“Some taxpayers close their eyes, some stop their ears, some shut their mouths, but all pay through the nose.” – Evan Esar, American Humorist

Thanksgiving marks the home stretch for the remainder of the year. Turkey, football, and family make way for Christmas, New Year’s, and (gulp) tax season. With a little tidying up, we can take the low hanging fruit and boost our after-tax returns, setting aside any worldly insights about what the market is going to do next.

Tax-Loss Harvesting

This has become a widely adopted practice to reduce capital gains in taxable investment accounts. We simply sell a holding with an unrealized loss prior to year-end, thus reducing our capital gain liability. For example, if we had a loss in General Motors, we could sell the stock and buy Ford. The loss is realized and we reduce our capital gains tax while staying fully invested. Unfortunately, Orion Advisors estimates there are billions of dollars in unrealized losses across their client base, which often remain unrealized—even when there are clear tax-loss harvesting opportunities. If you’re a do-it-yourself investor or working with an advisor that fails to capture unrealized losses at year-end, you’re lighting money on fire.

The 1099 Tells All

Last year we told mutual fund owners to check their 1099s for tax drag. 2018 was a nasty year for unsuspecting mutual fund owners getting saddled with outsized capital gains. We had a client that owned a legacy position in a mutual fund with low cost basis (large unrealized gain). The fund manager paid out a huge capital gain which adversely affected their eligibility for a healthcare credit. Remember, even if you don’t do any selling of a mutual fund, you can still get hit with a capital gains distribution at the end of the year.

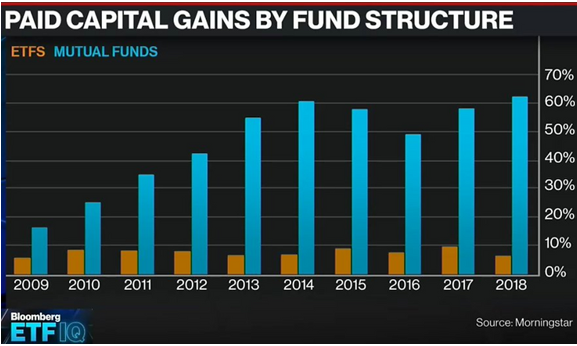

Source: Morningstar, Bloomberg

The above graph shows capital gains distributions by fund structure. The blue bars represent mutual funds. The orange bars represent exchange-traded funds (ETFs). Year after year, ETFs are much more tax-efficient than mutual funds (they also have much lower annual expenses). If you own a mutual fund in a taxable account in 2019, you’re doing it wrong.

Asset Location

For investors with a mix of account types i.e. Taxable, Roth, Traditional IRA, be mindful of where you own certain types of assets. For example, targeting a dividend paying stock strategy is fine, but doing it in a taxable account is sub-optimal (there’s no way to shelter dividend income from taxes outside of a retirement account). In our experience, asset location and tax-efficient investing is a lay-up that many investors miss (even those who work with a professional advisor). For more check out, How Much is Your Asset Location Costing You?

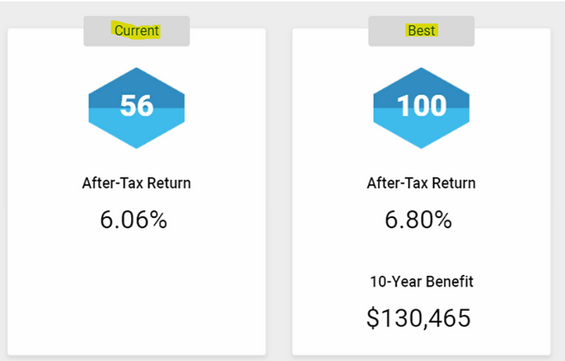

Source: Lifeyield

The above example shows an investor with an inefficient asset location. The optimized asset location (simply moving tax-inefficient assets to a IRA and vice versa) on the right produces tax alpha of 0.74% per year, or $130,465 over a 10-year period (assuming a $1,000,000 portfolio)! This exercise takes five minutes to run, but can have a major impact on your after-tax returns.

On behalf of Pure Portfolios, have a wonderful Thanksgiving holiday!