“Hold some cash in reserve to take advantage of future opportunities.”– Seth Klarman, author of Margin of Safety.

An underrated joy of writing our blog is receiving feedback from our readers. Recently, we received a thoughtful email in response to our last blog post, “Beware of the Lazy 60/40.” Our reader was growing uncomfortable about his growing cash position (his comments in italics):

I’m running 75/25% for all our retirement-only accounts. I also invest quite a bit outside of retirement, but have stopped all new purchases that are outside of automated retirement accounts (the set it and forget it routine).

My cash position is building, because I can’t find much in the way of good value at current prices. What areas should I be paying attention to?

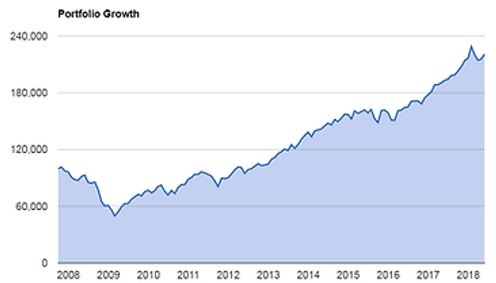

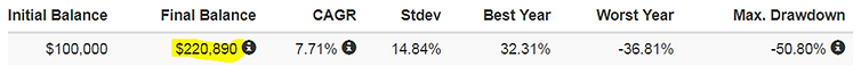

First off, kudos to our reader for keeping his retirement assets fully invested. Unless you’re embarking on retirement, or your personal financial situation has drastically changed, let the almighty power of compounding work for you. Let’s look at what would happen if you plugged $100,000 at the market top (October 2007) preceding the Great Financial Crisis:

The above chart shows a $100,000 investment in SPDR® S&P 500 ETF (SPY) from October 2007 to May 2018.

Our unfortunate timing resulted in an almost immediate loss of $50,000. However, we managed to ignore our human instinct to make drastic changes and stayed the course. Our patience was rewarded with a final portfolio value of $220,890 despite our unlucky start.

What about the growing cash position building outside of the retirement accounts? What should our reader be doing or paying attention to?

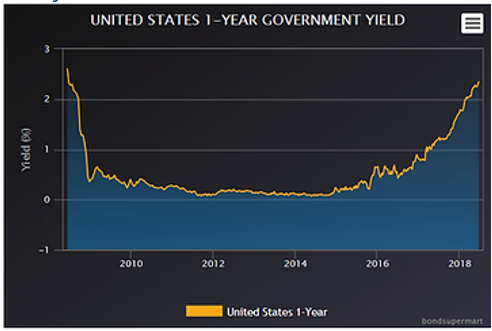

Patience grasshopper. Cash shouldn’t be looked at as a burden or drag on your portfolio. It should be viewed as a weapon waiting for an opportunity to pounce. Better yet, short-term interest rates have ticked higher and our cash can generate decent income while we wait, which has not been the case for the past nine years:

Source: Bond Supermart

The above graph shows 1 year U.S. Government Bond yields for the past 10 years. As of this writing, an investor can fetch ~2.3% yield for their opportunistic cash.

Lastly, our reader mentions the lack of investment opportunities at current prices. We generally agree with this statement, but would add that there is a lack of obvious investment opportunities at current prices. You can still find pockets of relative attractiveness at the margins. Looking back to January 4th, 2010, there were too many attractive opportunities. To name a few:

Amazon (AMZN) closed trading at $133.90. Purchasing $10,000 of AMZN would have generated an annualized return of 34.50% and a $121,143 portfolio value.

Apple (AAPL) closed trading at $30.57. Purchasing $10,000 of AAPL would have generated an annualized return of 25.97% and a $69,799 portfolio value.

Boeing (BA) closed trading at $56.18. Purchasing $10,000 of BA would have generated an annualized return of 28.12% and a $80,480 portfolio value.

Heck, even the U.S. government was begging people to buy residential real estate offering a generous home-buyer tax credit.

To summarize…

- Stick to your investing plan for core retirement assets.

- Let the powerful effect of compounding work uninterrupted. The exception would be, approaching retirement, or a dramatic shift in your financial situation.

- View cash as a strategic weapon, not a burden on your portfolio.

- Use the recent uptick in interest rates to your advantage and find a good home for your cash.

- Avoid the fear of missing out (FOMO).

- Recent history has shown investors that strategically hold cash can be rewarded with attractive investment opportunities.