“Pay attention to what they do, not what they say.” – Anonymous

I was perusing a research note from another financial institution on their portfolio positioning. It read something like a sad romantic novel.

“Inverted yield curve. Negative yielding debt. Slowing global growth. Hong Kong unrest. Erratic trade war. Currency manipulation. We remain overweight equities.”

Wait, what?

It felt like someone describing all of the things wrong with their relationship only to proclaim they’re getting married.

Note: Being overweight equities (stocks) is if your allocation calls for 60% equities, but you currently own more than 60%. The investor or advisor is basically proclaiming they have a favorable view of the immediate prospects for equities.

To be fair, erring on the side of economic optimism has historically been rewarded in the United States. On the flip side, financial institutions will almost never make a pessimistic market call for fear of spooking clients and seeing assets walk out the door (we have written about the perpetual bullish predictions of Wall Street here and here).

Money managers drove the “overweight equities” bus straight off a cliff in 2008. Check out these gems from Barron’s 2007 year-end forecast publication which surveys strategists from across Wall Street…

“The dozen seers we’ve surveyed all have penciled in higher stock prices in 2008, although their estimated gains vary widely, from 3% to 18%. On average, the group sees the Standard & Poor’s 500 at 1,640 by the end of next year, or about 10% higher.”

“The bullish consensus is particularly impressive considering that all 12 strategists also take a dim view of the U.S. economy’s prospects and expect the Fed to keep cutting interest rates to spur spending.”

“In 2007, worried investors lunged for the safety of bonds. Treasuries may hold less appeal next year, the Street’s leading strategists say. The strategists note, as well, that bull markets rarely end when the earnings yield on stocks — now around 6% — is higher than benchmark bond yields.”

“Stocks are screamingly cheap relative to bonds.”

“If Wall Street’s strategists are right about the market, the rich will get richer in 2008, along with most other equity investors.”

The S&P 500 went on to crater 37% in 2008.

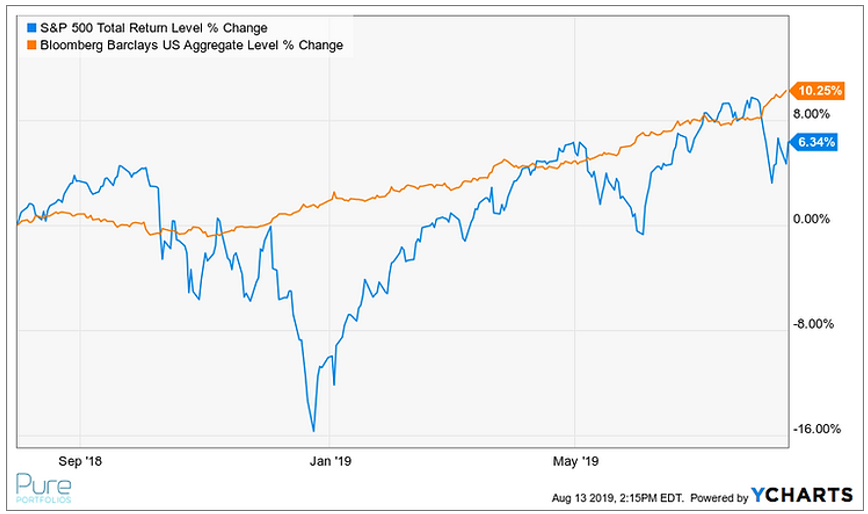

You might counter that the S&P 500 is up handsomely on the year (~14% as of this writing). This is true, but it’s also misleading. Up until the end of last week, the S&P is essentially flat over the past 12 months (the ride hasn’t been exactly smooth):

The above graph shows the S&P 500 (blue) and the Barclays US Aggregate Bond Index (orange) over the past 12 months. The bond index is outperforming on an absolute basis, +10.25% vs. +6.34% for the S&P 500 with a fraction of the risk. It’s not obvious on the surface, but bonds have been the superior asset class for the last 12 months and it’s not even close.

We are not saying equities should be avoided altogether, but if you’re a 60% stock/40% bond investor, do you really need to be overweight equities right now? If you’re retired or taking regular distributions from your portfolio, do you want to get caught reaching for extra return?

This isn’t a market call or a red alert notice for pending market doom. However, we don’t exactly feel the equity market risk/return profile is favorable right now. In our opinion, overweighting equities feels a bit reckless. History has shown that leaning offsides when financial markets turn could prove ugly, especially for retirees.

If you read market commentary from your money manager, it’s easy to get lulled into a sense of complacency. The only thing that matters is how portfolios are positioned.

Pay attention to what they do, not what they say.

For more on managing risk exposures within an asset allocation, check out Beware of the Lazy 60/40.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com