“I might just put my money in the S&P 500 and call it good. “ – anonymous prospective client

The drumbeat is growing louder as U.S. large cap stocks hit all-time highs. It goes something like this…

The S&P 500 has done the best. Everything else sucks. Why wouldn’t I just own the S&P 500?

It’s true, the S&P 500 has left the rest of the world in the dust.

Over the past 16 years, global stocks, international developed & emerging markets, have trailed the S&P 500. It hasn’t been close…

Source: Creative Planning

The above chart shows total return (includes dividends) for the S&P 500, International MSCI World ex-US, and MSCI Emerging Markets index. The performance gap between U.S. large cap and the rest of the world is the widest it has been in ~16 years!

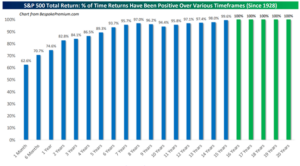

There is evidence to suggest if an investor’s time horizon is long enough, stocks should show a very high (100% in some cases) probability of a positive return…

Source: Bespoke Investment Group

The above chart shows the probability of a positive return for the S&P 500 over various time frames (data since 1928). For U.S. investors, time is our ally. Historically, the longer the time horizon, the higher likelihood of a positive return (including 100% for any rolling 16-year period).

We know U.S. stocks have crushed relative to global stocks the last 16 years.

We know the likelihood of a positive return increases with time.

Why wouldn’t a retiree allocate 100% of their investable assets to the S&P 500?

Fair question.

The answer has nothing to do with valuation, mean reversion, Magnificent 7, AI, bubbles, politics, sentiment, trend, inflation, or interest rates.

In my experience, the #1 reason a retiree shouldn’t own 100% of the S&P 500 is because most investors lose their minds when the market tanks.

We call it the “Plight of an All-Equity Investor.”

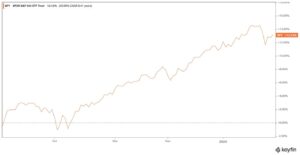

Meet new retiree Bertie. She retires in the fall of 2019. Bertie decides to allocate 100% of her $1,000,000 portfolio to the S&P 500.

The first few months leave Bertie confident. The S&P’s strong performance validates her investment decision…

Source: Koyfin

The above chart shows the S&P 500’s total return from Bertie’s retirement date 9/2/2019 to early 2020. Bertie is feeling great about her allocation decision. Her initial investment of $1,000,000 has grown to ~$1,130,000 in a few months.

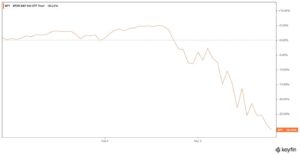

Boom, a global pandemic hits. Markets panic. Investors, from novice to Wall Street, have never seen anything like it.

The S&P 500 proceeds to have one of the worst drawdowns in recent memory…

Source: Koyfin

Bertie is completely shocked. She thought the S&P 500 was a safe place to put her retirement savings. Her $1,130,000 has turned into $791,000 in the blink of an eye. The balance is further reduced by monthly distributions that support her retirement lifestyle.

Unable to stomach any further losses, Bertie sells everything and starts to ponder going back to work.

While the above example might seem dramatic, it was the reality for many people that thought they were 100% equity investors, but were shocked, surprised, and emotional during the inevitable violent drawdown.

In hindsight, it’s easy to see the markets bounced back. We might even delude ourselves that such a crash was an obvious buying opportunity. In the moment, it was a period of panic and fear.

Here are a few of my blogs during the apex of the pandemic…

“Some Things Will Never be the Same.”

Jared Dillion, author of “No Worries: How to Live a Stress-Free Financial Life,” states…

“The purpose of volatility in markets is to make people do stupid %$#@.”

In my opinion, one of best anecdotes to support Jared’s point is the top performing Fidelity investment accounts are from dead people.

I find it puzzling that many investors talk about volatility and uncertainty like it’s a temporary phenomenon that can be waited out.

The thinking goes, “once things calm down and we get clarity around inflation, election, or (insert whatever is the last worry), then we can invest and everything will be fine.”

I would argue volatility, uncertainty, risk, etc. are a normal feature of equity markets. It’s supposed to be hard. Markets are supposed to rattle an investor’s cage from time to time.

In Morgan Housel’s book, “Same as Ever,” he articulates that…

“There is rarely more or less economic uncertainty; just changes in how ignorant people are to potential risks.”

No one is saying you can’t own a sizable position in S&P 500 (I’ve heard of much worse investment strategies). However, for most retirees, the best portfolio is the one you can stick to when markets get difficult.

For more reading, see “Should I Just Buy the S&P 500 in Retirement?”