“Invest in preparedness, not prediction.” – Morgan Housel, Collaborative Fund

Financial planning is important because it helps clients understand where they stand today and what steps they need to take to achieve their goals.

Investment management is important because once a client has built up their savings or retirement accounts, their assets should be properly invested so that their investment strategy aligns with their risk.

The higher rate environment has changed the equation for savers, borrowers, investors, and retirees.

How did we get higher rates? Look no further than decade high inflation…

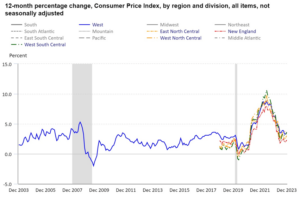

Consumer Price Index (CPI)

Source: U.S. Bureau of Labor Statistics

The above chart shows the rate of trailing 12 month inflation as measured by the Consumer Price Index (CPI). The spike to almost 10% in 2022, to a level not seen in 40 years, caused the Fed to hike interest rates aggressively in 2023.

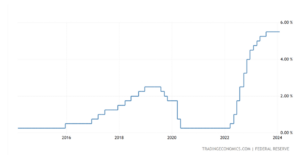

U.S. Fed Funds Interest Rate

Source: Tradingeconomics.com, Federal Reserve

The above chart shows the short-term interest rate hikes by the Fed in 2022 and 2023 as higher inflation proved to be more than transitory. Higher inflation was in part a function of unprecedented stimulus following the COVID pandemic in 2020.

Emergency Funds

Emergency funds are the safety net for life’s surprises.

How much do you need?

Where should you keep these funds?

A rule of thumb is to keep between three to six months of your monthly expenses readily available, although the exact amount you want for your situation may be more or less than that.

For example, if you’re spending $5,000 a month, you should aim to build $15,000 – $30,000 in your emergency fund. This allows you to have available cash for emergencies that arise without having to borrow money or use a credit card to cover expenses.

Emergency funds should be kept in a savings or brokerage account that you can readily access when needed. With the increase in interest rates, make sure you’re earning 4-5% per year on these funds, and continue to reevaluate what you are earning given potential interest rate changes in the future. Many financial institutions are paying savers 1% or less today, hoping that they won’t notice or won’t go to the trouble of moving the funds elsewhere.

Debt Reduction

It is never a bad time to pay down your credit card and other debts, but this is especially true today as rates have risen meaningfully over the past 12-18 months.

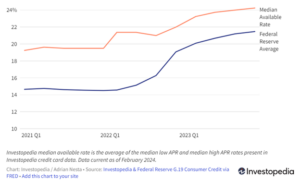

Average credit card rates have spiked to over 20%.

Auto loans come with a 7-10% interest rate or higher, even for those with good credit scores.

Source: Investopedia

The above chart shows the increase in average credit card rates from 2021 to today. A similar loan rate increase can be seen across most loan types following the interest rate hikes in 2022 and early 2023. While higher rates are good for savers, they are bad for borrowers.

Focus on paying down the highest interest rate debt first. When debating whether to pay down debt or invest the money, unless the expected return of your investment is greater than the interest rate on the debt being paid, you may be better off paying down the debt.

Buying a Home or Car

Make sure you fully understand the impact that higher interest rates will have on your monthly expenses before you make the purchase. If you have savings and investment goals, a purchase of a home or a car should not crowd out or impact your ability to continue to save and invest.

If you have to downsize your purchase to ensure the rest of your financial picture works, that is a far better option than getting overextended. Don’t rely on the assumption when you take out your mortgage that interest rates will fall allowing you to refinance to a lower payment.

Saving in a Higher Rate Environment

There is a positive benefit of higher rates for savers and investors. With short-term interest rates having increased to over 5%, you can earn that return today in a money market fund, bank CD’s, and many different types of short-term bonds.

Nik Schuurmans, Pure Portfolios’ Chief Investment Officer and President, wrote about the benefits of fixed income investments in a higher rate environment in a blog post late last year.

“Starting Yield and Future Bond Returns”

If you have short-term money that you don’t want to risk in the stock market, there are options available that allow you to earn a decent return while keeping the money safe.

Whether you’re still building wealth in your working years or harvesting wealth in your retirement years, market dynamics are not static. The spike in inflation and interest rates over the past couple of years is a prime example.

It is important to evaluate your financial decisions based on the world as it stands today, not as we wish it was or how it was yesterday.

Have questions about optimizing your plan or portfolio in a higher rate environment? Shoot us a note at insight@pureportfolios.com.