“It’s just that most people see what they want to see. We pride ourselves on living in reality.” – J.C. Parets, All-Star Charts, on the epidemic of market pessimism.

Let’s play a game.

You have to read the Wall Street Journal and CNBC.com every single day for one month straight. The daily headlines read something like this…

Multiple bank failures

The Fed continuing to raise interest rates

Surprise production cut from OPEC resulting in a spike in oil prices

The end of the U.S. dollar

Inflation still stubbornly elevated

Recession talk heating up

You cannot check stock prices during the 30-day period.

At the end of the exercise, you are tasked with guessing how the S&P 500 performed during the past month.

-5%?

-10%?

-20%?

You are shocked to learn the S&P 500 (SPY) was up 1.72% during the one month experiment…

Source: Koyfin

The above chart shows the S&P 500 (ticker SPY) over the last month (3/4/22 – 4/4/22).

Don’t worry, you’re not alone in the dungeon of despair. Professional investors are gloomy as well…

Source: CNBC.com

The above article highlights how professional investors feel about future stock prices. Of the 400 participants, which include chief investment officers, equity strategists, portfolio managers, and CNBC contributors, 70% project further declines for the S&P 500.

Looking back a bit further, the S&P 500 has been quite resilient since Q4 2022…

Source: Bespoke Investment Group

The above chart shows the S&P 500 price chart over the last 12 months. Despite the “things have to get worse” narrative, the U.S. large cap index has posted back to back positive return quarters (Q4 2022 +7.1%, Q1 2023, +~4%).

We hate to interrupt the doom party, but stocks don’t post back to back quarterly gains in a bear market.

We aren’t saying that things cannot get worse (they certainly can), but the narrative and negative market sentiment doesn’t jive what’s going on in equity markets.

Why is there a gap between how people feel about the stock market and what’s actually happening?

- There can be a huge disconnect with what’s happening in the economy and stock prices (see “Is the Market Unhinged from the Economy?”).

- Pessimism sounds sophisticated and intelligent. Optimism sounds naïve and aloof to risks (see “Intoxicated by Pessimism” why people love a good train wreck).

- Things get worse quickly. It’s easy to see cause and effect. Conversely, progress takes longer. It happens slowly and is hard to see.

- Most investors want to take a “wait and see approach” before getting invested (or reinvested). Markets don’t work that way (see “Waiting for the “All-Clear” Signal to Invest“).

——————————————————————————————————————————-

You might say that’s well & good, but surely this time is different.

Fair enough, let’s go back and evaluate future returns after a negative year (2022) & positive first quarter (2023)…

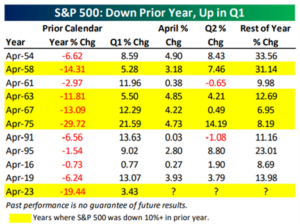

Source: Bespoke Investment Group

The above graph shows S&P returns after a negative year followed by a positive first quarter (1954 – 2023). Such instances have occurred 11 times since 1954. Coming off a calendar year loss with a positive first quarter, all 11 instances the S&P 500 was up. If the trend holds, 2022 would have seen a loss, followed by a positive first quarter of 2023, which could mean positive S&P 500 returns for 2023.

Narratives make for great stories, entertainment, and stimulating conversations. We prefer evidence and reality. Right now, the popular narrative doesn’t line up with what’s actually happening.

If you still can’t understand how stock prices could move higher despite all of the economic & global uncertainty, consider when investors feel awful about return prospect for the market, future returns are usually strong (see “Surprised by Surprises“).

If you’re a perma-pessimist and can’t get out of your own way, click here to find out how we mitigate human emotion in our investment process.