“If company management can’t think of anything else to do with their money, they should pay dividends. If they have good places to invest, that’s much better.” – Philip Carret, investor & founder of Pioneer Fund

I have a complicated relationship with dividends.

On one hand, I understand the allure of bird in hand. Company makes money. The company pays shareholders a portion of the profits. The dividend recipient can reinvest in the company, allocate capital elsewhere, or spend the money.

Not a bad deal.

On the other hand, dividends can be tax inefficient and might not be the best avenue for returning capital to shareholders. Above all, I’ve seen investors make horrible allocation decisions based on a juicy dividend yield.

The era of low interest rates and bond yields caused many investors, desperate to generate portfolio income, to make dodgy decisions based on how much a company paid in dividends…

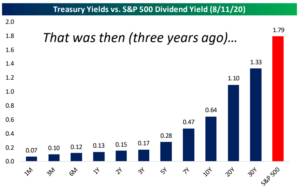

Source: Bespoke Investment Group

The above graph shows U.S. Treasury yields by maturity (blue) vs. the S&P 500’s dividend yield (red) on 8/11/2020. Investors looking for income couldn’t find it in the bond market. Many investors decided to allocate capital to equity markets for yield and potential growth opportunities. Unfortunately, some investors ended up “reaching” for dividends regardless of company fundamentals.

The Fed’s interest rate hiking cycle changed the equation. Bonds are finally producing meaningful interest income (see “Hey Retirees: The 4% Rule is Back“)…

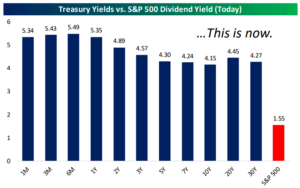

Source: Bespoke Investment Group

The above graph shows U.S. Treasury yields by maturity (blue) vs. the S&P 500’s dividend yield (red) on 8/11/2023. Investors can buy a 1-year U.S. Treasury bond and clip 5.35% “risk free”. Dividend investing is much less attractive when the Fed funds rate is north of 5%.

The result? Dividend investing is deeply out of favor.

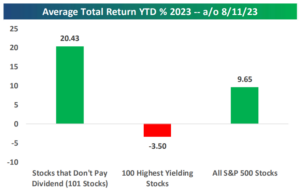

According to Bespoke Investment Group, the average stock in the S&P 500 is up roughly 10% year-to -date (YTD), but the 100 stocks with the highest dividend yields are down an average of 3.5% (including dividends). The 101 stocks in the S&P that don’t pay a dividend are up an average of 20.4% YTD.

Source: Bespoke Investment Group

The above graph shows the wide performance gap between stocks that don’t pay a dividend (green, far left) and the 100 highest yielding stocks (red). Low-growth companies with large dividend payments are massively underperforming this year.

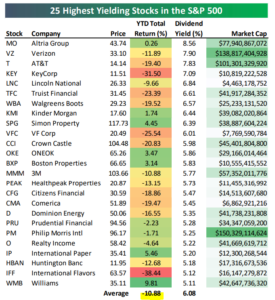

Drilling down a bit further, the 25 highest yielding stocks in the S&P 500 have fared even worse…

Source: Bespoke Investment Group

The above graph shows the 25 highest yielding stocks in the S&P 500, YTD total return %, and dividend yield. The average return for a top 25 dividend payer YTD is -11%. As of this writing (8/16/23), the S&P 500 is up 15.5% YTD. That’s some massive underperformance for the highest dividend payers. Yikes!

Is dividend investing dead? Probably not.

Do higher interest rates make dividend paying stocks less attractive? Probably.

A few observations…

- Investment styles go in & out of favor. While dividend investing is underperforming in 2023, it was a refuge in 2022.

- When interest rates move dramatically up or down, the relative attractiveness of some asset classes can change. For example, dividend investing might be prudent in a 0% rate environment, but might be sub-optimal in a 5% rate environment.

- Buying a company exclusively for the dividend yield is usually not a good strategy.

- Keep your investment identity small. It’s best not to identify as a particular type of investor (for example, “I’m a dividend investor!”). Be able to change your mind when the facts change.

———————————————————————————————————————————————————————————————————

Do you work with a non-fiduciary advisor? Not sure how much you’re paying in fees? Shoot us a note at insight@pureportfolios.com to find out why 90% of Pure Portfolios’ clients come from other advisors.