“This isn’t just one stupid bank making bad decisions. This is a real economic problem where the clients at Silicon Valley Bank were burning money on bad ideas. These bad ideas were rampant and real.” – Cullen Roche, The Orcam Group

A run-of-the-mill bank failure goes something like this…

Bank loans money to borrower.

Borrower doesn’t pay the funds back.

Bank goes bust.

That’s a crude example, but the bank failures of 2007-2009 loosely followed the above playbook.

The Silicon Valley Bank (SVB) debacle was not your typical bank failure.

As Silicon Valley Bank’s name implies, the bank served startups, venture capital firms, the crypto industry, and technology companies. There were boatloads of cash sloshing into the bank’s coffers over the last few years mirroring the prosperity of the technology sector.

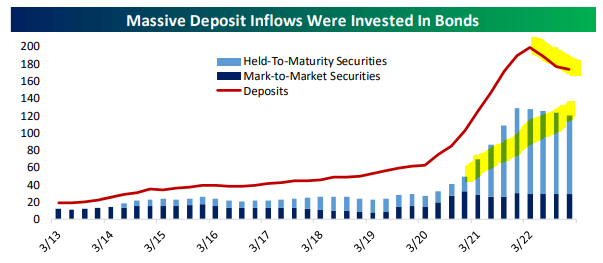

Source: Bespoke Investment Group

The above graph shows the rapid rise of cash deposits in SVB (red line) from 2020 – 2022. The blue bars show where the bank invested the deposits; high quality bonds.

Banks have two primary methods for earning on deposits; create loans or invest the money.

Since demand for loans weren’t keeping up with deposits, SVB invested in U.S. Treasuries and mortgage-backed securities (MBS).

Interest rates and bond yields were historically low, SVB ended up allocating a large percentage of cash to longer maturity bonds, which tend to offer higher interest. Interest rates had been low for so long, a rapid increase in rates wasn’t on anyone’s radar (including the risk management department at SVB).

Fast forward to fall of 2021, inflation was a problem. The Fed started increasing rates to slow the economy.

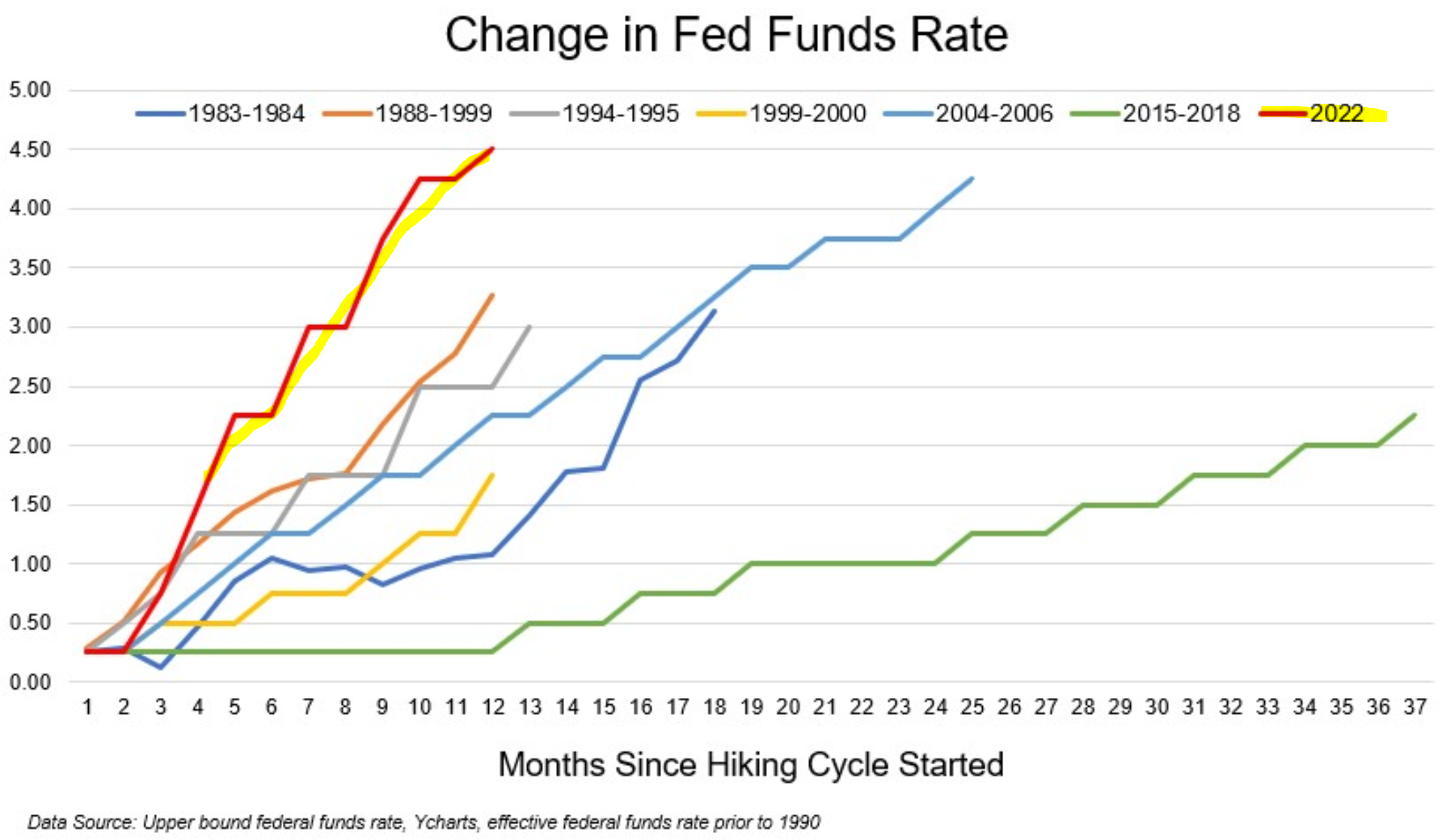

Inflation was a bigger problem than most expected. The Fed’s hiking campaign of 2022 ended up being the most aggressive series of rate increases since the 1980’s…

Source: Michael Batnick, YCharts

The above chart shows every Fed hiking cycle since the late 80’s. It’s not a surprise something broke going from 0% to 4.5% Fed Funds rate in one year (red line).

Back to SVB, the bulk of their bond portfolio was in interest rate sensitive, longer- maturity bonds. As bond yields go up, bond prices go down.

The result was billions in unrealized losses in SVB’s bond portfolio.

In hindsight, SVB did what the Fed wanted them to do. Buy high-quality collateral, U.S. Treasuries & mortgage-backed securities. What few saw, including the Fed, was the worst episode of inflation in ~40 years.

Meanwhile, SVB’s customers were having a rough go. The technology sector bore the brunt of the pain as investors shunned risky ventures and capital raising dried up. The air was coming out of the Silicon Valley bubble. SVB customers were burning cash at an alarming rate, which meant deposits were flying out the door.

To add fuel to the exodus, with higher rates, SVB bank depositors could find better alternatives to a paltry yielding checking or savings accounts (referred to as “cash sorting,” which we covered here).

The final nail in SVB’s coffin was a rumor that Peter Thiel, co-founder of PayPal & respected venture capitalist, was telling his portfolio companies to pull their cash out of SVB.

SVB responded by selling bonds from their investment portfolio to shore up liquidity due to heavy customer withdrawals. They also tried to raise capital at the 11th hour, but it was too late.

Silicon Valley Bank became the second largest bank failure in U.S. history, behind only Washington Mutual.

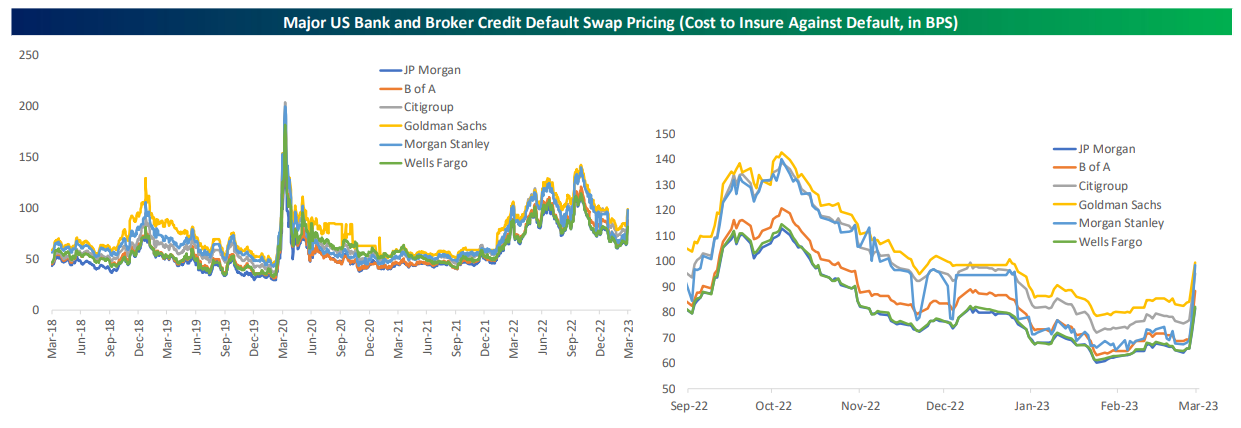

As of this writing (3/14/23), it doesn’t look like a systemic banking problem. The below graph shows the cost to insure against a default for major U.S. banks and brokerages (the higher the lines, the more stress in the banking system)…

Source: Bespoke Investment Group

Source: Bespoke Investment Group

The above graph shows credit default swaps (CDS) for important U.S. financial institutions. While CDS prices have gone up, they aren’t pricing in a widespread financial system problem.

Who is to blame for SVB’s collapse? It was a perfect storm of factors.

- SVB worked with a risky & volatile customer base that was riding high after a decade of prosperity not seen since 1999-2000 (the original tech bubble).

- The Fed may have kept rates artificially low for too long (more on this later).

- SVB risk management department took too much interest rate risk (buying long-term bonds for extra yield).

- The pandemic created all sorts of economic imbalances, which led to the highest inflation in 40+ years.

- When an important venture capitalist like Peter Thiel yells fire, people rush to the exits and pull cash.

In my opinion, there are two main lessons to be had…

Artificially low interest rates can lead to a misallocation of capital. When billions are sloshing around looking for higher returns, bad allocation decisions are likely to happen.

Unfortunately, there could be other SVB-type blowups as a result of too much money chasing low-quality, speculative opportunities (see “Stability Breeds Instability,” the seeds of destruction are often sown during good times).

SVB is another example of how the things investors are talking about are seldom what derails us. It’s better to put down the crystal ball and make sure you have sound risk management principles in place.

To find out how Pure Portfolios mitigates risk for random market events, click here.