“In investing, what is comfortable is rarely profitable.” – Robert Arnott, founder of Research Affiliates

Cash is comfortable.

It’s also finally producing some interest income after years of zero rates.

Throw in calls for a recession, geopolitical risk, an election year, etc. and it’s not hard to see the allure of cash.

“I’m going to sit on cash, make 4-5%, and see how this shakes out.”

It makes sense in theory. In practice, things can get messy. I’ve seen it play out like this:

- Investors go overboard with cash. They allocate money that should be invested in their long-term portfolio to cash.

- They wait for the perfect set-up to get reinvested. The perfect set-up is different for everyone; it could be their preferred candidate winning the election, a market rise, a market fall, etc.

The set-up they’re waiting for rarely comes, and they end up paralyzed by indecision.

“I’ve been sitting on a boatload of cash for five years. I missed the rally, now I don’t know what to do.”

The “I’m sitting in cash and have no idea what to do,” scenario is quite common.

The quandary stems from a broken process. It’s wrought with bias, blind spots, fear, and emotion.

Not sure how to strike a balance between cash and long-term investment?

We favor pre-determined rules to take the guesswork out of the equation. For example…

If you have a large expense in the next 12-24 months i.e. home purchase, remodel, college tuition, upcoming tax bill, etc. Park that money in cash, earn ~4-5%, and sleep well at night.

If you have volatile employment income, single earning household, or could have a big expense looming, it’s okay to sock away cash in an emergency fund. Again, park that money in cash, earn ~4-5%, and have flexibility if your plan doesn’t go according to plan.

Everything else? In our opinion, that should be invested in a long-term investment portfolio.

Most investors anchoring to cash have a fear of losing money.

In the short-run, equities can lose money and the potential range of outcomes is much wider than cash. However, the long run is a much different story. You can make the case cash is a riskier long-term allocation than equities…

Source: Creative Planning, Charlie Bilello

The above chart shows the odds of cash outperforming the S&P 500 (1928-2022). The probability of cash outperforming in the short run, 1-5 years, is ~25%. After 10 years, the odds of cash performing are quite low.

You might say, “I’m retired, I can’t invest in 100% equities.” Fair enough.

A retiree’s long-term portfolio might be a mix of stocks and bonds…

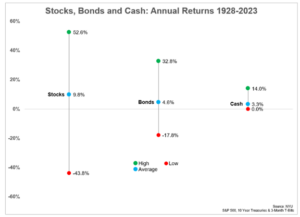

Source: NYU, Ben Carlson, A Wealth of Common Sense blog

The above graphic shows the high (green), low (red), and average return (blue) for stocks, bonds, and cash (1928-2023, returns are before inflation).

In the above chart, cash doesn’t look so bad, right? Now let’s factor inflation…

With a long-term inflation rate of 3%, these are the historical real returns for each asset class since 1928 (source: Ben Carlson):

- Stocks +6.8%

- Bonds +1.6%

- Cash +0.3%

It seems cash is a horrible long-term inflation hedge. History would suggest stocks tend to do much better as an inflation hedge over the long run (see “This is Why We Invest: Long-Term View on Markets.”).

In our opinion, cash is not a long-term investment.

In summary…

- Investors are going overboard with cash.

- Find the right balance between keeping enough cash for short-term expenses and emergencies. The rest can be invested in a long-term investment portfolio.

- Volatility, risk, and uncertainty are a normal function of financial markets (rather than a bug in the system). In investing, what’s comfortable is rarely profitable.

For additional reading, see “How Much Cash is Too Much?”

Have a question? Shoot us a note at insight@pureportfolios.com