“Owning individual stocks invites infinitely more behavioral hurdles than a simpler strategy. It’s easier to ignore index funds and ETFs. You can’t ignore individual stocks.” – Ben Carlson, Wealth of Common-Sense blog

Is there a better feeling than being early on the next NVIDIA?

The money piles up. You brag to your friends. You’re ripe with confidence that you can sniff out the next winner.

Here’s an open secret…picking individual stocks is hard.

According to famous investor Michael Mauboussin, the majority of public companies fail to earn cash returns…

“Almost 60% of all public companies since 1920 have failed to earn treasury bill returns, and they destroyed an aggregate of $9T of wealth.”

That doesn’t stop many investors scouring Motley Fool looking for the next hot stock.

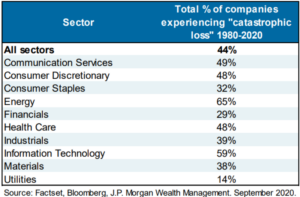

Recent history backs up Mauboussin’s claim. According to Benjamin Felix, 44% of all companies that appeared in the Russell 3000 from 1980-2020 experienced a loss of at least 70%, which was never recovered.

The above chart shows the percentage of companies by sector experiencing a “catastrophic loss” (70%+) from 1980-2020. Technology and energy companies have the greatest percentage of catastrophic loss.

What percentage of companies achieved superior returns?

The above chart shows percentage of stocks experiencing negative returns (left), percentage of stocks that failed to beat the Russell 3000 (middle), and percentage of stocks defined as mega-winners (right, mega-winner is a stock that went up 500%+). If a stock wasn’t a “mega-winner”, catastrophic loss, negative returns, and/or failing to beat their benchmark was the most likely outcome.

What can we learn from the individual stock return data?

- Most stocks fail miserably. Outsized returns are generated by a narrow set of stocks. No one can tell you ahead of time which stocks or active managers (mutual funds) are going to be winners. Most stocks have worse returns than cash!

- Picking individual companies can be emotional warfare. Approximately 73% of individual stocks experience a drawdown of 50%+ over their lifetime. I don’t care who you are, this will test the conviction of the most seasoned investor. (Source: Wes Gray of Alpha Architects)

- Narrow baskets of individual stocks are the way to outperform. It’s also a tried-and-true way of getting destroyed. Let’s look at 2024 for example (see “Tale of Two Markets“).

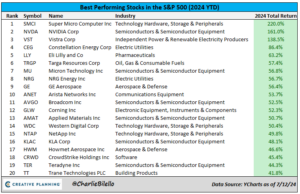

For every Super Micro and Nvidia, there’s a Walgreens and Lululemon. Here are the best and worst performing stocks in the S&P 500 year-to-date (as of 7/12/24)…

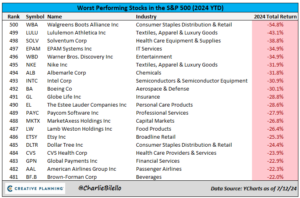

Even professional investors struggle to pick stocks. According to S&P Global, over 90% of active mutual fund managers (it’s their job to pick stock winners) fail to beat their benchmark.

Source: S&P Global, SPIVA 2023 Scorecard

The above chart shows the percentage of U.S. equity funds that underperform their benchmark (as of 12/31/23). Notice the percentage of underperformance is lower in the short-term (less than five years). A mutual fund manager might get lucky in the short run, but over the long-term (10+ years) ~90% of U.S. funds underperform.

If it’s hard to pick winners, why do individual investors like picking individual stocks?

- Dreams of riches

- Complexity sells. Simple, boring solutions that are most likely to work don’t

- False confidence, many investors think they have an edge

- Makes for great stories (investment ego)

- Intellectual stimulation

Should you avoid picking individual stocks?

Not at all. If you enjoy it, can put in the time, and have the emotional make up, have at it.

If investors are going to pick stocks, they should know what they are getting into…

- Most companies don’t earn higher returns than cash

- People often base the expectations of individual stock returns on a small subset of winners

- No one tells you who is going to win or lose ahead of time

- Highly paid mutual fund managers have a low success rate over the long-term (10+ years)

- An investor can get lucky in the short term, but sustained success can be fleeting

If you want to pick individual stocks, slicing of 10-15% of your investable assets is fine. We call it scratching your degenerative itch.

We leave you with a Morgan Housel quote on good investing, “Good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with, and which can be repeated for the longest period of time.”