“It’s not just good news that causes bear markets to end, but better-than-expected news that is simply less bad.” – Ben Carlson, Wealth of Common Sense blog

A casual reader might describe my market outlook as optimistic or glass half full.

I think that’s a fair assessment, but it’s missing context.

I’m a proponent of empirical evidence and market history. I think of myself as a realist.

Two things I believe to be true…

1. History is not riddled with perma-pessimists (also called perma-bears) enjoying investment success. Most of these “world is ending” types have dismal track records. Doom & gloom becomes part of their identity making it almost impossible to admit things could be getting better.

2. It’s okay to be a pessimist, but it’s not okay to stay a pessimist. It would be delusional to ignore the perils of the current market and economic environment. It would be a mistake to extrapolate dire conditions perpetually into the future (see number 1).

Here are three silver linings, in an otherwise dismal year, that even the most bearish investor can’t ignore…

Fixed Income Finally Has Income

Fixed income (bonds) has served two roles in diversified portfolios:

a) reduces portfolio risk by acting differently than equities, especially during times of stress

b) provides investment income

Aside from 2022, bonds have lived up to their role as a diversifying asset class (see 2020 as a recent example).

However, due to the Fed’s zero rate policy for the majority of the 2010s, bond investment income has been non-existent (see our August 2021 post, “Is There a Mythical Place to Get a Return on Cash?”).

That’s changed…

Source: Charles Schwab

The above graphic shows yield to maturity (YTM) across several bond types and maturities. An investor could park money in a “risk-free” 1-year U.S. Treasury and clip ~4.625%. Not too shabby!

The drastic change in interest rates and bond yields is a great development for savers and retirees. Not so much for borrowers.

Could the 4% distribution rule for retirees make a comeback?

Flush Out the Garbage

We recently wrote about the unsustainable exuberance of the last cycle in our post, “Year of the 180.”

Here’s a snippet…

“Novice traders were using gamified trading apps to gamble on options, meme stocks, crypto, etc. on leverage. Companies that were technically insolvent skyrocketed to nosebleed valuations for no logical reason. Crypto projects that were called a joke by their own creator minted new millionaires.”

Nobody seemed to care because asset prices were going up. In hindsight, much of the behavior was egregious.

Perhaps nothing captured the euphoria better than the Natixis Global Survey of Investor Return Expectations.

In mid-2021, U.S. investors’ long-term return expectations were 17.5% per year (above inflation).

Think about that. U.S. investors were expecting the best 10-year period for the S&P ever (note: According to fourpillarfreedom.com, the best 10-year period for the S&P 500 was 17.9% between 1949-1958).

The humbling experience of 2022 flushes out rampant speculation, delusional return expectations, and reckless allocation decisions that were all too common in 2021.

Dark Days Potentially Lead to Better Days

High returns today can lead to lower returns tomorrow.

Poor returns today can lead to better returns tomorrow.

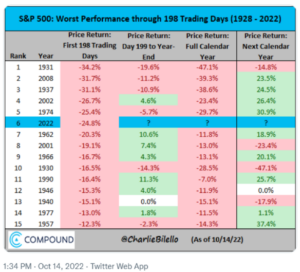

The below graph outlines the S&P 500’s worst starts through 198 trading days (since 1928) and the price return for the next calendar year.

Source: The Compound, @charliebilello on Twitter

The above graph shows 2022 (blue) is the sixth worst start for the S&P 500 since 1928. There are exceptions, but empirical evidence would suggest it’s not uncommon for difficult years to be followed by positive return years.

For those living in the dungeon of despair, it’s okay to be bearish. It’s not okay to stay bearish. Be able to change your mind when the facts change.

There is no “All-Clear” signal that indicates a market bottom.

Stock prices often turn when it feels the worst or things get slightly less bad.

For more reading/viewing on investing in bear markets, see…

Waiting for the “All-Clear” Investment Signal

Investing Cash in a Bear Market (video)