“Fear, greed and hope have destroyed more portfolio value than any recession or depression we have ever been through.” – James O’Shaughnessy, Founder of O’Shaughnessy Asset Management

Hard landing?

Soft landing?

Recession or nah?

Can anyone agree on the technical definition of a recession? Not so much.

In my opinion, a recession is a change in consumer & market participant behavior. We covered this in our July 7th, 2022 post, “Recession Obsession,”…

During good economic times, a rational person might decide to embrace risk.

“Let’s take out a loan, buy a parcel of land, and build some luxury condos.”

During a recession, the same rational person might decide to shun risk.

“Let’s hunker down. I don’t want to take risk in this environment.”

——————————————————————————————————————————-

Rather than debate whether we are in a recession or not, we examine assets that have held up or even gained value when the economy is shrinking.

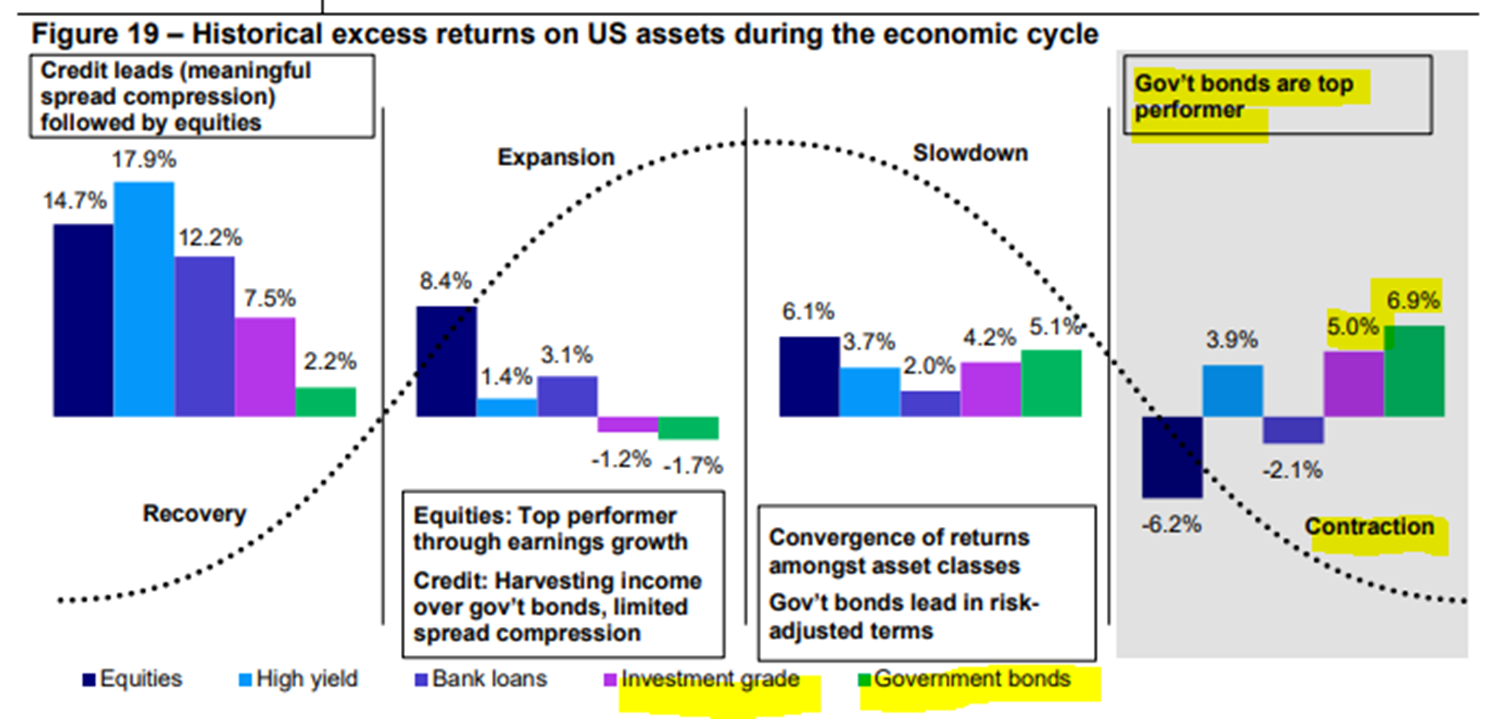

The below graph shows performance for equities, high yield bonds, bank loans, investment grade corporate bonds, and government bonds during every economic cycle between 1970 – 2021.

We are interested in the far right of the graph, which shows performance during an economic contraction.

Source: Invesco

The above graph shows which asset classes performed the best during every economic contraction since 1970 (far right). It would seem high quality fixed income, government & investment grade corporate bonds, performed quite nicely during previous economic contractions.

Why didn’t bonds do their job in 2022?

1). Inflation and higher interest rates are bad for most every asset class, including bonds.

2). Bond yields were next to nothing the previous cycle. There wasn’t much room for error if rates increased rapidly (bonds tend to be more sensitive to higher rates when yields are paltry).

In my opinion, now that bond yields have stabilized after an aggressive Fed hiking campaign, the risk/reward equation looks much better for bond investors. In other words, fixed income finally has income.

You might say, “the Fed is still increasing rates. In most recessions, the Fed cuts rates.”

Fair point.

The truth is the Fed can say whatever they want.

At the end of the day, markets will have the final say.

Right now, Mr. Market is calling BS on the Fed.

I wrote back in a November 2022 post, “When the Fed Pivots,” we are closer to a Fed pivot (pausing and then cutting rates) than most expect…

“Market participants seem to believe inflation needs to return to the Fed’s 2% target to see a pivot. If historical Fed action holds, we could be much closer to a pivot than expected.”

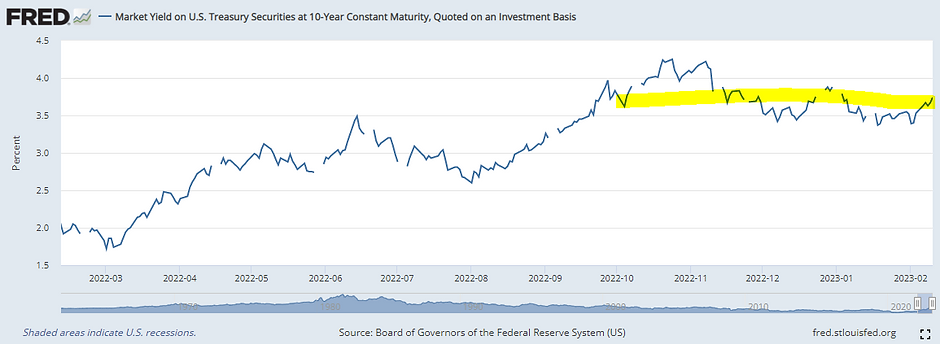

Further, the U.S. 10-Year yield tends to peak shortly before a Fed pivot.

If the current U.S. 10-Year yield holds and the Fed pivots, the bond market would have sniffed out a pause/rate cut months before most knew what was going on.

Source: St. Louis Fed, Board of Governors of the Federal Reserve System

The above graph shows the yield on a 10-year U.S. Treasury bond over the past year. Despite the Fed’s aggressive talk on rate increases, the 10-year yield has actually gone down over the past three months. Did the bond market sniff out a Fed pivot in November 2022 (peak 10-year yield)?

If you’re worried about a economic slowdown, it could make sense to layer in some investment grade corporate and/or government bonds to soften the blow.

If you’re paralyzed by indecision because you’re convinced things have to get worse, notice the period following a contraction is a recovery, which stocks tend to lead. We have stated in the past, it’s fine to be bearish, it’s not okay to stay bearish.

Most would do well spending less time predicting a recession and more time focused on mitigating damage.

If you’re curious how Pure Portfolios reduced risk during 2022, send us a note at insight@pureportfolios.com