“There are decades when nothing happens, and weeks when decades happen.” – Uday Kotak, founder of Kotak Mahindra Bank

The gap between how people are feeling about the economy and what’s happening is bigger than the Grand Canyon.

The soft data is soft. Think of monthly survey reports from consumers and business owners.

The hard data could be explained as mixed, but overall, not that bad. It sure doesn’t line up with the “inevitable recession” that many saw coming a few short weeks ago.

Rather than throw out wild scenarios based on headlines, short-term noise, and political bias, we cover several market-based metrics that could be a precursor to an economic slowdown.

Which recession signals are flashing red (and which ones are not)?

Stock Market

Most people don’t associate the stock market as a recessionary indicator, but one could argue it’s the best forecaster of all.

The market has a track record of sniffing out recessions before everyone else…

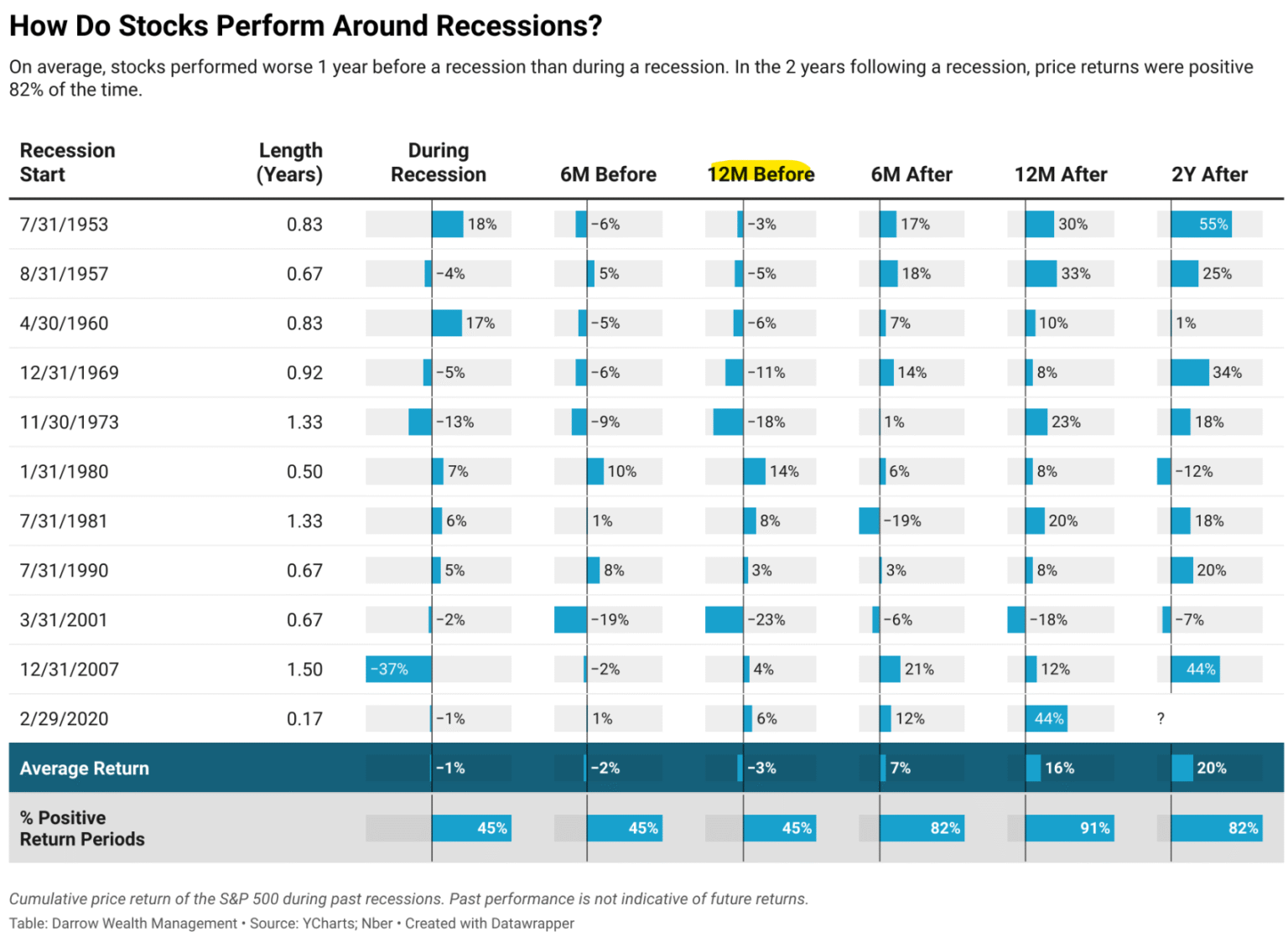

Source: Forbes, YCharts, Darrow Wealth

The above graph shows post-WWII recessions and the S&P 500’s behavior before and after. True to the stock markets forward looking nature, the S&P 500’s performance is worse 12 months prior to a recession. The S&P 500’s performance post-recession is quite good, especially 12 to 24 months after (far right columns).

If you’re not convinced the market has a huge impact on the average American’s mood (which could affect consumer spending), check out this X poll from Creative Planning’s Charlie Bilello…

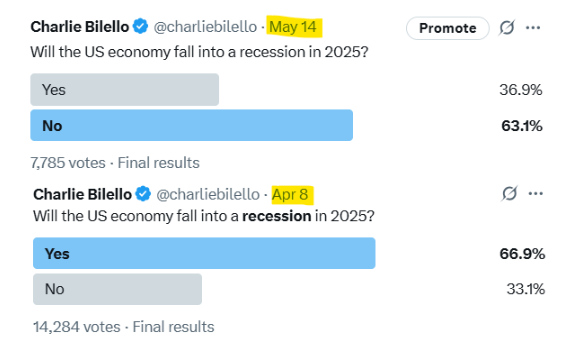

Source: Charlie Bilello’s X account

The above survey asks the same question on two dates; “Will the US economy fall into a recession in 2025?” The question was first asked on April 8th, the market was selling off aggressively as tariffs were applied to most every U.S. trading partner. Most participants (~67%) thought the U.S. was headed for a recession.

On May 24th, the same question was asked, the market had almost fully bounced back, and most participants (~63%) thought we would avoid a recession. We’ve said it before, and we will say it again; stock market prices drive sentiment (not the other way around).

Current Status: Despite the difficult market environment to start 2025, the S&P 500 is up 1.10% on the year (as of 5/20/25). If the economy was on the doorstep of a recession, we would expect the market to be faring much worse.

Interest Rates/Bond Yields

In the last Fed meeting, Chaiman Jerome Powell warned interest rates could remain higher for longer.

This doesn’t jive with Fed action during previous recessions.

“While our policy rate is currently well above the lower bound, in recent decades, we have cut the rate by about 500 basis points when the economy is in recession.” – Jerome Powell, 5/6/2025.

The U.S. treasury yield curve rate of change over the past two years has been minimal…

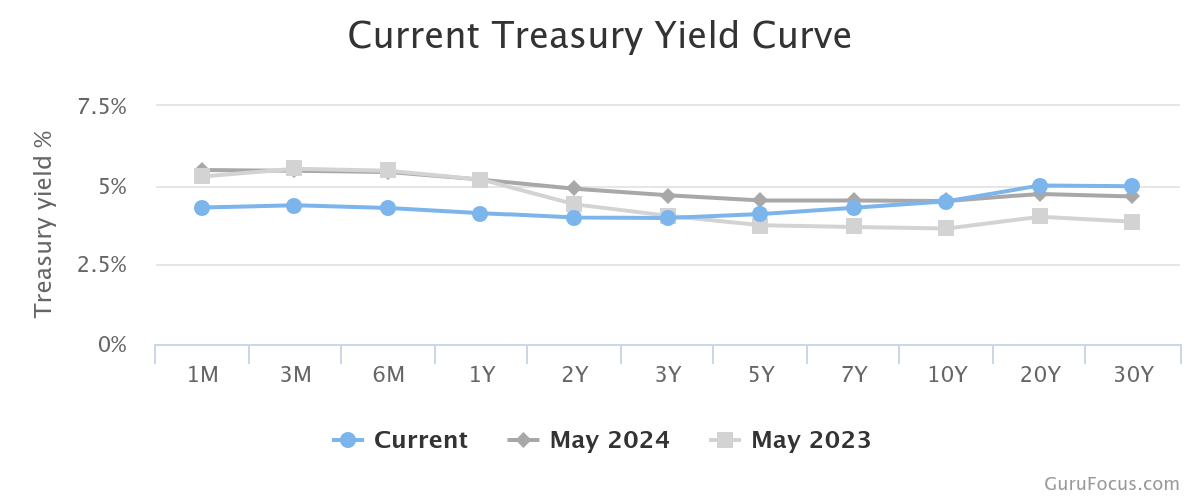

Source: Gurufocus.com

The above chart shows the U.S. Treasury Yield Curve from May 2023, 2024, and 2025 (blue). Treasury yields usually decline (sometimes aggressively) during periods of economic slowdowns. Over the past three years, U.S. Treasury yields have been quite stable.

Current Status: U.S. Treasury yields are not signaling a recession.

Corporate Earnings

This earnings season has seen almost 1,800 company reports so far.

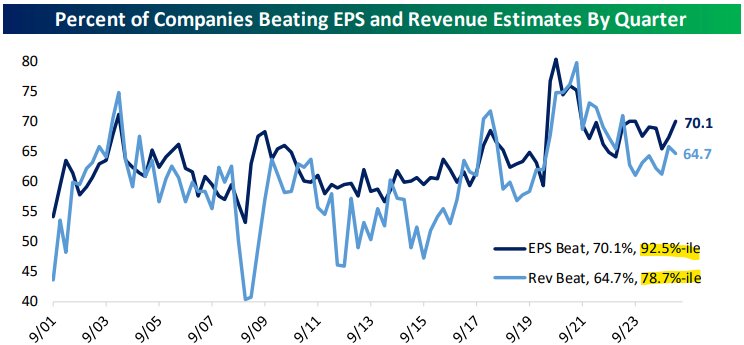

According to Bespoke Investment Group, an impressive 70.1% of companies beat earnings-per-share expectations (EPS), registering in the 92nd percentile (since 2001). This was one of the strongest corporate earnings reporting periods in recent years.

Revenue “beat” rates fell sequentially and were less impressive, but still hit the 78th percentile, which is pretty darn good.

Source: Bespoke Investment Group

The above graph shows the impressive earnings-per-share (dark blue) and revenue (light blue) “beat” rates for U.S. corporations in the first quarter of 2025.

Current Reading: Corporate earnings typically begin showing weakness prior to an official recession call.

Retail Sales

The U.S. economy is a heavily influence by consumption. Americans buy a lot of stuff. It’s been said, “so goes the consumer, so goes the U.S. economy.”

Given how negative consumers’ attitudes are, one could have expected to see weakness in the April 2025 retail sales number. That was far from the case with U.S. Retail Sales showing a +4.8% increase from the previous year.

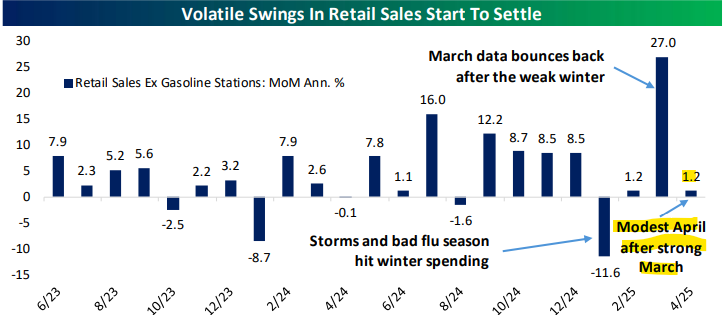

Source: Bespoke Investment Group

The above chart shows monthly retail sales (minus gas stations) month over month annualized percentage change. April wasn’t a blowout month for consumer spending, but it wasn’t a disaster either.

Current Reading: One would expect the consumer to hunker down and not spend on the doorstep of a recession. Despite all the trade policy uncertainty, that wasn’t the case in April.

Initial Jobless Claims

Companies, public & private, tend to lay off workers in the face of a slowdown. It’s no surprise that initial jobless claims (newly laid off workers) tend to spike at the beginning of a recession.

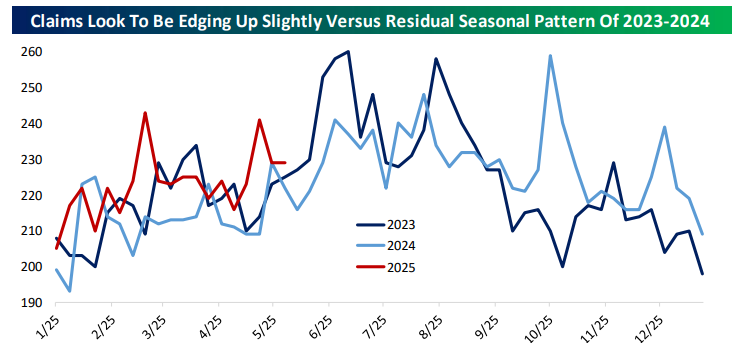

Source: Bespoke Investment Group

The above chart shows initial jobless claims from 2023 (dark blue), 2024 (light blue), and 2025 (red). There seems to be a seasonal trend of jobless claims rising in the first half of the year and falling in the second half. Year-to-date, initial jobless claims are running a tad higher than previous years, but the trend is hardly recessionary.

Current Reading: Recent job reports are slightly elevated vs. 2023 & 2024, but not rising in a way that signals a recession.

Price of Oil

Aside from a global conflict or war, the price of oil often falls aggressively in the face of an economic slowdown.

Manufacturers cut production

Families postpone vacations

Businesses reduce employee air travel

Millions of micro decisions to delay consumption, activity, travel, production, etc. result in lower oil demand, which puts downward pressure on prices.

An extreme example occurred during the COVID pandemic, oil prices went negative as the oil glut became so severe traders had to pay storage facilities to take unused oil.

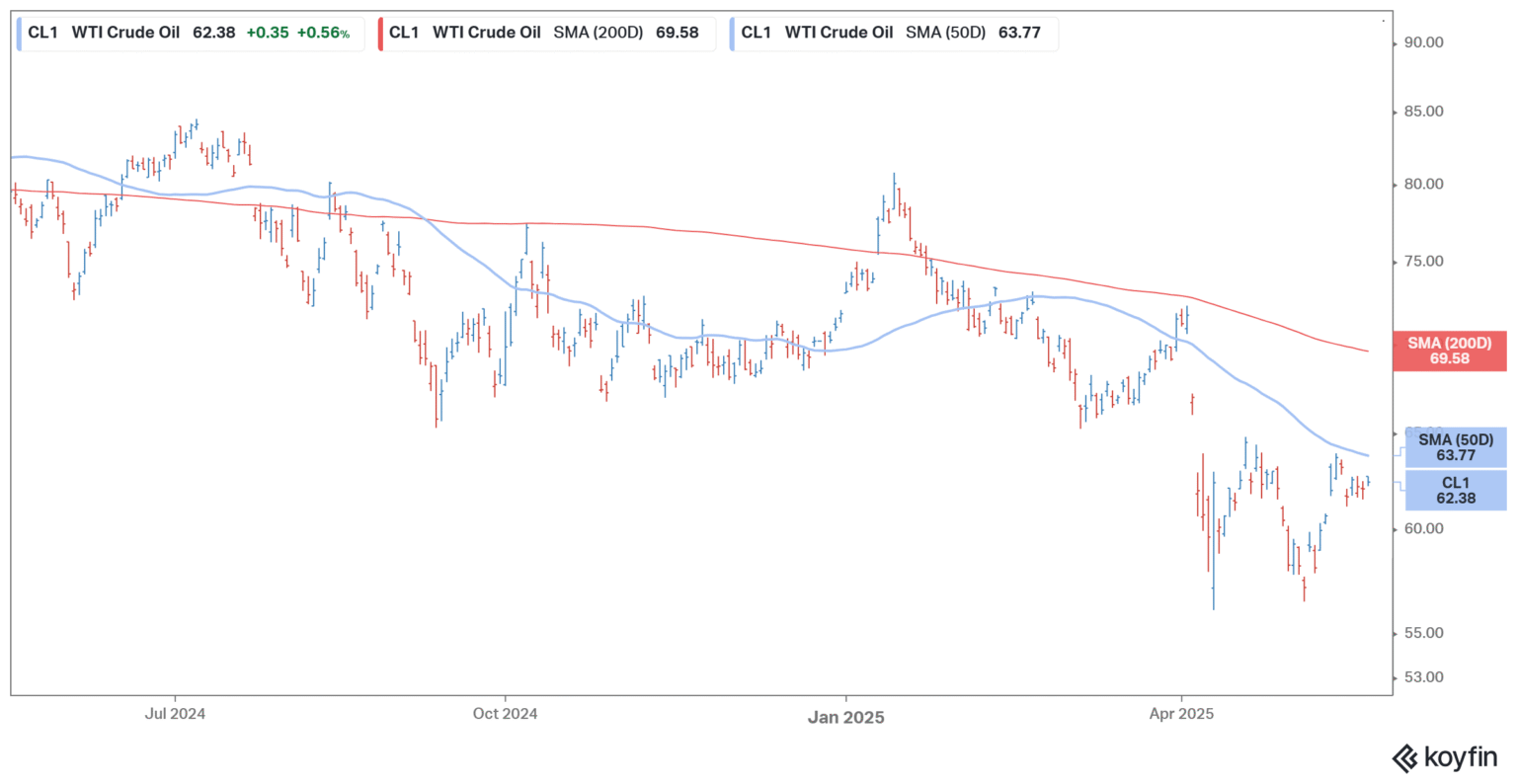

While oil prices have trended down over the past year, the bottom hasn’t fallen out…

Source: Koyfin

The above graph shows the price of WTI Crude Oil over the past year. While the price of oil has come down, it’s hardly been an extreme move signaling recession.

Current Reading: Oil prices have softened, but aren’t signaling an imminent slowdown.

While your neighbor will tell you the world is ending, the hard data isn’t that bad. Many savvy investors were able to keep their head during the April selloff by separating market-based data from gloomy, sensationalized headlines.

It’s also important to note recessions are normal. A recession will inevitably come. We will all experience some level of pain in a recession. Our focus should shift away from being a prediction oracle to how we can mitigate damage.

If you’re worried about a recession, market selloff, or any other disaster scenario, we would suggest turning your focus inward to what you can control.

Mitigating Damage without Playing the Market Oracle

Assets That Could Hold Up During a Recession

Market drawdowns are a great opportunity to evaluate portfolio risk, diversification, and decision making. If you would like a second opinion on your investment portfolio, shoot us a note at insight@pureportfolios.com or click here.