“Humans have something weird in their DNA which prohibits them from adopting good ideas easily.” – William Green, Richer, Wiser, Happier

Sally is a nervous wreck. It seems every time she invests money in the stock market it crashes.

The last time Sally invested a chunk, the market crashed by 20%, she sold out at the bottom and missed the ensuing bounce back.

She’s scouring financial news for any clues on when a good time might be to put her growing pile of cash to work.

It all seems so confusing, the folks she follows on Tik Tok are warning of a market crash, Instagram influencers are preaching the safety of annuities, her close friends think the economy is going into a recession.

Trying to nail the timing of investing her cash is taking up too much head space. The weight of the decision is taking an emotional toll on Sally.

Sally is fictional of course, but Sally’s concerns aren’t without merit, nor does her track record inspire confidence. Stock market investing isn’t for the faint of heart.

The S&P 500 has experienced four bear markets (-20% or more) over the past 25 years…

- Dot-com bubble burst (2000)

- Global financial crisis (2008)

- COVID-19 pandemic (2020)

- Inflation surge (2022)

The most recent market pullback saw the S&P 500 fall almost 20% in a little over a month.

What happens if Sally consistently invests at market tops, but instead of panic selling just keeps investing?

The results are quite amazing.

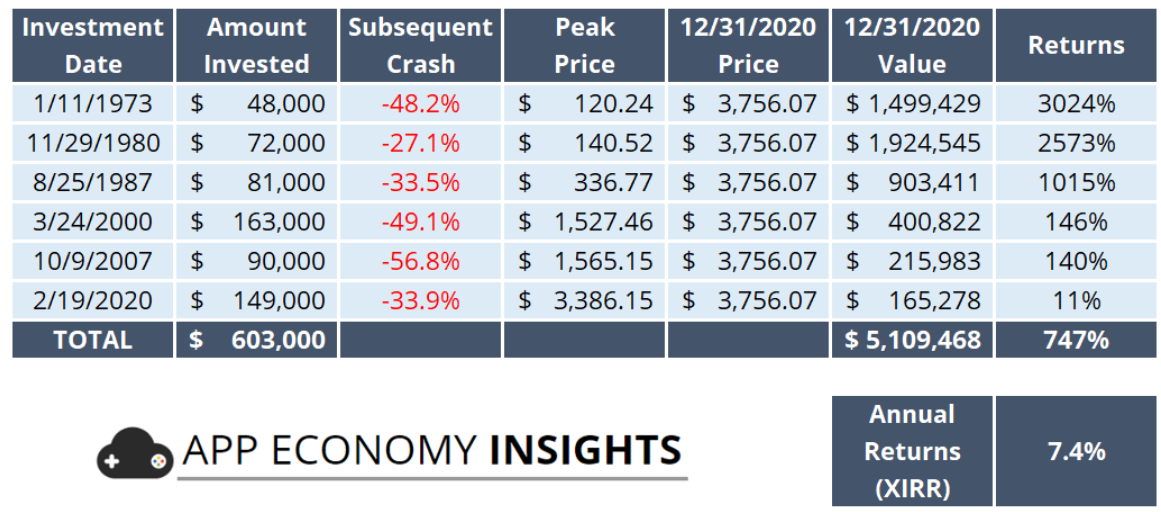

Source: App Economy Insights

The above chart shows the unfortunate timing of Sally, who invested cash in the S&P 500 right before every significant market crash since 1973. Despite her awful timing, Sally was able to generate significant wealth, turning her $603,000 initial investment into ~$5,100,000 over the next 47 years. The power of time, saving, and compounding can smooth out even the worst timing decisions.

What’s the investment lesson?

For folks with a longer runway, just keep saving and investing. There seems to be an epidemic of younger folks that try to time the market, hoard cash, and panic sell when things get difficult. This isn’t anecdotal…

- A 2024 Allianz Life survey found that 58% of Millennials adjusted their portfolios toward more conservative investments amid market volatility.

- A study by Revere Bank highlighted that Millennials are investing less and saving more than previous generations, indicating a more cautious financial approach.

- Research from the Investment Executive revealed that Millennials are more likely to set aside money and decide what to do with it later (31%) compared to Gen X (22%) and Baby Boomers (22%). They are also less inclined to buy and hold investments for the long-term.

Often the simplest playbook is the best; savings, time, compounding = wealth.

For folks close to retirement or currently retired, you’ve spent your whole life saving, investing, and seeking risk. It’s time to downshift from a “building wealth mindset” to “keeping wealth mindset”.

We wrote about the inability to be content with what one has built in our Oct. 8th, 2020 post, “What is Your Enough?”…

“It sounds rather simplistic; build wealth, find your happy place, and enjoy life. But there are countless examples of people building wealth, only to never take their foot off the gas. They keep pursuing wealth without ever considering the question, ‘what is my enough?’

In many cases, failing to identify their ‘enough,’ resulted in financial ruin due to taking unnecessary risks.”

How can a retiree build an “I have enough” portfolio?

Build a risk-aware portfolio that you can stick to when things get uncomfortable. Boring is good, in my opinion, and the ideal retirement portfolio is one where you could not look at the balance for one year and not give it a second thought.

A couple other nuggets…

- Don’t take risks where the best case won’t change your life, but the worst case will derail your plan.

- If you bail on stocks during times of market stress, you are invested incorrectly.

- If you embrace risk when times are good, but shun it when times are bad, you’re invested incorrectly.

- If you’re constantly worrying about what the market does next, you’re invested incorrectly.

A last word for all investors, it’s obvious but at the core of all emotional, destructive investment decisions…

An investor must accept that negative outcomes are part of investing.

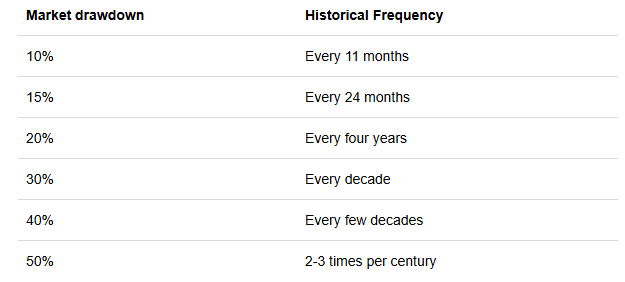

We’ve outlined the historical frequency of pullbacks since 1928…

Source: Seeking Alpha, App Economy Insights

Embrace negative outcomes and you will thrive. Try and avoid losses, you’ll drive yourself nuts and make some massive mistakes along the way (see “Probable Probabilities” for how professional investors think).

Did your portfolio get crushed during the spring sell-off? Shoot us a note at insight@pureportfolios.com for a risk management check-up.