I have an evening routine of perusing Twitter for market research nuggets. I email myself interesting articles to read the following morning. I’m not looking for mainstream stories you would read on the news ticker, rather I’m looking for abstract viewpoints, insights, or graphics from professional investors. I used to shun Twitter until I realized I could create a customized news feed from the brightest minds in finance. I believe it’s one of the best unfiltered, real-time mediums to access investment research (not to mention it’s free). You can follow Pure Portfolios on Twitter @pureportfolios.

On New Year’s Day, the below tweet from Ryan Detrick resonated with me:

Ryan Detrick, CMT (@RyanDetrick) tweeted at 10:59 AM on Mon, Jan 01, 2018:

Dow up +25% in ’17 … time to look for a pullback?

Since ’50, up >25% YTD 10 times.

Higher next year 8 times with 6 of those times up double digits.

Avg +12.6% vs avg yearly return of +8.5%.

In other words, don’t turn bearish simply because ’17 was up a lot.

The first line of “Dow up +25% in ’17…time to look for a pullback” is roughly the consensus sentiment amongst the investing public. A quick look at market history shows that since 1950, after a +25% year in the equity market, the following year is up 80% of the time.

I’m also seeing a bunch of average or single digit appreciation forecasts from Wall Street. Market history has shown returns seldom are average.

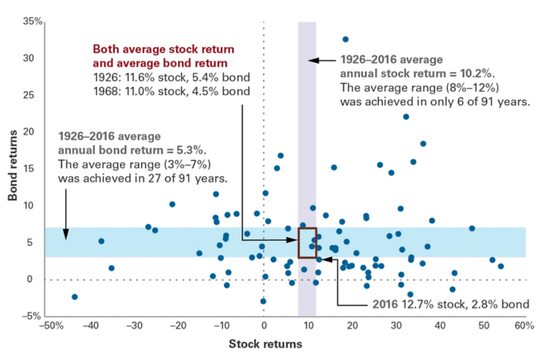

Source: Vanguard Blog

The above graphic shows U.S. market returns have realized their average, between 8%-12%, only six out of 91 observations! You can see the distribution of returns is either really positive or really negative. It seems 2017 was more normal than it appears.

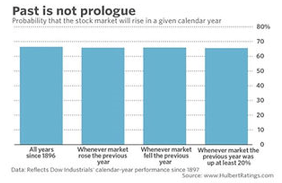

Source: www.hulbertratings.com

Here’s another graphic that goes back even further. Since 1897, US markets are up approximately 65-70% of the time.

As evidence-based investors, we are more interested in what’s happened than following a narrative. I’m not saying the market cannot go down in 2018, it very well could (see What’s All This Volatility Talk and our Signs of a Market Top series). However, trends and investor sentiment can be a powerful force in financial markets. To borrow a phrase from our Twitter friend Ryan, don’t turn bearish simply because 2017 was up a lot.