a wide range of outcomes 30+ years into the future.

Hardly a meaningful exercise for clients, right?

Hundreds of financial plans later, I can confidently say the planning process is one of the most impactful exercises for our clients. In fact, it’s often the missing piece for clients who transfer from other advisors.

Here are a few tips for generating relevant, useful, and actionable financial plans.

Decisions Backed by Data

Money is emotional. We aim to strip human bias and emotion out of the equation (sound familiar?). We want to make decisions based upon data and evidence. Clients have used our planning process to decide whether to buy a winery or vacation home, how much to donate to charity each year, or amount they can bequeath to their kids, etc.

Case Study: A client wanted to buy a new construction home. They met with the builder, sifted through various finishes, and toured the model home. They were eager to proceed with an offer. Credit to our clients, they called us first. We scheduled a meeting the following day and adjusted their current plan to assess selling their home and buying the new construction home. The new home really stressed their financial plan and jeopardized their retirement. Armed with the proper information, they decided to forgo on the new home purchase and remodel their existing home.

What are you Worried About?

We all worry about something. It could be suffering investment losses, inflation, living too long, or a healthcare event. Planning for the ugly can go a long way to providing piece of mind. Often times, people have a larger margin of safety to absorb unforeseen events than they think.

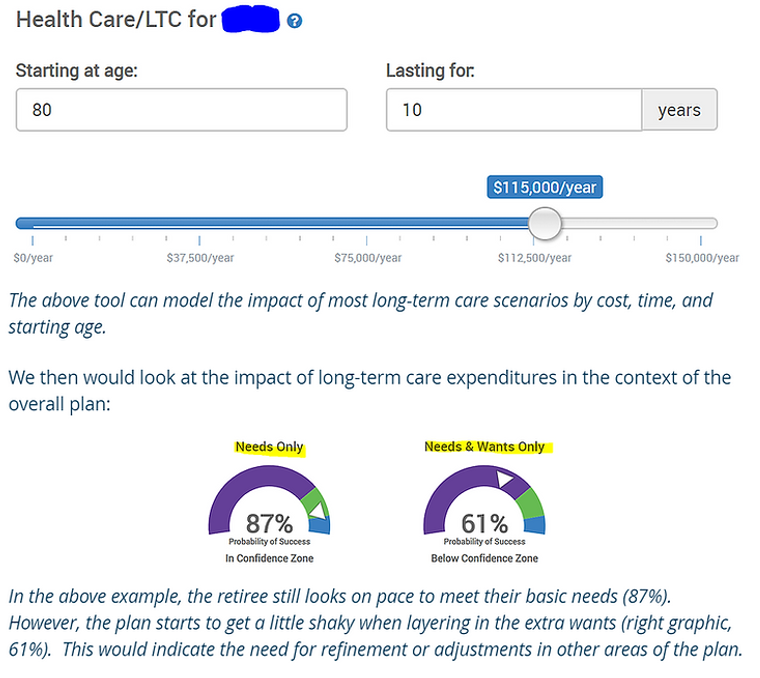

Case Study: Below is a scenario we ran for a client that was worried about the need for long-term care:

Source: MoneyGuide Pro

Taking Unnecessary Risk

For all of our clients, we want to know what is the least risky portfolio that allows them to reach their goals? That’s a great starting point. It doesn’t mean we have to invest in 100% U.S. Treasuries, but it’s nice to know we could. Remember, it’s not worth seeking risk if the best case outcome will not change your life, but the worst case would be devastating.

Case Study: The below example is from our “Less Obvious Mistakes“, blog that ran in the Portland Business Journal:

We recently read the sad story of an elderly couple with $16,000,000 invested in technology stocks at the behest of an advisor. After the dot-com bubble burst, the couple was left with $3,000,000 and a ton of regret. In the aftermath, another advisor asked if growing their investable assets from $16,000,000 to $25,000,000 would have changed their life. The couple said no. However, allocating to frothy technology stocks with their entire portfolio unnecessarily increased their risk of ruin. The large bet essentially had limited upside (wouldn’t change their life if they were right), but could endanger their retirement dreams.

Scenario Analysis

People are faced with important financial questions all the time. Some of the most common include:

- Should I take Social Security benefits at 62 or 70?

- When can I retire?

- How much do I need to take from my investment accounts per year?

- How much can I spend on travel per year?

- Should I pay off my mortgage early or stay invested?

- What is the approximate value of my estate upon death?

- Can I pay for the grandkids’ college education?

- We can run side by side comparisons of your current plan vs. layering the above scenarios individually (to isolate the impact).

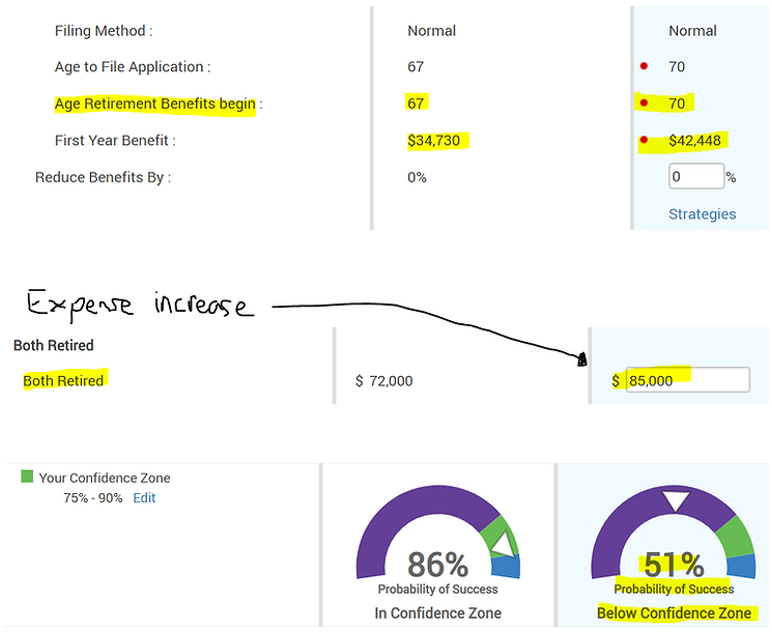

Case Study: In the below scenario analysis, we run taking Social Security benefits at age 70 (the current plan was realizing SS benefits at 67) and increase retirement expenses from $72,000/yr to $85,000 per year:

Source: MoneyGuide Pro

In this case, deferring Social Security to age 70 and increasing monthly expenses to $85,000 lowers the probability of success to 51%.

In my experience, independent advisors (RIAs) are more savvy on the financial planning side. Many partner with the leaders in planning software (MoneyGuide Pro, eMoney), to drive real client outcomes. Furthermore, independent advisors understand that the planning process is fluid and will update the plan to reflect life changes.

The biggest gaps in financial planning (often no real plan at all) come from the large institutions. If they do offer planning, it’s often proprietary software designed to see what outside assets you have. Remember, your advisor is under tremendous pressure to bring on new accounts. Client outcomes is an afterthought.

Find out how you can make better decisions with sound financial planning.