Quick question, which below stock market graph would you deem more risky?

Graph A or B?

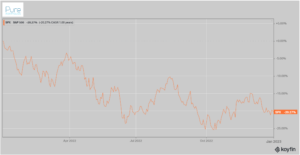

Graph A

Source: Koyfin, Pure Portfolios

The above graph shows the S&P 500’s journey in calendar year 2021. Investors enjoyed outsized returns with very few bumps along the way.

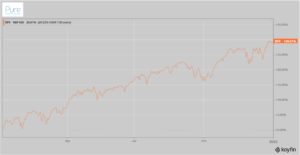

Graph B

Source: Koyfin, Pure Portfolios

The above graph shows the S&P 500’s journey in calendar year 2022. Investors were punished with never ending volatility and double digit losses.

99.9% of people would answer graph B.

On the surface, that would seem like a no-brainer.

However, one could argue that graph A is fraught with risk, while graph B is actually less risky.

How could a market in free fall, with investor confidence in the dumps, higher interest rates, elevated inflation, and an economy that could be on verge of a recession, be less risky?

The short answer is Mr. Market flushed out a ton of garbage. The irrationality and speculation of 2021 gave way to the Year of the 180. Virtually every market & economic trend we knew to be true reversed.

The consensus among the investment community, professional & retail, is that things have to get worse before they get better (Wall Street’s 2023 forecasts are the most pessimistic is recent memory).

Investing expert Robert Shiller sums up the perception of risk perfectly…

“After a stock market decline, people many perceive more risk than before when, in fact, the decline may have taken some of the risk out of the market.”

Mr. Shiller is saying it’s often more risky to shovel money into the market when investing seems easy. On the flip side, an investors margin of safety could be bigger investing capital after the market is down 20+%.

The night & day pivot from 2021 to 2022 waged war on investor psychology; when times are tough, it’s easy to predict market conditions will get worse. When times are good, it’s easy to predict the bliss will continue in perpetuity.

In my opinion, we are seeing this narrative everywhere. It is consistent with every difficult market in my career.

When people are pessimistic, it takes a titanic shift to turn them into optimists. The slightest hint of bad news sends them right back into the dungeon of despair.

When people are optimistic, it doesn’t take much to turn them a pessimist. Any number of the horrendous headlines over the past two years would do the trick.

Unfortunately, this isn’t how markets work.

- The market often sniffs out the light at the end of the tunnel when most see pitch black.

- The market doesn’t wait for every economic issue to dissipate and then scream higher.

- Predicting perpetual doom has not historically been a recipe for investment success. It’s okay to be bearish, but it’s not okay to stay bearish.

- The time to put cash to work or get fully allocated is often when it feels the worst.

I’m not saying things can’t get worse, they certainly can. However, an investor might do better by reframing their perception of risk after such an ugly year.

Let us know what you think…

Is the 2023 stock market more or less risky than 2021? 2022?

insight@pureportfolios.com

For more reading on how bad markets could turn into good markets, check out Silver Linings in a Dismal Year.