We have penned blog after blog how elections are a non-event in the grand scheme of your investment portfolio.

We recorded a video outlining every election cycle since the 1920’s.

We wrote a blog highlighting how stocks perform in election years going back a century.

We cautioned how investing and politics do not mix.

Throw all of that out the window.

If you’re worked up over the election and the impact on financial markets, this is your chance to let it all out…

We’ve officially entered the squirrely election window.

In the six U.S. Presidential election years since 2000, the S&P 500 has averaged a decline of 3.7% in the six weeks prior to election day with declines four out of six times. (Source: Bespoke Investment Group)

But, wait there’s more, volatility tends to spike as well…

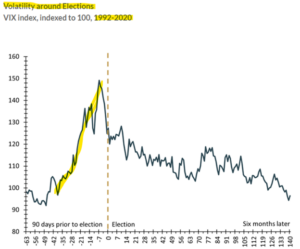

Source: Investopedia

Historical data shows that stock market volatility, as measured by the VIX index, typically spikes in October as uncertainty around the election outcome rises (yellow highlights). Notice volatility tends to subside after the election is decided, regardless of the winner.

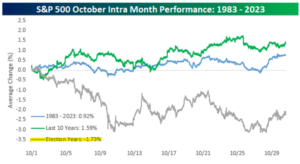

Source: Bespoke Investment Group

The above graph shows S&P 500 performance from 1983 – 2023 for the month of October. The blue line is the average October performance over the past 40 years (+0.92%). The green line is the average October performance over the past 10 years (+1.59%). The gray line shows average October performance during election years (-1.73%).

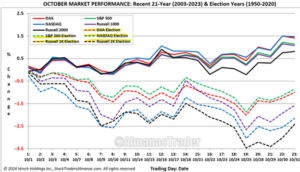

Source: Almanac Trader

The above graph goes back a bit further, 1950 – 2020, and includes several other equity asset classes. The dotted lines show October market performance during election years since 1950. The story is the same; stocks big, small, value, and growth, experience a rough patch the month prior to the presidential election.

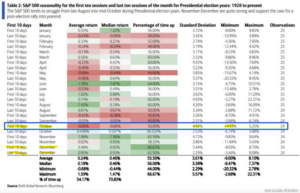

Source: BofA Global Research, Bloomberg

The above graph shows S&P performance during various periods during an election year (1928 to present). The first 10 days of October during an election year are historically the worst. The period leading up to the election is nothing to write home about either. Notice how strong post-election December tends to be, it’s one of the best periods during election years!

It would seem the uncertainty surrounding policy changes, economic impacts, and anxiety inducing headline risk can all contribute to heightened market swings in the final weeks before voters go to the polls.

What’s a person to do? In our opinion, nothing.

Post election, our daily lives go back to normal, and markets tend to move on from the election noise rather quickly.