“At the end of the day, it’s not a normal condition to have interest rates at zero.” – Lloyd Blankfein, former CEO of Goldman Sachs

On 12/31/2021, the 1-year U.S. Treasury bond yield was 0.39%.

A $500,000 portfolio invested in 1-year U.S. Treasury bonds would produce interest of ~$1,950 per year.

Nothing to be excited about.

In our 2021 post, “Is the 4% Rule Dead?,” we outlined why the popular shortcut for retirees was obsolete due to record low-interest rates…

“The 4% rule might be the ultimate retirement mental shortcut.

The 4% rule states a retiree can safely withdraw 4% of their portfolio each year and not run out of money. “Live off the interest” and “I don’t want to invade principal” are all rooted in the idea of the 4% rule.

There’s one problem, the 4% rule was created during a period of much higher interest rates and bond yields.”

Fast forward to 2023, the most aggressive interest rate hiking campaign since the 1980’s caused angst among investors. Once the dust settled, savers, investors, and retirees looking to generate investment income had plenty of options (we highlighted the new interest rate paradigm in our post, “Silver Linings in a Dismal Year”).

Today, the same 1-year U.S. Treasury is yielding 5.4%.

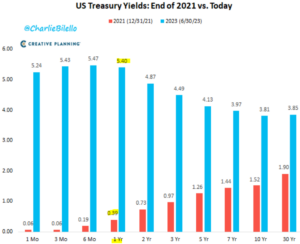

Source: Charlie Bilello

The above graph shows U.S. Treasury yields at the end of 2021 (red) vs. June 2023 (blue). Yields across the curve have adjusted higher providing savers and retirees an attractive option for generating investment income.

As of 6/30/23, a $500,000 portfolio invested in 1-year U.S. Treasury bond would produce ~$27,000 per year in interest.

Not too shabby.

Historically, bonds have done well to diversify equity risk and produce income. The income component went away following the Great Financial Crisis and the record low interest rates that followed.

Now, fixed income finally has income.

Savvy investors are starting to take notice.

Verdad Capital posted a research note on 7/3/23 highlighting the “Smart Debt Money” i.e. big insurance companies are flocking back to the bonds.

“For the first time in years, the bond share of investments on insurance company balance sheets increased in 2022. The longer rates stay high, the more we would expect this shift to continue.”

In our opinion, it’s a great time to be a fixed income investor (not so great to be a borrower).

The result is a more favorable total return equation for investors.

Total Return = Income + Appreciation

Using the above equation, let’s assume we have a portfolio of 50% 1-year U.S. Treasury bonds & 50% U.S. Large Cap stocks.

Let’s see how total return shakes out from 2021 vs. 2023…

2021

0.39% + 6.61% = total return of 7%

In a low-rate environment, virtually all of the total return came from the appreciation of the assets.

2023

5.4% + 1.6% = total return of 7%

In today’s rate environment, the income component explains most of the total return.

Instead of a total return drag, fixed income could be a return tailwind to diversified portfolios going forward.

*For simplicity, we did not include portfolio weights in the above example. We also used the same hypothetical 7% total return for 2021 & 2023. *

In the previous low-rate regime, investors had to reach for yield, duration, and speculate in lower quality securities to generate paltry income (see “Not a Typical Bank Failure“).

The result was picking up nickels in front of a steam roller. For example, it wasn’t uncommon for investors to clamor over dividend yields of 10%, which usually signaled trouble in the underlying company, only to see the stock fall 40+% (that’s a total return of -30%).

In summary, higher interest rates are a great development for savers, investors, and retirees looking to generate portfolio income without taking a boatload of risk.

Dare we say the 4% rule is back?