What would you do if your investment lost 20%?

- A) Buy more

- B) Sell

- C) Do nothing

You’ve probably seen or taken a risk tolerance survey with similar scenarios. Gathering out of context inputs and manufacturing a risk profile is the norm for most advisors. The practice is outdated, obsolete, and more importantly, can lead to dangerous conclusions about how you view risk.

The textbook definition of risk is to expose (someone or something valued) to danger, harm, or loss. Within the context of investing, it’s a bit more opaque and nuanced. Is risk a permanent loss of capital? Is it how much your portfolio moves in relation to an benchmark? Is it the probability that you will lose your mind and abandon a long-term investment plan? You could make a reasonable argument that risk is all of the above.

When it comes to building a successful investment program, much of the work is done at the beginning. Trying to be reactive and make adjustments in response to what’s happening in financial markets is a recipe for failure. Here’s how you can build a portfolio that mirrors your attitude towards risk, and stick to it.

Frame Risk by Range of Potential Outcomes

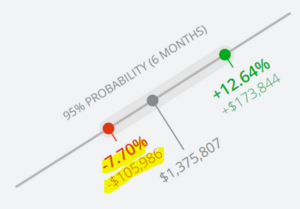

The below graphic captures the range of potential outcomes over a six month period for a sample portfolio.

Source: Riskalyze

In the above case, if the investor is uncomfortable with the possibility of losing 7.70% or $105,986, we go back to the drawing board to reduce total portfolio risk. Notice the framing of risk in percentage and dollars is much more powerful than our “what would you do if you lost 20%” scenario at the top of the blog.

You might wonder why we’re using six months as our time period. We find it’s hard to get an investor to stick to a long-term investment plan if they don’t understand the range of potential outcomes in the short-term. This is an important distinction and goes against how we’ve been conditioned to “focus on the long-term.”

We encourage folks to focus on the worst possible outcomes. In the below example, we run our sample portfolio through 2008 to see how it holds up…

Source: Riskalyze

The above stress test shows our sample portfolio holding up reasonable well vs. the S&P 500 during the debacle of 2008.

Investors will tend to let the current economic, market, or politic environment influence their risk appetite. This is a mistake. If times are good, the investor might be full of bravado. If times are bad, the investor could be overly pessimistic.

Do You Need to Take Risk?

This is where the financial plan comes in. In some cases, a client’s plan is overwhelmingly favorable taking limited investment risk. This is a powerful position to be in. Interestingly enough, this can lead to opposite, but completely acceptable investment portfolios – either very conservative or aggressive, depending on what you want for the next generation/legacy planning.

We encourage folks to avoid risks where the best possible outcome does not change their life, but the worst case would completely derail their plan. You would be surprised how often people unknowingly engage in behavior that puts their entire plan at risk, i.e. leveraging up at age 70+, going overboard helping adult children, speculating with a sizable chunk of their investable assets, etc.

Are You Behaviorally Equipped to Handle Risk?

This takes some honest self-assessment which is easier said than done. How are you really going to respond when things get difficult? The past 12+ years of virtually uninterrupted gains has created a blindness to risk and/or an attitude that investment gains are easily generated.

We’re not talking about being a 100% equity investor during 2010-2019, but rather walking into the eye of the storm and being able to stay emotionally stable. They say the best investment strategy is one you can stick to.

Perhaps a more realistic risk assessment questionnaire would read…

Let’s say you’re newly retired and have a $1,000,000 portfolio. The market tanks and you lose 20% or $200,000 in three months. The media, your golf buddies, and former colleagues are all shouting the world is ending. What do you do?

- A) Buy more

- B) Sell

- C) Do nothing

It’s a bit different when real money is at stake and you’re surrounded by chaos.

Are You Tracking Risk?

Let’s assume you take our advice and match up your portfolio to how you feel about risk, run a financial plan to see if you need to seek risk, and have shown the ability to stick to your investment strategy when things get difficult. So far, so good, right? Absolutely, but there’s one more piece. As investors, we are all aware of how our investments perform, but are often blind to how much risk we are taking to generate our performance (we call it Naked Performance).

Here is a simplified, extreme example:

Portfolio #1: Produces an 8% return investing in a mix of investment grade corporate bonds and intermediate-term U.S. Treasuries.

Portfolio #2: Produces an 8% return investing in illiquid Russian small-cap technology stocks with 3x leverage.

When evaluating a portfolio, most investors fixate on the 8% return. One would completely miss that Portfolio #2 is drastically inferior to Portfolio #1 on a risk-adjusted basis. More shocking still, the majority of financial institutions cannot even track how much risk their clients are taking to generate returns.

Remember, when it comes to building a successful investment program, much of the work is done at the beginning.