“My most important discovery—a finding that changed the course of my career—is that the future is far less predictable than most investors think. The best places to make money in markets are where others are too confident in their forecasts.” – Dan Rasmussen, The Humble Investor

When markets are cratering, investors panic sell and flock to cash. The result is bursting money market fund assets. It turns out, peak money market assets are a contrarian indicator.

In our May 25th 2023 blog, “How Much Cash is Too Much?” we highlighted when money market assets peak, future stock returns are quite good.

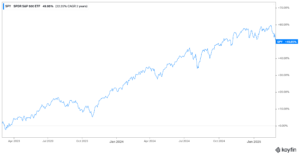

According to Morningstar & Blackrock, money market assets peaked at $5.2 trillion in March 2023. The S&P 500 proceeded to do this…

Source: Koyfin

The above graph shows the S&P 500’s total return from 3/1/2023 to 3/4/2025. Investors that made the emotional decision to sell stocks coming off a difficult 2022, were punished by ascending stock prices in 2023 & 2024.

Don’t get us wrong, there are valid reasons to hold cash. However, panic selling stocks, hoarding cash, and waiting for ‘better opportunities’ isn’t one of them. Having a FIXED cash allocation is okay if its purpose is covering short-term obligations and/or pouncing on opportunities (note: this isn’t proceeds from selling, it’s a predetermined cash allocation).

In our opinion, putting cash to work in a crisis market is the closest thing we can get to a fat pitch in investing. Unfortunately, many investors run the other way in the face of market declines.

Why bring this up now? A similar dynamic has occurred, but in the opposite direction.

Professional investors are full send on stocks and light on cash. Fund manager cash allocations are at a 15-year low…

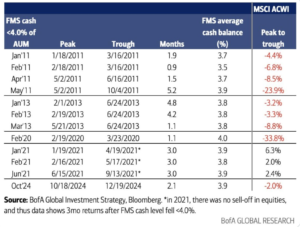

Source: BofA Global Fund Manager Survey

The above chart shows average cash levels for professional fund managers. Cash holdings are at the lowest level in 15 years at ~3.5%. Notice how low levels of cash can signal market tops i.e. 2001, 2007, 2021. Conversely, high cash balances are consistent with market bottoms i.e. December 2008, April 2020, October 2022.

How do future stock returns look when fund manager cash dips below 4%?

Source: BofA Global Research

The above chart shows short-term MSCI ACWI (global stock index) returns once fund manager’s cash balances dip below 4% (far right column). Light cash balances among professional investors can signal performance chasing, crowded trades, and frothy sentiment.

Remember 2022 & 2023 when everyone under the sun was predicting a recession?

The same survey is also signaling “no recession risk” in sight.

Source: BofA Global Fund Manager Survey

The above chart shows the net percentage of professional fund managers predicting a recession. We went from the consensus pounding the table on recession calls to “nothing to see here.” Notice how the market bottomed almost to the date when recession calls were the loudest (red circles).

Let’s recap…

- Professional investors are fully invested

- Cash allocations are at 15-year lows for fund managers

- Future global stock returns could be challenged when cash allocation dip below 4% (currently 3.5%)

- Recession expectations have gone from a near certainty to non-existent

No one can predict the next market crisis. However, we can gather clues from sentiment extremes, investor psychology, and behavioral finance to avoid getting wrecked.

We’ve said before, a savvy investor would do well to identify irrational sentiment extremes and do the opposite. There are certainly worse strategies.