“Bonds are dead.” – Warren Buffett via CNBC

The recent uptick in yields has the reignited the “bonds will get crushed” angry mob.

We can stroll down memory lane and find similar headlines for every year going back to when Obama was in office.

“Think Bonds are Safe? That Could Cost You.” – Barron’s, January 2020.

“The Great Bond Party of 2019 is Ending.” – NY Times.

“Rising Bond Yields Could Batter Stocks.” – Barron’s, October 2018

You get the point.

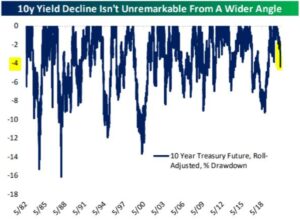

While the U.S. Treasury 10-year yield has spiked higher in recent weeks, the current move doesn’t really sound the alarm from a historical perspective. You can see many fits and starts of rising yields, within a long-term trend of falling yields.

Source: YCharts

The above chart shows the U.S. 10-Year Treasury yield over the past 30 years. While the latest uptick has been swift, it barely registers within a longer term framework. Bond yields could certainly move higher from here, but that’s not necessarily a bad thing for savers.

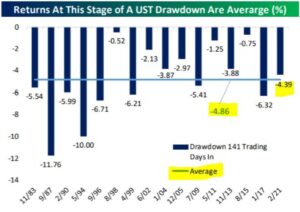

Source: Bespoke Investment Group

Source: Bespoke Investment Group

The above charts show the recent drawdown of the U.S. 10-Year Treasury vs. previous drawdowns. The latest decline is unremarkable relative to history and in-line with previous declines.

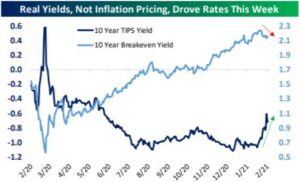

A popular narrative for the increase in bond yields is inflation (see “Is Inflation Coming?”). The recent market action doesn’t support the inflation narrative…

Source: Bespoke Investment Group

The above graph shows the 10-year breakeven yield (light blue, U.S. 10-Year yield – 10-Year TIPS yield). You can see the breakeven yield actually declined last week. You would expect the breakeven yield to blow out to the upside if the market was pricing in outsized inflation.

In our opinion, the adjustment higher in bond yields has more to do with investor’s exiting the bunker mentality rather than outsized inflation.

Here’s a excerpt from a previous Pure Portfolios blog which we think is relevant for today’s environment…

“In a previous Fed era, interest rate increases and higher bond yields were consistent with an overheating economy and inflation. In the modern era, interest rate increases and higher bond yields are consistent with a normalizing economic environment.”

Let’s assume we are wrong and inflation becomes a problem. The Fed is forced to act and hikes short-term interest rates. Doesn’t that mean chaos for bond investors?

Maybe. Maybe not.

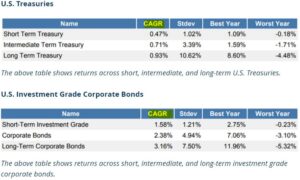

From 2015 to 2018, the Fed increased interest rates seven times, here were the results…

CAGR = Compounded Annual Growth Rate (Annualized Return)

StDev = Standard Deviation measures the dispersion of returns vs. an average value. The larger the percentage, the wider dispersion of returns

Although bond returns were lower, they were positive across the board.

What about equities? Aren’t higher bond yields bad for the stock market?

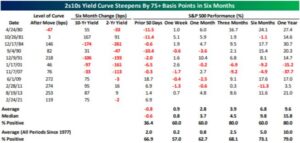

Source: Bespoke Investment Group

The above chart shows future S&P performance for steepening yield curves since 1980 (longer yields rising faster than short yields). There can be some market stress in the short-term, but longer term returns are in-line with historical averages.

In our opinion, here’s what is relevant…

- Rising interest rates & bond yields benefit net savers as they earn higher investment income.

- Lower interest rates & bond yields benefit net borrowers as their interest expense and borrowing costs are lower.

- If inflation becomes a problem, the Fed will step in and increase interest rates. That doesn’t necessarily mean bonds or stocks are doomed.

- Given low starting yields, future returns for fixed income will be muted. The benefit of owning bonds is that they’ve historically mitigated equity risk.

There are no absolutes in investing i.e. bonds are dead, inflation will crush everything, etc. Anchoring to extremes is a recipe for disaster.