“Telling people to “ignore the noise” or “think for the long-term” does not help in the moment unless you’ve set realistic expectations ahead of time. If you don’t build corrections and bear markets into your investment plan you are setting yourself up for failure.” – Ben Carlson, A Wealth of Common Sense Blog.

Being positive is an admirable trait. The right mindset can help to overcome many of life’s unexpected twists and turns. Applying a sense of optimism to your financial plan is encouraged too, but ignoring or failing to understand what could go wrong would be irresponsible.

Too many times we hear the same generic advice of stay the course, think long-term, and ignore the noise. To be fair, this isn’t the worst advice, but it makes two large assumptions:

- Your current plan is correct.

- You understand the range of outcomes in the short-term, which allows you to stick to a long-term financial plan.

In other words, what would horrible market environments, lower future returns, unexpected expenses (like a need for long-term care) do to your chances of success? Let’s find out.

Stress Test

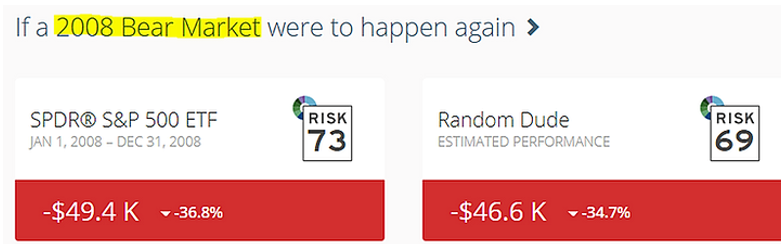

Source: Riskalyze

The above graphic shows the S&P 500 performance in 2008 (Risk 73) vs. Random Dude’s portfolio (Risk 69). You can see Random Dude (RD) would have participated fully in the carnage. If RD understands that a negative 35% drawdown is a potential outcome, he’s more likely to stick with his investment program. However, if the prospect of taking a ~35% hit makes RD uncomfortable, we can avoid a disaster by getting him invested correctly before a market event happens.

Lower Future Returns

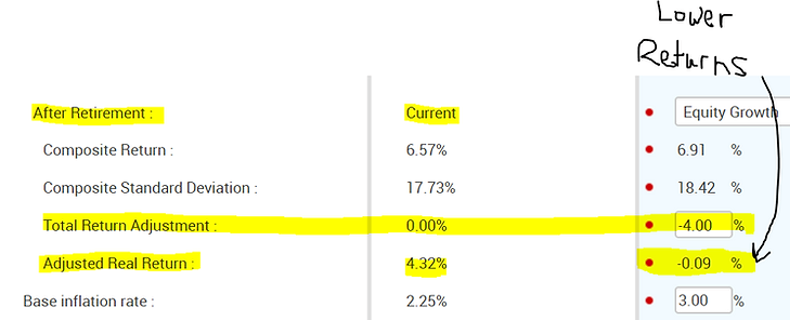

Historically, higher current valuations have led to lower future returns. We haven’t seen this come to fruition in the U.S. equity markets yet, but modeling a return expectation grounded in reality is imperative. What good does it do to model 10+% per year in your financial plan? That’s a set-up for disappointment.

The above graphic shows the return assumptions for Random Dude’s plan of 4.32% (middle column). To shock the plan, we modeled negative real returns for the life of the plan (right column, -0.09% per year). For the record, multi-decade periods of negative equity market returns has never happened in the U.S. However, in foreign markets, Japan as an example, this is very much a reality.

Source: MoneyGuide Pro

Danger Zone

We define the “danger zone” as two years before retirement or newly retired. This is a crucial period as any dramatic market loss could derail the most well thought-out retirement plan.

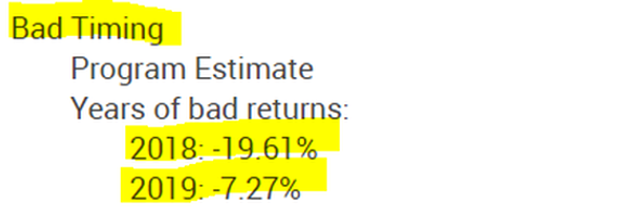

Source: MoneyGuide Pro

Our software generates random back to back negative return years for a new retiree. We are attempting to capture the impact of poorly timed negative returns on the overall financial plan.

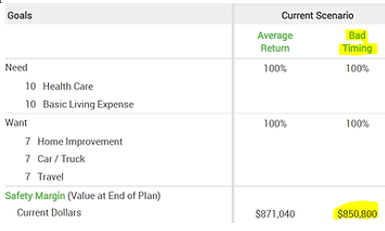

Source: MoneyGuide Pro

The above graphic shows the impact of bad timing (new retiree experiences back to back negative return years). The plan shows our newly retired friend can still fund all of his goals (left column) and his ending investable assets are still quite sizable, although slightly lower than our average return scenario. This margin of safety should give our new retiree confidence that despite the bad timing, his plan is still on track for a successful outcome.

Health Care or Long-Term Care (LTC)

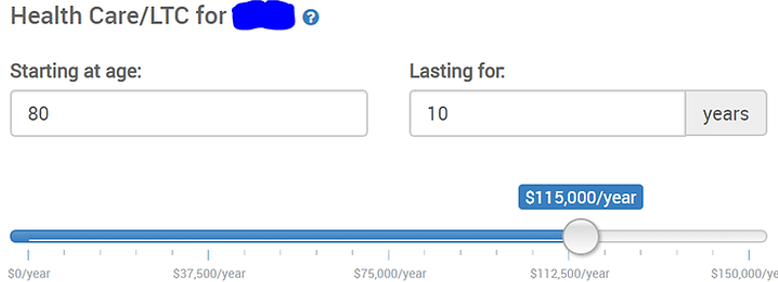

The cost of health care is often a primary concern of retirees – more specifically, the unknown cost of potential medical emergencies or long-term care.

Source: MoneyGuide Pro

The above tool can model the impact of most long-term care scenarios by cost, time, and starting age.

We then would look at the impact of long-term care expenditures in the context of the overall plan:

Source: MoneyGuide Pro

In the above example, the retiree still looks on pace to meet their basic needs (87%). However, the plan starts to get a little shaky when layering in the extra wants (right graphic, 61%). This would indicate the need for refinement or adjustments in other areas of the plan.

So, live your life through an optimistic lens. Be positive. Find the good in people. Let us beat you down with modeling the apocalyptic outcomes (kidding, sort of).

Remember, you’re more likely to stick to a long-term financial plan if you understand the full range of potential outcomes, good and bad.