“Cathie Wood’s stubborn reluctance to accept reality is starting to look less and less like an investment advisor and more like me betting the midnight Arkansas-Pine Bluff vs. Hawaii college basketball game.” – Quoth the Raven Blog

Amazing returns.

Huge money inflows from investors looking for riches.

The media hype machine pushing the fund manager to rock star status.

Then it all changed.

We examine the rise and fall of Cathie Wood.

Who is Cathie Wood?

A professional investor with an impressive career path.

Co-founder of a hedge fund.

Chief investment officer of a multi-national investment manager.

CEO and founder of ARK Invest.

ARK Invest is where Cathie made her mark on the investment world.

She pioneered a suite of exchange-traded funds (ETFs) that focused on disruptive technology. Think artificial intelligence, machine learning, robotics, and electric cars.

Cathie famously made a huge bet on Tesla stock. It paid off handsomely for ARK investors and validated her reputation as an investment pioneer.

Seemingly overnight, Cathie went from unknown to a household name within financial circles.

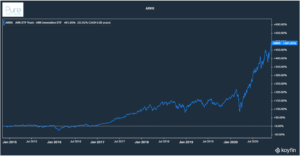

Source: Koyfin, Pure Portfolios

The above chart shows the meteoric rise of ARK’s flagship ETF (ticker: ARKK). Over a six-year period, ARKK achieved a 33.92% annualized return.

In the summer of 2021, investor risk appetites started to change. Many of ARKK’s high-flying technology companies started to come back down to Earth.

In late 2021, the wheels came completely off…

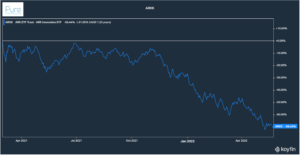

Source: Koyfin, Pure Portfolios

The above chart shows the rapid fall of the flagship ARKK ETF. Investors that chased ARKK’s performance were left with massive losses.

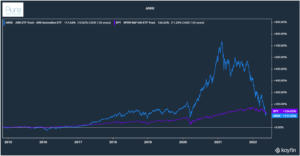

If you think the S&P 500 has been volatile over the last few years, the ARKK ETF says “hold my beer.”

Source: Koyfin, Pure Portfolios

The above graph shows the ARKK ETF & S&P 500 (SPY) returns over the last 7.5 years. The start and end points are roughly the same, but the journey couldn’t be more different. This is why we encourage investors to understand risk when evaluating performance.

Did Cathie Wood suddenly lose her Midas touch?

It’s complicated.

There’s a debate within the investment community if good investment results are based on luck or skill.

In the short run, luck could have an outsized impact on performance.

Over the long term, skill could have a bigger impact on performance.

We can debate what qualifies a time period as short vs. long.

The problem with humans is that we equate good results with skill and bad results with luck to protect our egos.

Back to the original question…did Cathie lose her touch?

I believe investment styles go in and out of favor.

The media and investment community create narratives around certain managers or strategies.

For example, if I’m a growth manager specializing in innovative technologies, 2018 – 2021 was a good time for my investment style. It was tough to miss. I very well could be anointed as an investing genius.

On the flip side, many value managers were raked over the coals during the past decade of underperformance.

Did those value managers get dumb overnight?

Of course not.

Value was simply out of favor.

To drive this home, there were whispers that Warren Buffett had lost touch with the digital economy.

Mr. Buffett trailed the tech-heavy S&P 500 for the better part of the past two years…

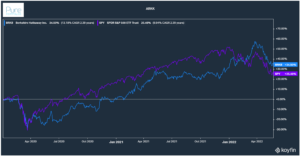

Source: Koyfin, Pure Portfolios

The above chart shows Buffett’s Berkshire Hathaway (BRKB, blue) vs. the S&P 500 (SPY, purple) since March 2020. Mr. Buffett didn’t turn stupid overnight, his value-based investment approach was simply out of favor. Ironically, Mr. Buffett ended up getting the last laugh as Berkshire has crushed the S&P in 2022.

What can we learn from all of this?

- The financial media and investment community heaps praise upon managers whose investment style is outperforming. We shun underperforming styles and managers, saying they are losing touch with the current investment landscape. Neither is likely true. Rather, investment styles go in and out of favor.

- Investors want to believe in anything that will make them money. Unfortunately, what’s in favor can quickly become out of favor. The result is that performance-chasing investors end up holding the bag. If you’re a conservative investor, stick to your identity. Chasing an asset or strategy that you don’t understand or that is outside of your risk tolerance usually doesn’t end well.

- In the short run, luck can play a massive role in “explaining” investment returns. Over the longer term, skill plays a bigger role. Avoid attributing investment success to skill and poor results to being unlucky.