“Tariffs are a tax on business that get eaten by the consumer.” – Cullen Roche, Pragmatic Capitalism

We won’t pretend the headline risk of tariff talk doesn’t impact markets. That would be foolish.

February 1, 2025 – Initial Tariff Imposition: Trump announced a 25% tariff on imports from Canada and Mexico and a 10% tariff on imports from China

February 10, 2025 – Steel and Aluminum Tariffs: Trump reinstates a 25% tariff on steel imports and increasing aluminum tariffs to 25% from 10%.

February 13, 2025 – Reciprocal Tariffs: Trump signed a memorandum directing “reciprocal tariffs” to match other countries’ tariff rates.

February 26, 2025 – EU Tariff Threat: Trump announced plans for 25% tariffs on European Union imports

March 1, 2025 – Lumber: Trump ordered a national security investigation into lumber imports.

March 3-4, 2025 – Tariffs Enacted: Trump confirmed the 25% tariffs on Canada and Mexico and a 20% tariff on China (up from 10%) would take effect.

March 7, 2025 – USMCA Adjustment: Goods qualifying under the USMCA trade agreement would be exempt.

When you dig a bit deeper, the “tariffs are going to cause the market to tank and plunge the U.S. into a recession!” doesn’t really hold water.

According to the U.S. Trade Representative website…

China was the top supplier of goods to the United States, accounting for 16.5% of total goods imports.

The top five suppliers of U.S. goods imports in 2022 were: China ($536.3 billion), Mexico ($454.8 billion), Canada ($436.6 billion), Japan ($148.1 billion), and Germany ($146.6 billion). U.S. goods imports from the European Union 27 were $553.3 billion.

The United States is the world’s biggest purchaser of goods. Many countries in the tariff crosshairs rely on the U.S. to purchase most of their exports.

The U.S. accounts for ~80% of total Mexican goods exports.

The U.S. accounts for ~76% of total Canadian goods exports.

The U.S. accounts for ~17% of total Chinese goods exports.

The U.S. accounts for ~20% of total European Union goods exports.

If we are slapping tariffs on every good flowing into our country, wouldn’t you expect the “tariff pain trade” to be highest in the countries that sell the U.S. the most stuff?

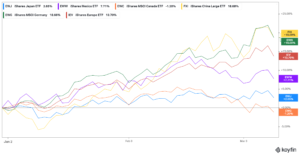

Source: Koyfin (as of 3/10/25)

The above chart shows year-to-date performance (as of 3/10/25) of countries and regions (EU) that sell the U.S. the most stuff. Except for Canada (down a modest 1%), every “tariff target” country, including Europe, is off to a great start in 2025.

China Large Cap ETF (FXI, yellow) +18.68%

Germany DAX ETF (EWG, green) +18.66%

European Union ETF (IEV, red) +13.70%

Mexico ETF (EWW, purple) +7.71%

Canada ETF (EWC, orange) -1.20%

How can countries at the epicenter of the United States’ trade ire be off to such a strong start?

In our opinion, there are two reasons…

-

The tariff headline risk is more noise than signal. We’ve seen this movie before…

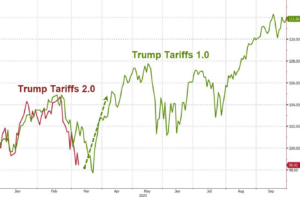

Source: Zero Hedge

The above chart shows the S&P 500’s journey during the first round of tariff announcements in President Trump’s initial term (green) vs. the second term (red). No one knows how this will end, but the choppy nature of tariff negotiations could be a temporary phenomenon.

2. Aggressive U.S. large cap valuations leave little margin for error and the AI narrative is losing steam.

In our opinion, this is an excessive valuation and AI froth story. The recent pain has been concentrated in high rising technology stocks heavily exposed to massive AI investments…

Source: Koyfin

The above chart shows year-to-date performance for the S&P 500 (SPY, purple), technology heavy Nasdaq (QQQ, blue), and Magnificent 7 stocks (MAGS, orange). When sectors of the stock market are aggressively overvalued, the margin of error is slim.

For the record, we don’t like tariffs over the long run. They have the potential to stifle competition by boxing out foreign producers, limiting consumer choice, and can slow innovation.

In the short run, they can protect emerging industries, promote “reshoring” (moving supply chains back to the U.S.), and be used as a bargaining chip to revise existing trade agreements.

In our opinion, this is a sentiment fueled sell off from the tenuous position of aggressive valuations for U.S. Large Cap stocks. It’s a wake-up call to shore up position sizing, diversify, and quit chasing yesterday’s winners.

The good news is the investment universe doesn’t end with the S&P 500 & big technology stocks. There are several asset classes that offer attractive risk/return dynamics.

For further reading…

Will Outsized U.S. Stock Returns Continue?

Reckless Gov’t Spending: How it Could Impact Your Portfolio

For more information on how Pure Portfolios manages risk and avoids large drawdowns, please email insight@pureportfolios.com