“The purpose of volatility is to make people make stupid decisions.” – Jared Dillion, The Daily Dirt Nap

Yen carry trade

Weak jobs report

Fed slow to cut interest rates

Experts have pointed to several potential reasons for the rollercoaster ride of the past few weeks.

The following meme from Bloomberg Twitter was spot on…

Whatever caused the latest swoon, the market selloff caught many investors off guard.

Could this be the start of a deeper drawdown ahead?

No one knows. However, we can provide perspective on the nasty drawdown through a historical lens.

Drawdowns are Normal

Stock market drawdowns are a feature of investing, not a bug in the system.

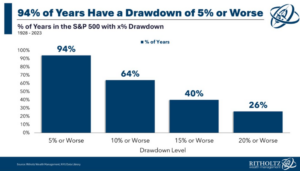

Source: Ritholtz Wealth Management

The above chart shows the frequency of various drawdown percentages for the S&P 500 (1928 – 2023). Much of the time (over 50%), the S&P 500 has seen a 10% correction during a calendar year.

From our June 2024 blog, “Probable Probabilities,”…

When you think in probabilities, you’re less likely to get caught off guard or spooked by potential market decline.

- You’re less surprised by surprises (see “Surprised by Surprises“).

- You’re likely to avoid making predictions about the next week, month, or year.

- You won’t need to identify as optimistic or pessimistic on stock market prospects.

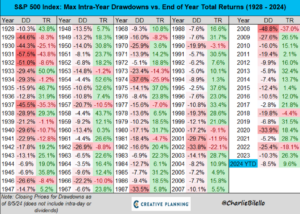

Here’s a great chart from Creative Planning’s Charlie Bilello outlining the S&P 500 intra-year drawdowns vs. ending total returns by calendar year (since 1928)…

Source: Charlie Bilello

The above chart shows intra-year drawdown for the S&P 500 (DD) and the total return for the given year (TR) since 1928. Even with the latest drawdown, 2024 is quite calm compared to history.

Did You Pass the Test?

Bouts of volatility are a litmus test for your asset allocation. How someone reacts in the face of drawdowns says much about if they’re invested appropriately. Let’s look at two investors, both own 100% stocks.

Investor A doesn’t blink when their 100% stock portfolio goes down. They understand that negative outcomes are part of such an aggressive allocation.

Investor B, also own 100% stocks, has the urge to sell everything. They can’t stand the feeling of losing money. They want to enjoy gains, while avoiding losses. In our opinion, Investor B likely shouldn’t be investing in 100% equities.

Investing is easy when markets are melting up with limited volatility. It’s much harder to watch your portfolio value tank.

If the current sell-off made you uneasy, it could be a sign you’re taking too much risk.

The Only Constant is Change

Markets can turn on a dime. Just when it feels investing is easy, the markets have a way to humble overconfident investors.

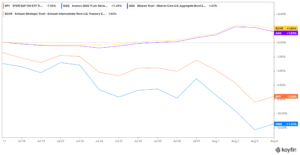

Source: Koyfin

The above chart shows the U.S. Aggregate bond ETF (purple), Intermediate U.S. Treasuries ETF (yellow), S&P 500 ETF (orange), and the Nasdaq QQQ ETF (blue) since July 16th. Crowded trades can unwind quickly, which is why we preach risk management and appropriate position sizing.

A bull market covers up many portfolio warts. It’s why we caution investors, especially retirees, from getting carried away with any individual company, theme, or sector.

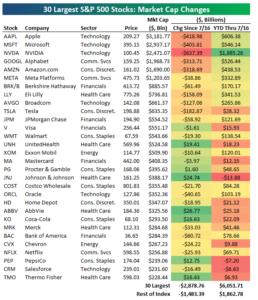

Source: Bespoke Investment Group

The above chart shows the largest 30 S&P 500 stocks and the value destruction since July 16th (by market cap, left column). The top 30 companies in the S&P 500 lost ~$2.8 trillion in value in less than a month! Much of the destruction was in the high flying ‘Magnificent 7’ names i.e. Apple, Microsoft, Nvidia, Google, and Amazon.

Takeaways…

- Market corrections are normal. Since 1928, 64% of the years experienced a 10% drawdown for the S&P 500.

- Volatility is the cost of admission for a stock market investor, not a glitch or bug in the system.

- If you’re getting worked up about losses and/or volatility, you might be taking on too much risk.

- The only constant in markets is change. Avoid anchoring to a particular narrative, getting emotionally attached to any one stock, theme, or sector. Be able to change your mind.

In our experience, it’s not the known risk that everyone is talking about that gets investors, true risk is what’s lurking in the shadows that no one is talking about.

Risk is what’s left over after you’ve thought about everything that could derail the market.