“To be uncertain is to be uncomfortable, but to be certain is to be ridiculous.” – Michael W. Covel, American author.

Most investors have heard of popular investing strategies and factors such as dividends, value, growth, buy the dip, buy & hold, etc. Depending on your life stage and what you’re trying to do, each of the aforementioned approaches could have merit.

Let’s say you’re retired, and you want a reasonable return while avoiding a major drawdown.

In our opinion, trend following could be worth exploring.

What is trend following?

In simple terms, an investor would buy a risky asset when it’s trending up and sell the risky asset when it’s trending down.

Source: Koyfin

The above graph shows the Schwab Emerging Market Equity ETF (SCHE) price year-to-date. We overlay a simple 200 moving average line (SMA). We own SCHE when the price is above the 200 SMA line (light purple). We sell when SCHE breaches the 200 SMA on the downside.

Why would trend following be appropriate for retirees?

Most retirees do not have the capacity, either emotionally or financially, to take a major drawdown on retirement assets. The biggest risk to retirees, especially recent retirees, is sequence of return risk. A major portfolio loss early in retirement could impact their capital base and adversely affect their financial plan.

Empirical evidence across global equity markets suggests that trend following can offer similar returns to buy & hold, but with less risk.

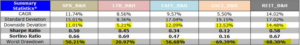

Source: Alpha Architects, Wes Gray

The above chart shows asset class returns from 1976-2014 (key below). The numbers are compounded annual returns (CAGR), which include dividends & interest reinvested. If an investor bought and held, these are roughly the annual returns they would have achieved. Pay close attention to the downside deviation and “worst drawdown” numbers.

• SPX = S&P 500 Total Return Index (brown)

• EAFE= MSCI EAFE Total Return Index (light blue)

• LTR = The Merrill Lynch 10-year U.S. Treasury Futures Total Return Index (pink)

• REIT = FTSE NAREIT All Equity REITS Total Return Index (Grey)

• GSCI = S&P GSCI Total Return Index (peach, commodities)

Let’s compare the above benchmark index results with a trend rule* overlay across the same asset classes.

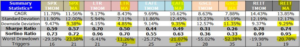

Source: Alpha Architects, Wes Gray

The above example shows the same asset classes and dataset, but introduces a simple trend rule. Across all asset classes, we were able to generate similar returns to buy & hold (highlighted in yellow), but drastically reduce downside risk and drawdowns. Note: ignore the TMOM rule, the trend rules risk & return metrics are designated as “MA”.

What’s the catch?

There’s no bulletproof strategy to achieve market returns with limited risk. Trend following is no different.

The Whipsaw

In the first example, we went underweight emerging market stocks when falling below the 200 simple moving average. What if emerging markets immediately snapped back and went 20% higher in a few days? We would miss out on sizable gains and negatively affect our performance. This is called getting whipsawed. It happened to many trend followers back in the spring of 2020 when the market raced higher post-COVID selloff.

Short-term Volatility

Choppy short-term market movements can send conflicting signals.

Human Override

We go back to spring/summer of 2020. Trend rules were favorable post-COVID selloff as the market violently bounced back. A trend follower might have added to equities while the economy was in shambles which can feel deeply uncomfortable (in hindsight, it turned out to be the right move). A true trend follower has to take their cues from the market rather than listen to outside noise.

Taxes

Trend following can lead to a decent amount of trading. We recommend running trend strategies in qualified accounts i.e. IRAs, Roth IRAs, etc. to avoid tax drag. Trend can be tax inefficient due to trading and reversing trends.

This is a high level summary of trend. There are many methods to introduce trend rules into a portfolio strategy. Trend can be combined with other rules to create a robust framework for making portfolio management decisions.

I’m more convinced than ever that introducing trend into a retirees investment strategy is prudent.

Consider…

- Many investors are concerned about current equity valuations. Trend allows you to own stocks while they are trending higher, while giving you a plan to reduce risk when the tide changes.

- Trend tends to work for those that have emotional and cognitive investment biases. Again, 2020 solidified our conviction in trend. Many investors who followed gut instinct and human intuition found it was a poor way to manage money last year.

- Trend following means you have a plan for when the stuff hits the fan. No longer will you wonder, “What should I do now?” rather you’ll have a framework in place to make evidence-based investment decisions.

In our opinion, the current environment is perfect for trend. Can you imagine trying to analyze or forecast how the most complex systems on Earth, economies & financial markets, are going to react to a mutating virus?

No thanks, we’ll take our cues from the market.

If you want to learn more about Pure’s rules-based framework, including how we incorporate trend following, please reach out here.

*Trend rule in the example…

– Moving average = average of last 12 month price

– If current price is > average of last 12 month price, we own the risky asset. Otherwise, we own T-Bills.