“When something is on the pedestal of popularity, the risk of a decline is high. When people assume — and price in — an expectation that things can only get better, the damage done by negative surprises is profound.” – Howard Marks, OakTree Capital

By any measure U.S. equities are stretched. Stretched relative to history. Stretched relative to other investment opportunities. Stretched relative to the rest of the world.

Does that mean we are due for a correction? No.

Does it mean investors might do well to tamp down expectations? Probably.

Pure Portfolios’ December video commentary covered the prospects for U.S. large cap stocks, which prompted several questions. Many viewers thought we saw an imminent decline coming. That’s not our conclusion; however, we can confidently suggest the next decade for U.S. stocks might look different than the previous decade…

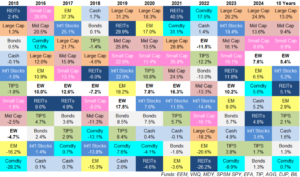

Source: A Wealth Of Common Sense, Ben Carlson

The above quilt shows the best performing asset classes by year since 2015. Apart from 2022, U.S. large cap stocks have been an absolute juggernaut. The sustained outperformance has created an aura of invincibility for U.S. investors (“Why Not Go All-In on the S&P 500?”).

Will Outsized Returns for U.S. Large Cap Stocks Continue?

When equities are out of favor and beaten down, future returns are usually higher. For example, valuations in 2009 were so beaten down, there wasn’t much downside left.

When equities are doing well and expectations are high, future returns are usually lower. In 2025, U.S. large caps are priced to perfection, meaning not much has to go wrong for sell-off.

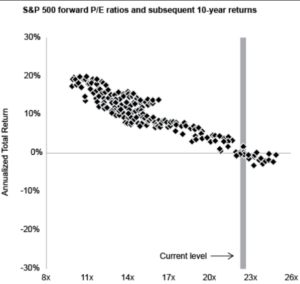

Source: J.P. Morgan

The above graph shows annualized total returns (vertical axis) for the S&P 500 based on starting valuation (bottom axis, the lower the number, the cheaper stocks are). From current valuation levels marked by the gray bar, future 10-year S&P 500 annualized returns have historically hovered around zero.

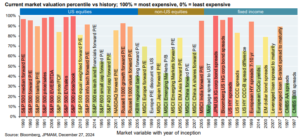

Here’s a chart that shows where U.S. equities, non-U.S. equities, and fixed income are trading relative to history…

Source: Bloomberg, J.P. Morgan

The above chart shows current market valuation vs. history (100% = most expensive, 0% = least expensive). Focusing on the left side of the chart (under the blue ‘U.S. equities’ banner), U.S. equity valuations are approaching the most expensive in history.

How do current valuation and historical future returns jive with investor expectations?

Let’s just say there is a massive disconnect…

The above chart shows the percentage of U.S. households expecting higher stock prices in the next 12 months. The current reading indicates ~60% of U.S. households think stock prices will be higher over the next 12 months. Not exactly a favorable set up with stretched valuations and lofty investor expectations. Notice how in a difficult year (2022) most folks thought the pain would continue. The following year, 2023, turned out to be quite good.

Could the S&P 500’s Fate Depend on AI?

I don’t think it’s a stretch to say much is riding on AI theme.

In our opinion, the questions about the incoming administration’s policies, inflation, and what the Fed does next pales in comparison to THE question…

Will the mammoth bet in AI payoff?

It’s too early to tell, but the pioneer and bellwether of the AI revolution, OpenAI, is still unprofitable.

According to January 6th 2025 “The Hustle” newsletter, OpenAI’s CEO Sam Altman posted on X that the company is currently losing money on its $200 monthly ChatGPT Pro subscription because people are using it “much more” than expected.

OpenAI losing money isn’t new: The company’s not profitable, despite raising ~$20B since its founding. Plus, it projected losses of ~$5B on $3.7B in revenue last year. It seems hard to fathom that the world’s most talked-about tech company isn’t cashing in, but ChatGPT was once costing OpenAI an estimated $700k per day, including on expenditures like staffing, office rent, and AI training infrastructure

The AI theme has the potential to influence S&P 500 returns due to the sheer size of the companies involved. The handful of companies driving AI investment make up ~35% of the index (Apple, Microsoft, Amazon, NVIDIA, Google, Tesla)…

The above graph shows the percentage of the largest seven companies in the S&P 500. It’s not a problem when those stocks go up driving the index higher. The flip side is that an unsuspecting investor buying an index for diversification is really placing a momentum bet into a small subset of companies.

There you have it, virtually every fundamental, technical, and behavioral metric (sentiment & expectations) is pointing to lower future returns for U.S. large cap stocks. Of course, financial markets are inclined to make logical, rational analysis look foolish. It wouldn’t surprise us if the party continued to rage on. After all, U.S. corporations are cash cows, the envy of the world, and the greatest wealth creation engine in history.

If there’s one takeaway (no, we are not saying a correction is imminent), it’s investors in U.S. large cap stocks might do well to revise their return expectations lower. There’s a high likelihood the next decade of winners looks different than the last decade’s winners.