“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis, famous investor

Generating a reasonable return on cash wasn’t a thing much of the last decade. The Fed’s interest rate tightening cycle changed that.

Now, there’s a safe place to generate a return on cash. Fixed income finally having income was one of the silver linings during a difficult 2022.

This is a great thing for savers & retirees with idle cash looking for a friendly home. Good riddance to the 0% “yield” in your big bank savings account (we covered our approach to optimizing cash here and here).

But when can too much cash become a drag?

Should investors be selling risky assets (stocks) in their long-term portfolio for the safety of cash?

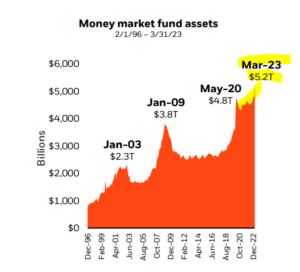

That seems to be what’s happening. Money market flows have hit historic levels…

Source: Morningstar, Blackrock

The above chart shows money market fund assets from 2/1/96 to 3/31/23. Higher yields and market volatility have caused cash balances to swell.

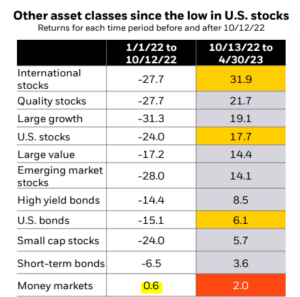

The flight to cash is a predictable reaction to the market carnage of 2022…

Source: Morningstar, Blackrock

The above chart shows various asset class returns from 1/1/22 – 10/12/22 (left column) and 10/13/22 – 4/30/23 (right column). In 2022, cash was one of the only places to hide during a historically ugly year. After the October 2022 low, investors that have shunned equities for the safety of cash have missed out.

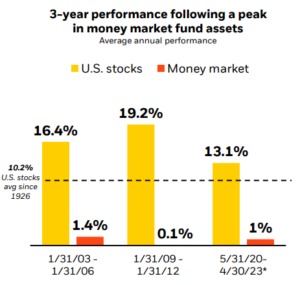

Looking at recent history, there’s a positively correlated relationship between peak money market levels and U.S. stock returns. In other words, when money market assets reach cycle highs, stocks usually do well…

Source: Morningstar, Blackrock

The above graph shows 3-year annualized performance after peak money market assets (1/1/2003 – 4/30/2023). During the last three cycles, peak money market assets resulted in annualized equity returns well above long-term averages.

Admittedly, the above sample size is small, both in time period and number of money market cycle peaks. Nonetheless, we can’t ignore the human psychology message; investors flee when it might make sense to be greedy. Investors are often greedy when they should exercise caution.

Delving into the emotional side of investing, we’ve stated the reasons for each recession or bear market are different. However, investor behavior is quite predictable.

Source: Brian Feroldi, @brianferoldi Twitter

The above graph shows a hypothetical market going up (left) and down (right). Investors are eager to invest cash in an up market because they do not want to miss out on gains (FOMO or fear of missing out). Investors are eager to sell and sit in cash during difficult markets to avoid losses. It’s an emotional volley between greed and fear.

It seems investors like the comfort of cash, especially following a difficult year. The funds are safe, and the bleeding has stopped.

However, going to cash is a two-part decision; a) selling b) getting reinvested. The former is easy. The latter is almost certain to be butchered.

Make no mistake, we encourage finding a friendly home for an emergency fund, savings account, rainy day fund, or down payment for a house, etc. This is rational behavior.

It becomes a subtle way of market timing when you’re ratholing cash with funds that would usually be invested in a long-term investment portfolio.

In investing, there’s no “all-clear” signal and the right thing is rarely comfortable.