“Owning US tech was the trade of the last decade. Look forwards not backwards. That trade is over. What will be the one to take over?” – Martin Pelletier, TriVest Wealth portfolio manager

It’s been said you can learn about someone by the music they listen to. Research shows there is a connection between music preferences and personality.

In my professional experience, this relationship holds true in investing. I can usually gain insight into someone’s investment personality by what they own.

We had just onboarded a new client. As I was unpacking what they currently own and trying the understand the existing strategy, the new client chimed in…

“This is a great time to buy technology stocks. They are down big-time.”

This isn’t the first time I’ve heard someone say this. Heck, it might even be true.

While it’s often better to buy a great company after it’s gone down by 40%, assuming yesterday’s winners will lead the next cycle doesn’t jive with history.

This is what I hear when someone is predicting a return of the technology bull market…

“I think we are going to see the return of a speculative market environment. Inflation will be low. Interest rates will be low.”

I’m not a market forecaster, but the Fed has been quite clear that they’re going to do the opposite; aggressive rate increases until inflation subsides.

The point is not to bash technology stocks. Pure Portfolios owns a handful in our proprietary stock models. I personally own a few in my IRA.

The lesson is what’s in favor yesterday seldom leads the pack tomorrow (see Year of the 180).

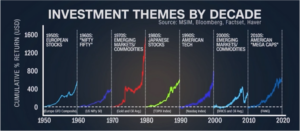

The below graph captures investment themes by decade (going back to 1950).

Source: NS Capital

The above graph shows cumulative returns (left margin) by decade going back to 1950. Winner’s seldom repeat. Losers in the previous decade can become winners. If the pattern holds, American mega caps/big tech will pass the baton to another theme for the next 10 years.

A few observations…

• Performance chasing into yesterday’s winning asset class, fund, ETF, or stock seldom works. It’s not uncommon for a period of outperformance to be followed by a period of dismal performance (Japan’s property & stock bubble, early 2000 tech crash, emerging markets lagging in the 2010s, etc.)

• It’s impossible to predict tomorrow’s winners

• Diversification is a hedge against not knowing what happens next

• Be mindful of over-exposure or becoming emotionally attached to an asset class (see The Identity Leak).

Which investment theme will dominate the next 10 years? No one knows. History might suggest it won’t be big technology stocks.

For more on themes we are watching, check out Pure Portfolios’ December 2022 Video Commentary.