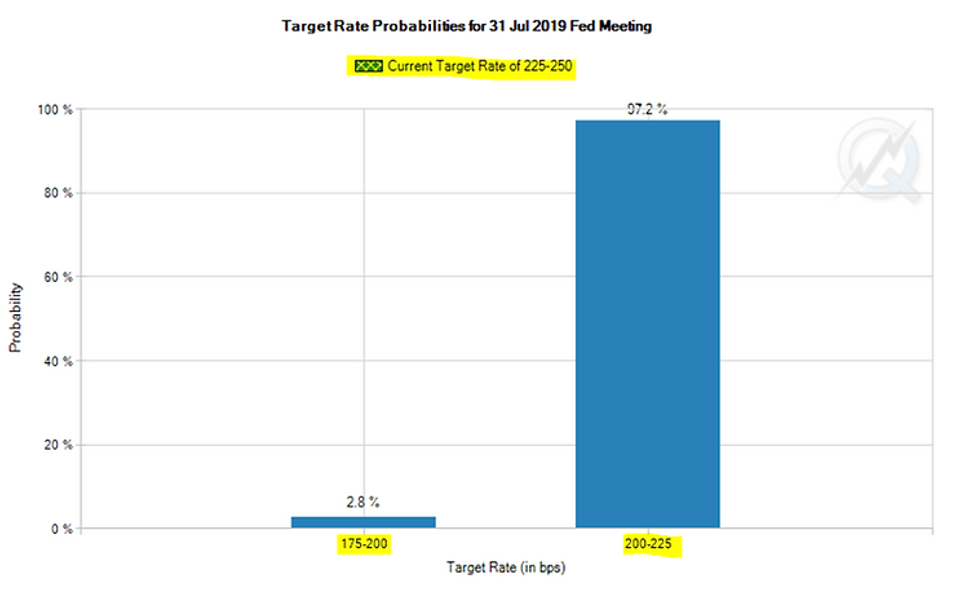

Just a year ago, the consensus was for the Federal Reserve to methodically increase interest rates to “normal” levels. As of this writing (7/9/2019), the futures markets are pricing in a 100% chance of an interest rate cut during the Fed’s July meeting.

Source: CME Group

The above graph shows a 97.2% probability of a 0.25% cut during the Fed’s July meeting. The more aggressive cut, 0.50%, shows a probability of 2.8%. Either way, the market is 100% expecting the Fed to cut rates in some capacity this month.

What the heck happened? Did things really get that much worse in 12 months (if they did, would someone please tell the U.S. stock market)?

You can blame the trade war. Volatile global markets. Brexit. Iran. Twitter. But one thing is clear, the Fed is a follower, not a leader, of markets and the economy. Placed into that context, the Fed’s next action becomes a little more clear. They’ll do everything in their power to align with market expectations. We’ve seen what can happen if they go against the grain (4th quarter of 2018 and the ill-fated interest rate increase).

This is the unenviable position of the Federal Reserve. The market tells them what to do, and they usually fall in-line.

But what if the market is wrong?

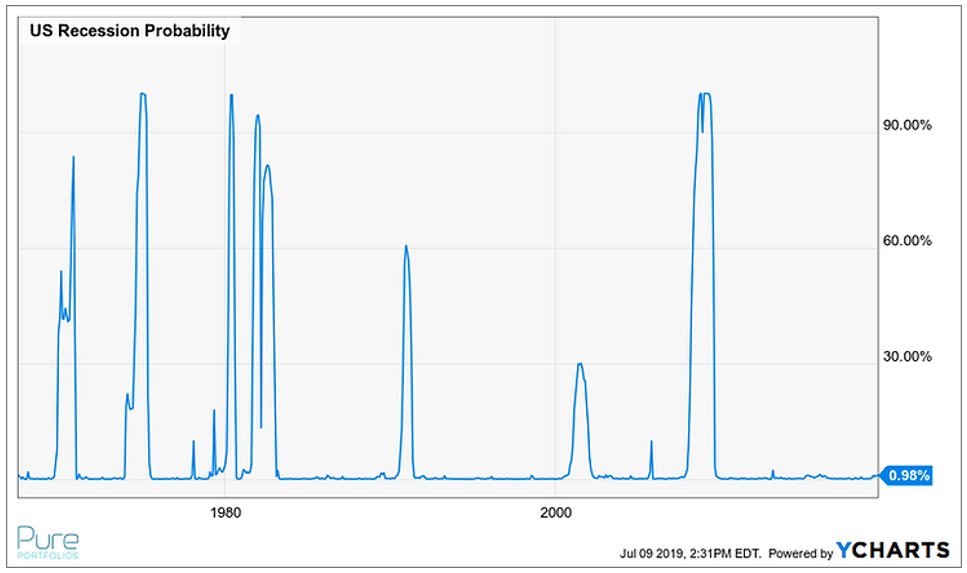

Source: YCharts

The above graphic shows the probability of a U.S. recession. It’s certainly not flashing red.

Let’s say the Fed does cut in July. Recent history would suggest the Federal Reserve has limited capacity to soften the next economic downturn.

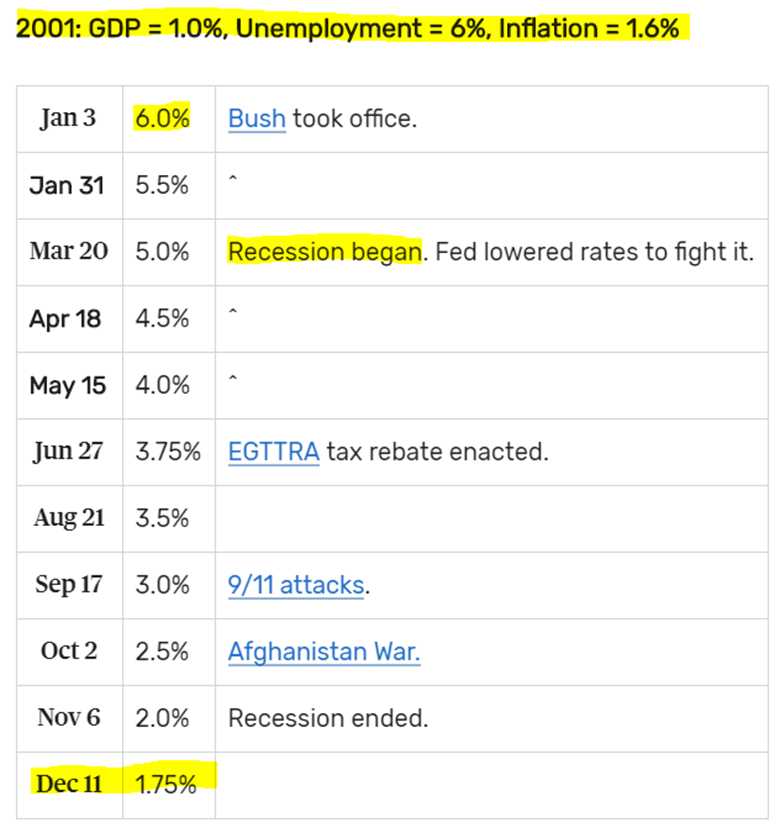

Source: The Balance

The above graphic shows the timeline of the Fed cutting rates during the recession of 2001. You can see the starting point of 6% provided the Fed with plenty of cushion to lower rates to boost economic activity. The Fed ended the loosening cycle on June 25, 2003 with a benchmark rate of 1.00%.

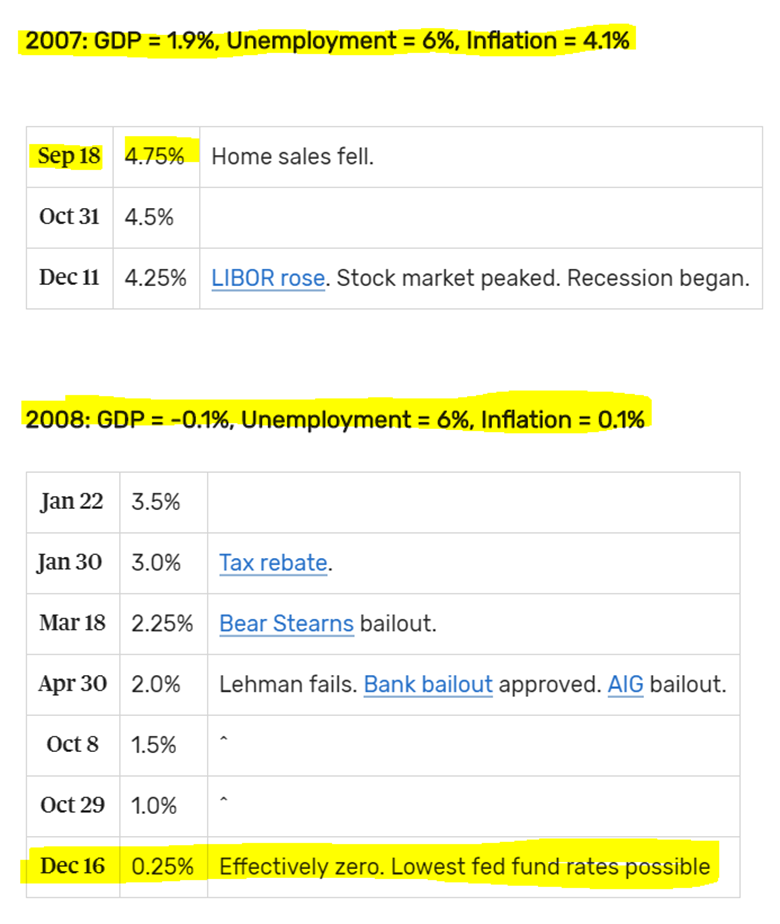

Source: The Balance

The above graphic shows the Fed’s response to the Great Financial Crisis. Again, notice the higher starting rate of 4.75%. The Fed aggressively cut to soften the impact of the housing crisis. Although the recession officially ended in 2009, the Fed kept the benchmark rate at 0% until December 2015.

When people say the Fed is out of ammo, this is what they’re referring to. We are starting from already historically low rates (2.25%-2.50%) and are about to cut during a non-recessionary time.

What is the Fed to do during an actual recession?

Find out how we manage risk before and after a market event happens.

Share your questions and feedback on Twitter @pureportfolios or insight@pureportfolios.com