“History shows us, over and over, that bull markets can go well beyond rational valuation levels as long as the outlook for future earnings is positive.” Peter Bernstein, famous economist.

The S&P 500 is up ~18% for the year (as of 9/13). It’s made 51 new all-time highs in 2021.

Impressive stuff, but you might say U.S. stocks have to be due for a correction, right?

Maybe.

You might be surprised the market is actually cheaper today than it was at the start of 2021.

How could this be?

In short, earnings caught up with price.

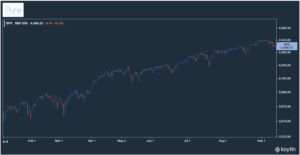

Source: Koyfin

The above graph shows the absolute price change for the S&P 500 year-to-date. The index has drifted higher in 2021, the P (as in Price) started the year around 3,700. As of this writing (9/13), the S&P hovers just below 4,500.

What about the E (as in earnings)?

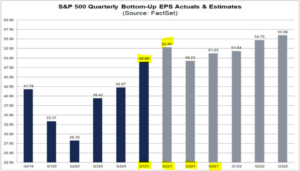

Source: FactSet

The above graph shows quarterly realized earnings (dark blue) for the S&P, and future quarterly estimates (light blue). Realized earnings for the first half of 2021 have exploded higher due to pent up demand, reopening, and government stimulus.

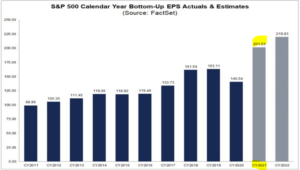

Source: FactSet

The above shows annual realized earnings combined with estimates for the remainder of 2021 (highlighted in yellow). Even if earnings fall off a cliff the second half of 2021, we should see sizable year over year earnings growth.

What does that mean for the S&P’s trailing P/E ratio?

Source: FactSet

The above graph shows the S&P’s trailing P/E ratio going down, down, down since the start of 2021. The S&P’s current trailing P/E ratio is slightly above the 5-yr average (green dotted line) and the 10-yr average (blue line).

Based on realized earnings, the S&P’s price to earnings ratio (P/E) has actually fallen from 35 to 27 the first half of 2021. While P has ascended higher, E has caught up and then some. The result is a lower valuation for the S&P 500.

What’s the point?

There’s more to investing than “market hit all-time high = market must be expensive = market must crash.”

Steve Mandel, founder of Lone Pine Capital, picked up on the perils of linear thinking in financial markets…

“People can be unbelievably smart but if they’re very linear thinkers, they won’t work as analysts (investors). Our world is about probabilities and weighing outcomes. Shades of grey. It’s not about knowing the answer to math problems.”

Market all-time highs are normal. P/E expanding and contracting is normal. Future market action requires predicting changes in human risk appetites, which is impossible to forecast.

The market can drift higher and get cheaper for no apparent reason (2021). The market can fall quickly and get more expensive (2020).

Clear as mud, right?

For more readings on investing at all-time highs, and on P/E ratios…

Do P/E Ratios Matter?