“I already have a financial advisor managing my money.”

That’s a good thing, right? Depends on the advisor.

It can be dangerous to assume your portfolio is rooted in sound investment management principles.

How do you actually know you’re getting good advice from a financial advisor?

Despite common perception, not all advisors are equal. There’s virtually zero minimum standard to calling oneself a financial advisor. Furthermore, there’s no standardized portfolio management training for advisors.

We’re going to give you the tools to put your portfolio to the test. This exercise will run through a list of four metrics that are pillars of evidence-based portfolio management.

This will be helpful for do-it-yourself investors and those working with a traditional financial advisor (especially if it’s one of the Wall Street behemoths).

The evaluated criteria will be based upon:

- Cost – Is the all-in cost of investing prohibitive to reaching my desired outcome?

- Risk – Does my portfolio reflect how I feel about risk? Do I understand the range of outcomes, both good & bad?

- Diversification – How do the portfolio components work together during market stress?

- Tax-Efficiency – What is the estimated yearly tax-drag of my portfolio?

We have provided case studies below which are the basketball equivalent of a flagrant foul for each metric.

Cost

We have covered the all-in cost of investing formula ad nauseam. It’s worth repeating your total cost of investing is likely much more than the often quoted 1%. Also, nobody works for free (especially large financial companies).

Total Cost = Advisor Fee + Third-Party Fund Expenses + Tax Drag

Still not sure what you’re paying your advisor? Take the One-Page Challenge.

Case Study: We recently onboarded a new client that was working with a large bank. She was under the impression her annual fee was 0.90%. We ran some calculations based upon her recent statement and the annual advisor fee was 1.10%. In addition, she had a heavy allocation to “Long/Short Alternative Mutual Funds” which carry an embedded annual expense of >2%. Fighting a ~3% fee headwind every year is like running a marathon with your shoelaces tied together.

Risk

To most investors, risk is an afterthought during good times. We enjoy seeing our portfolio ascend during up-markets. Unfortunately, investing includes periods of losses, large swings, and huge drawdowns (2000-2010 was essentially a lost decade of ~0% returns for U.S. Large Cap stocks).

It’s important to understand the full range of outcomes, particularly the worst-case scenarios. In our opinion, stress-testing is a useful exercise to bring risk to life:

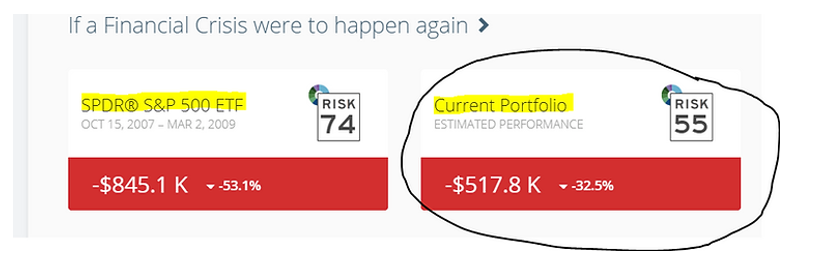

Source: Riskalyze

The above is a sample portfolio vs. the S&P 500 (left) during the Financial Crisis.

Not sure how you feel about risk? Find out here.

Case Study: It’s common to meet prospective clients that think of themselves as conservative, risk-averse investors. Upon evaluating how they’re actually invested, we get a different story. Many people are taking much more risk than they intended without knowing it. Your portfolio should reflect how you feel about risk all the time. Your appetite for risk should not ebb and flow with what’s going on in financial markets.

Diversification

We’re going to make this simple. Bust out your investment statement from Q4 2018. If you track online, a good client portal should give you the option to customize the date range (10/1/18 – 12/31/18) for portfolio values and performance.

Did the non-risky portion of the portfolio i.e. bonds, alternatives, precious metals, cash proxies, etc. act differently than your equities? If the answer is no, you’re not diversified.

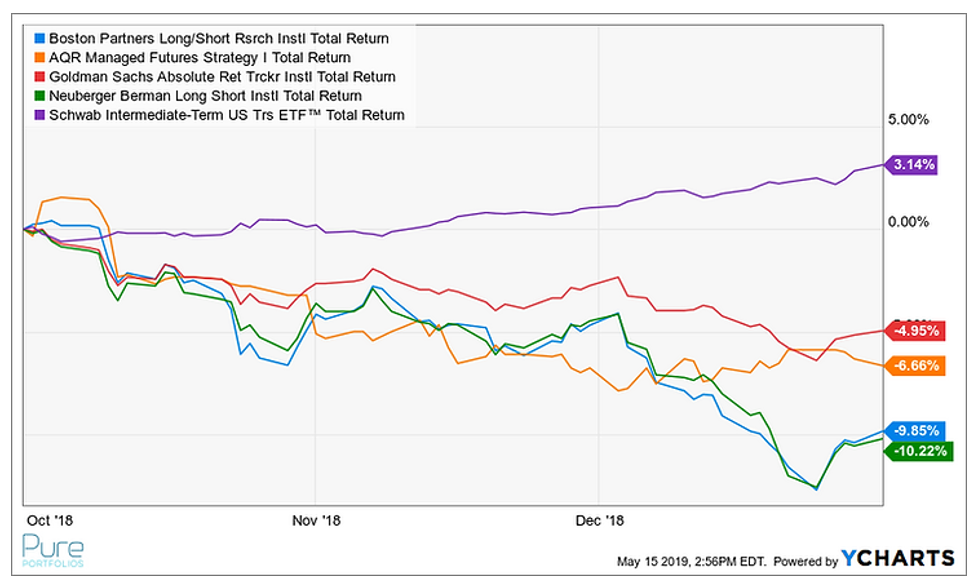

Case Study: Given the perception that bonds aren’t attractive due to low yields, many advisors are allocating a sizable chunk of client assets to alternatives (think exotic hedge fund strategies). These are essentially black holes of high fees (1-3% per year) and lackluster performance. Even if the story your advisor tells you about the benefit of hedge funds comes to bear, the heavy fee structure would mute any return benefit. For bonus points, check out how your hedge funds performed in the 4Q 2018.

The above graphic shows a few popular “hedge funds” performance during Q4 2018 when the S&P 500 was down 13.5%. We use quotes because the funds didn’t hedge much of anything. The purple line is a boring Intermediate U.S. Treasury ETF that costs next to nothing to own (0.06%). That’s what a real hedge looks like.

Tax-Efficiency

The silent killer of portfolio returns, paying unnecessary taxes. Taxable money should be managed differently than tax-deferred, retirement assets. Remember, there is no way to shelter dividend income from tax. Additionally, corporate and government bond coupon interest is taxable. If you own mutual funds in a taxable account, pay attention to your 2018 1099. As our friend Meb Faber says, “It’s really hard to make an argument for mutual funds in a taxable investment account.”

Case Study: We had a new client that owned mutual funds from a previous advisor. In an ideal world, we would have sold the mutual funds immediately, but due to embedded gains we had a plan to stagger the sales over multiple tax years. In 2018, the mutual fund manager distributed a sizable short-term capital gain to shareholders. This bumped up our client’s tax bracket and cost them thousands in unnecessary taxes.

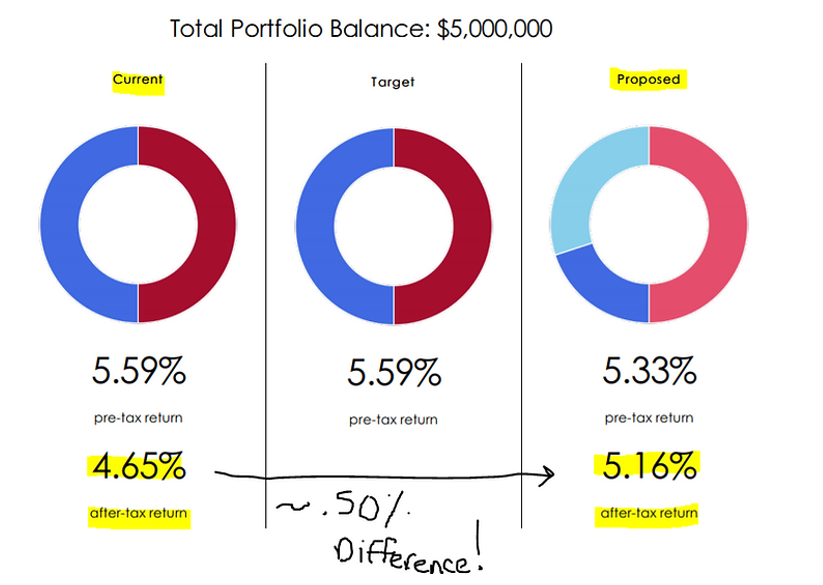

Source: Lifeyield

We use software that tells us the optimal allocation to reduce tax drag. The above client is projected to generate 0.50% per year in tax alpha (fancy term for adding value through tax optimization). Over a 10-year period, that’s ~$390,000 the client would keep rather than sending to Uncle Sam. Find out how we do it here.

It’s documented we are evidence-based investors, which we define as the relentless pursuit of what works. The above metrics serve as the foundation for how we approach portfolio management. Unfortunately, there is an army of advisors that are openly anti-evidence-based. They tell stories, sell things, make grand prognostications, invest client money differently than their personal assets, and quite frankly, seem to have little clue how to build an investment portfolio.

For do-it-yourself investors, use the above metrics as a check-up on your portfolio.

If you work with a financial advisor and wish to have Pure grade your portfolio, click here.