“A fine is a tax for doing something wrong. A tax is a fine for doing something right.” Anonymous

You sold a large chunk of company stock in a taxable portfolio to reduce concentration risk.

Uncle Sam is coming for his share. By your calculations, the realized long-term (LT) capital gain is $100,000, which means $15,000 in taxes owed, assuming a LT capital gains rate of 15%.

Most investors have heard of tax-loss harvesting, which involves selling an investment with an unrealized loss to offset realized gains in a portfolio. This is a fine strategy that any competent advisor or do-it-yourself investor should be doing.

However, with equity markets ascending higher, unrealized losses might be tough to come by, leaving you potentially stuck with a outsized tax bill.

Do we bite the bullet and write an outsized check to the federal government?

With a little portfolio management magic, you can chip away at the capital gain and reduce your tax bill.

Think of it as tax-loss harvesting on caffeine (also referred to as direct indexing).

Here’s how it works…

Back to our earlier example, you’ve freed up $100,000 in cash by selling company stock.

You want to continue to have U.S. large cap exposure, however, you also want to avoid the industry you work in (and obviously your company stock). For this example, let’s assume you work for a big technology company.

We choose an appropriate index to replicate, the S&P 500 minus the technology sector.

We don’t feel it’s practical buying 400+ stocks, therefore, we identify 80 U.S. large cap stocks that “explain” 90% of the S&P 500’s performance (again stripping out technology stocks).

We invest $1,250 into each of the 80 stocks for a total investment of $100,000.

We put a calendar reminder for every Monday to check where each stock is trading at vs. what we paid for it (cost basis).

After the first week, we notice a few positions have a loss…

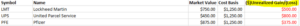

The above graphic shows the current market value of each stock, what we paid, and the unrealized gain or loss. In this case, all three positions show an unrealized loss. This is what we want!

We would sell each position and realize $1,675 in losses.

Our total LT realized capital gains is reduced from $100,000 to $98,325.

But wait, now we have cash from the sale and we still want to be invested.

Due to wash sale rules, the IRS says we cannot sell a stock, realize a loss, and buy the same stock within 30 days. No problem.

We might buy Northrup Grumman as a proxy for Lockheed Martin. FedEx as a proxy for UPS, and substitute Johnson & Johnson for Pfizer.

We now are fully invested and can rinse and repeat the same process until our realized capital gain is whittled down to nothing.

To maximizing the benefit of the above direct-indexing approach, here’s a couple of rules of thumb…

- If you’re going to incur a capital gain in your portfolio, it’s best to take it at the start of the year. This allows the entire calendar year to implement the above approach. Time is your friend.

- You want stocks that move. When you choose an index, you can optimize for stocks that are volatile. This gives an investor the best chance at harvesting losses to offset gains.

- If you’ve recently exercised options/sold company stock, sold restricted stock units (RSUs), or incurred realized capital gains in a taxable account, etc. you can reduce taxes owed, stay invested, and maximize your net after tax return.

Confused?

Pure Portfolios does this for clients every day. It’s a way to add value without having an opinion on what the market does next. We call it taking the low hanging fruit and optimizing the things you can control.

For tips on maximizing your net after returns, check out “How to Punt Stacks of Cash to Uncle Sam” and “Is Your Asset Location Costing You?“