“Stories are always more powerful than statistics.” – Morgan Housel, Same as Ever

There’s lots of wild theories rolling around about what the federal government can or can’t do.

This isn’t uncommon during transitions of power. Since the beginning of time, folks have tied their economic prospects to which party is sitting in the White House.

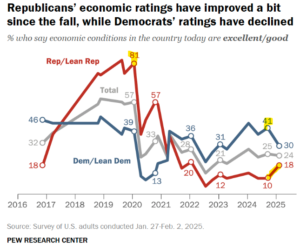

The above chart shows the % of Democrats (blue) and Republicans (red) who say economic conditions are good or excellent. Post election, you can see the dip in Democrats confidence and the rise in Republican confidence.

If folks are honest, they know such wild changes in economic prospects are a stretch. I’ve long stated that what people do on a Tuesday afternoon doesn’t likely change based on who is President.

Zooming out, the U.S. economy is the most complex economy in the world valued at ~$30 trillion dollars. Even if a President tried to derail the economy, there are dozens of more influential factors that market participants care about (inflation, interest rates, corporate earnings, consumer spending, credit spreads, etc. to name a few).

That said, people just can’t help themselves. Politics have filled much of our free time and head space. According to the Wall Street Journal, the average retiree spends 4.5 hours per day watching TV.

We can’t cover every scenario, but we aim to provide an objective look at some of the narratives out there…

*Note: This is not a political rant or angle. We have been consistent since the inception of Pure Portfolios that investing and politics do not mix. Our goal is to help people avoid making investment decisions based on their political beliefs.

Will Federal government layoffs cause a recession?

Probably not. However, mass firings of federal workers could significantly increase the unemployment rate in locations where the government is a major employer, like Washington D.C. The hope would be displaced federal workers may be able to find jobs in the private sector.

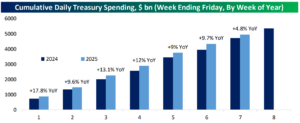

What could impact the economy is federal spending, which is currently running slightly above 2024 levels.

Source: Bespoke Investment Group

The above chart shows cumulative Treasury spending during the first 8 weeks of the year for 2024 (dark blue) and 2025 (light blue). Government spending is a sizable portion of Gross Domestic Product (GDP or a measure of economic growth).

Why is the government able to gain access to our SSN and banking information and what if they use that for ill intent?

The Bureau of the Fiscal Service and the Treasury Department have access to sensitive information like Social Security numbers, addresses, and banking details because they need this data to process tax refunds, Social Security payments, and other government disbursements.

This was true before the inception of the Department of Government Efficiency (DOGE).

Irrespective of DOGE, we would encourage folks to remain diligent to protect their financial data. Review your bank and credit card statements for unauthorized transactions. Monitor your credit report for signs of identity theft or fraud. Be mindful of clicking email links or text messages from unknown senders.

Is Social Security going to run out or be reduced?

The Social Security Trustees estimate that the combined Old-Age, Survivors, and Disability Insurance (OASDI) Trust Fund will be depleted by 2035. Once the Trust Fund is depleted, continuing income from payroll taxes will only be able to cover around 83% of scheduled benefits.

Aside from the fiscal challenges facing Social Security, it would be political suicide to cut benefits.

For the long-term solvency of the program, it’s likely going to need reform. Some ideas floating around are means-testing, reduced benefits for future generations, and/or increasing Social Security taxes or changing the eligibility age.

If FDIC doesn’t exist, how is my money protected?

The FDIC was established during the Great Depression to maintain stability and public confidence in the U.S. financial system. The FDIC insures bank deposits up to $250,000 per depositor, per FDIC-insured bank, per ownership category. This means your money is protected even if your bank fails.

Without the FDIC, there would be no federal guarantee protecting your bank deposits. In the event of a bank failure, you could potentially lose all your uninsured deposits, leaving you vulnerable to financial hardship.

In our opinion, it’s highly unlikely the federal government would want to undermine confidence in the banking system.

Is President Trump going to tank the market?

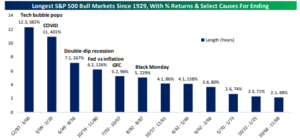

If you look at the end of every bull market since 1920, none came from what a President did or didn’t do.

Source: Bespoke Investment Group

The above chart shows the longest bull markets since 1929 and their select causes for ending. The end of bull markets are often an external economic shock that most did not see coming. Past performance is no guarantee of future results.

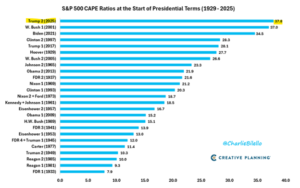

In Pure Portfolios’ January 2025 Market Commentary, we outlined the biggest challenge for President Trump as it relates to stock market prospects is sky high valuations.

We also covered how future S&P 500 returns could be lower based on frothy valuations.

Source: Creative Planning

The above graph shows the cyclically adjusted price-to-earnings ratio (a measure of how expensive stocks are) by President since 1929. The top bar shows President Trump is starting his term with the highest stock market valuation for any President since 1929.

Why is there an urgency to reduce Federal spending?

The current path is unsustainable. As of January 2025, it costs $392 billion to maintain the debt, which is 16% of the total federal spending in fiscal year 2025.

One could make the case continuing our irresponsible spending path is the riskiest path of all.

We identified reckless government spending as one of the key themes that’s likely NOT to change over the next 5-10 years. Here’s a post about which assets are likely to do well given high deficits/spending…

Reckless Government Spending: How it Could Impact Your Investments

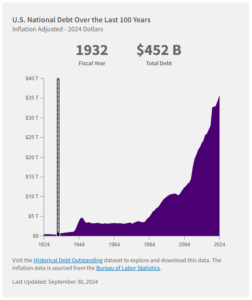

Source: U.S. Treasury

The above chart shows the explosion of federal debt over the past 100 years. The rate of change has gone parabolic over the past 20 years. If the U.S. cannot get debt levels under control, outsized inflation, reduced standard of living, higher interest rates, and slower growth are potential outcomes.

Allowing political leanings to influence investment strategies is a recipe for poor outcomes. It’s crucial to maintain an objective, data-driven approach and avoid letting emotions or political biases derail your long-term strategy.

For further reading on the perils of mixing politics and investing, please see…

The Danger of Mixing Politics and Investing

Market After Major Geopolitical Events

Have a question or feedback? Shoot us a note at insight@pureportfolios.com