“The complaints about how sticky inflation has been nearly matches the claims that it was transitory back in 2021.” – Bespoke Investment Group

On November 3rd, 2022, we outlined potential inflection points that could propel equities higher in our post, “When the Fed Pivots.”

A natural ebbing of inflation unlocks the possibility for the Fed to pivot.

Historically, inflation doesn’t need to return to the Fed’s 2% target to trigger a monetary policy change. A modest decrease in inflation could lead to a Fed pivot & market inflection point.

If market history holds, the hurdle for a Fed pivot is lower than most realize.

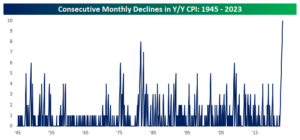

Lo and behold, inflation has slowly retreated for 10 straight months.

Source: Bespoke Investment Group

The above chart shows consecutive monthly declines in year over year Consumer Price Index (CPI). While inflation is still stubbornly high, it’s moving in the right direction. With April’s reading coming in at 4.9%, headline CPI has declined 4.2 percentage points in the ten months since the June 2022 peak.

Source: Bespoke Investment Group

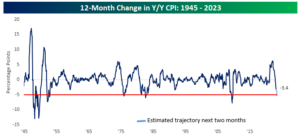

The above chart shows year-over-year changes in the Consumer Price Index (CPI). If the current trend holds over the next two months, CPI would have dropped five percentage points since the peak in June 2022 (red line). The 12-month decline in CPI would be one of the largest drops since WWII.

What are future stock returns when inflation falls over a long period of time?

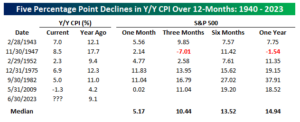

Source: Bespoke Investment Group

The above graph shows S&P 500 returns following five percentage point declines in year-over-year CPI (1940 – 2023). Over the last ~80 years there have been six other instances of CPI dropping five percentage points (or more), on almost every occasion future S&P 500 returns over one, three, six, and 12 months were positive.

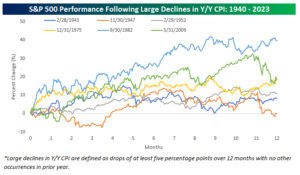

The following graph shows the same data in a different format…

Source: Bespoke Investment Group

——————————————————————————————————————————————

What’s the takeaway?

- While inflation is still elevated, no one is talking about the gradual fall of CPI.

- In prior periods when year-over-year CPI declined by a similar or larger magnitude, S&P forward returns were overwhelmingly positive.

Over the last ~80 years, falling inflation has been a tailwind to stocks. This time could be different and there’s no shortage of things that could go wrong. However, the link between falling inflation and stock returns shouldn’t be ignored.

Let us know what you think, does it feel like inflation is falling? Send us a note at insight@pureportfolios.com