According to a 2018 Cerulli study, 42% of investors either believe their financial advice is free or they have no clue how much they pay.

In other words, in response to the question;

“How much do you pay for financial advice?”

42% of people responded “I don’t know” or “it’s free”

That’s not good.

The State of Massachusetts is doing something about it.

Secretary of the Commonwealth William Galvin is pushing a proposal that would require Massachusetts investment advisors to publish all fees, expenses, and compensation on a one-page document.

Despite what most advisors will tell you, the total cost of investing goes beyond their typical answer of “about 1%”.

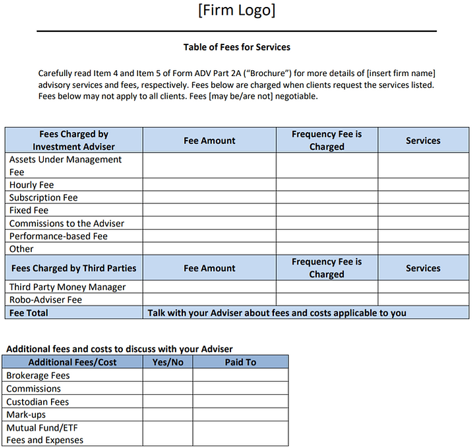

Source: Massachusetts Secretary of State

The above graphic is an example of the proposed table of fees and expenses an advisor would have to present to a potential client. Fees would have to be outlined in dollar terms, frequency in which the fee is charged, and services to be delivered.

The early response has been overwhelmingly positive. A few Massachusetts based advisors joined a working group to try out the transparent one-pager:

“They (consumers) like it universally. It was a one-page document with simple, easy-to-read information that’s pretty clear.” – John Power, Power Plans (quote from Investment News story).

At Pure Portfolios, we have our own version of the all-in cost of investing that we have used since day 1. Since we’re big on ultimate transparency, we filled out the State of Massachusetts form for our two fee tiers:

The below examples are based upon a $1,000,000 portfolio. Our fee includes investment management, financial planning, tax-efficient investing, estate planning guidance, and behavioral coaching.

Pure Custom Portfolio (fees tied to investment performance):

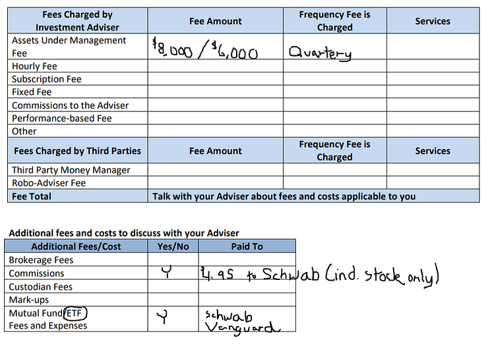

Source: Massachusetts Secretary of State

The above graphic shows our ‘Fees Tied to Client Outcomes’ tier. For a $1,000,000 portfolio, the Pure annual fee would be $8,000, ($6,000 if the set performance hurdle is not achieved- we do not take upside fees for exceptional performance). The portfolio would be customized owning a mix of ETFs, individual stocks & bonds. The annual ETF expenses would run ~$300-$700 per year paid to Schwab, Blackrock, and/or Vanguard. Note: Schwab does charge a slight mark-up for some types of bonds. Other types of individual bonds are offered at zero mark-up.

Pure ETF Portfolio

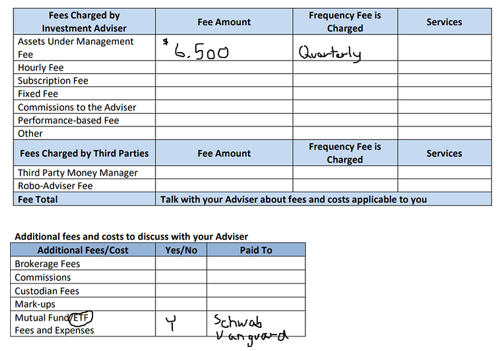

Source: Massachusetts Secretary of State

The above graphic shows our ETF model tier. For a $1,000,000 portfolio, the Pure fee would be $6,500 per year. The portfolio would be entirely comprised of ETFs, hence the annual expense payable to Schwab, Vanguard, Blackrock would run slightly higher ~$700-$1,000 per year. There are no trading commissions or bond markups for ETFs.

For every reader of this blog who works with another advisor or thinks all advisors are the same, we offer you a friendly challenge. Kindly ask your current advisor, either in person or by email, to fill out the above form (you can print or download it here on page 9). If you work with a traditional financial advisor at a large institution, here’s what you might see (assuming they’re forthright):

The below example is based upon a $1,000,000 portfolio.

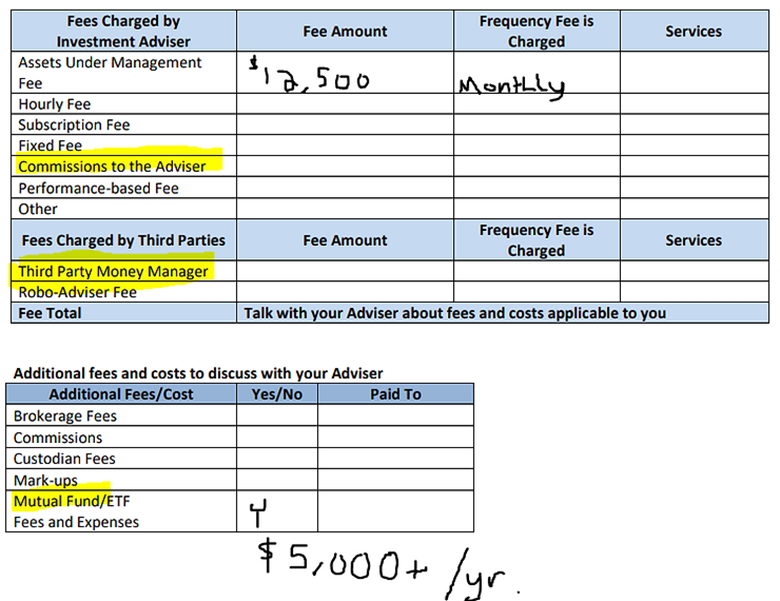

Source: Massachusetts Secretary of State

The above graphic shows what a traditional advisor’s fee tier might look like. Not only is the assets under management fee higher, if they invest in mutual funds or other third-party investment managers (hedge funds, private equity, private real estate, etc.) the all-in fee would be much higher. According to Investopedia, the average mutual fund expense ratio would cost an investor an additional $5,000-$10,000 per year. An unsuspecting investor could be paying all-in costs over $20,000 per year (assuming a portfolio size of $1,000,000)!

Advisor fee structures come in all shapes and sizes. Some advisors are upfront and transparent about the total cost of investing. The majority play in the shadows, and gloss over important details, hence the need for common sense policy from our friends in Massachusetts.

Take the one-page challenge and present the table of fees and services to your advisor. Pay close attention to their body language when presented with the document. That will tell you all you need to know.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com