“The Fed’s ability to raise and lower short-term interest rates is its primary control over the economy.” – Alex Berenson, writer & author

We don’t own a crystal ball, but it’s reasonable to conclude the Fed is in the bottom of the 8th of its hiking cycle (we expect a 0.25% increase in July).

When rates are going up, money market funds provide a refuge from volatile stock & bond markets. Since money market funds invest in short maturity, high quality issues, taking a capital loss is rare.

We outlined Pure Portfolios’ playbook for bond positioning when rates were going up in 2022 (see “Does it Still Make Sense to Own Bonds?”)…

Bond yields tick higher.

Short-term bonds mature.

The investor reinvests at higher yields and enjoys the extra interest income.

A popular argument against bonds over the last decade has been low yields. As bond yields adjust higher, there will be opportunities for astute investors to clip higher coupon payments.

What happens when the Fed potentially starts cutting rates?

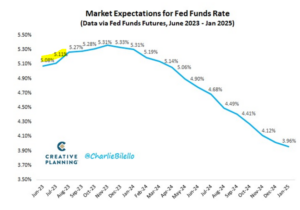

The Fed futures market thinks rate cuts are around the corner…

Source: Charlie Bilello, Creative Planning

The above graph shows market expectations for the Fed Funds rate for the next ~18 months. The market is expecting another hike or two in 2023. In early 2024, market expectations are calling for a new rate cut cycle.

You might say, “What’s the big deal? I can still get a decent cash yield even if the Fed is cutting rates.”

True, but it’s not optimal. In our opinion, it might be time to dabble in longer maturity bonds to a) get paid higher interest for longer b) achieve bond appreciation if yields go lower.

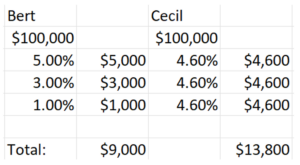

Let’s look at two investors: Bert and Cecil.

Bert is content to park cash in a ~5% money market fund. He doesn’t want to do anything else.

Cecil is open to allocating to a 3-year U.S. Treasury. He wants to mitigate reinvestment risk and lock in higher yields for longer.

You can see Bert and Cecil’s initial investment of $100,000 and estimated interest payments for money market (Bert) and 3-year U.S. Treasury (Cecil)…

The above hypothetical example shows the expected interest payments for Bert & Cecil. We assume interest rates go down over the next three years from 5% to 1%. In Bert’s case, money market yields track very closely to the Fed funds rate. As the Fed cuts rates, money market yields follow. For Cecil, his 3-year yield is lower today, but pays out a higher rate of interest in year two & three. In general, the Fed has direct influence on money market yields and short-term bond yields. Longer maturity bond yields are influenced by economic growth & inflation.

Bert would be subject to reinvestment risk if & when interest rates go lower. His future interest payments would be reinvested at the new, lower market rate.

Cecil would receive a lower interest payment today ($4,600 vs. $5,000), but realize higher interest payments in future years (Cecil would likely capture some bond appreciation if rates went down).

What is reinvestment risk?

Reinvestment risk is the possibility that the bond’s cash flow will go into new issues with a lower yield (source: Investopedia).

To be fair, if interest rates end up going higher, Bert would likely be better off as money market funds are less sensitive to rate hikes.

Confused? Don’t feel bad.

Bonds are a perplexing asset class.

Much can happen with economic data, market expectations, and Fed policy. However, it seems we are nearing the end of the current hiking cycle. A savvy investor could do well to nibble at longer-maturity bonds to potentially generate sustainable interest income, capture bond appreciation, and mitigate reinvestment risk.

For professional guidance on building or tweaking your bond portfolio, reach out to insight@pureportfolios.com